Inflation is rising. There’s heated political debate in Washington.

In some ways, this sounds like the 1970s.

Before Watergate, policymakers struggled with inflation. They tried abandoning the gold standard. They tried wage and price controls. Nothing worked, and families struggled throughout the decade.

Finally, sky-high interest rates broke inflation.

Fifty years later, inflation and political debate dominate the news again. Congress is even considering price controls. A new bill under consideration would only limit price increases for energy. But once a bad idea gets started, it can take on a life of its own.

There is one big difference between now and the 1970s. In some ways, the economy was more stable back then.

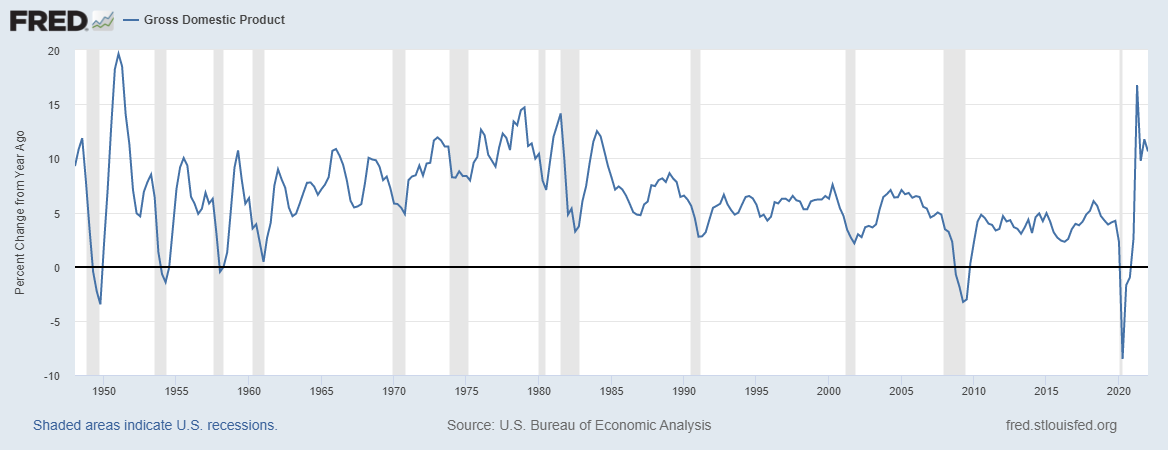

The chart below shows the year-over-year change in GDP. Gray bars mark recessions. From the 1960s until 2009, the economy grew when compared to the previous year during recessions.

Recession Doesn’t Mean Zero Growth

Source: Federal Reserve.

There’s Still Growth Within Recessions

While a recession is an economic contraction, until recently those contractions were more of a slowdown than a step backward. Economic growth would slow for a few quarters and then resume growing. These periods were painful, but recoveries tended to be quick.

In the last two recessions, the economy contracted when compared to a year ago. Before 2009, this had only happened three other times. Economists believed the Federal Reserve had tamed the business cycle. Of course, that wasn’t the case.

In the 2020 recession, the economy also shrank compared to the previous year.

We could argue that 2009 was a recession caused by a financial crisis. The same was true in the 1970s and early 1980s when bank failures contributed to recessions.

Why This Time Is Different

The 2020 recession was unique. The pandemic brought it on.

But the end of government programs initiated during the pandemic will probably trigger the next recession. As central banks take liquidity out of the market and governments cut back on spending, a recession seems increasingly likely.

The next recession is likely to coincide with a bear market. The bear market will push stocks down by 30% to 50% or more, and the economy will again need time to recover.

Bottom line: High inflation, a weak stock market and ineffective political leaders. It sounds a lot like the 1970s. But this time it’s different and potentially far worse.

Click here to join True Options Masters.