Unemployment is relatively high, and job growth is sluggish. Getting Americans back to work is important from an economic perspective. Employees produce stuff in the economy, earning wages for their efforts and using those wages to buy stuff that others produced. Employment is at the center of economic growth.

Economists took this obvious idea and quantified it. Arthur Okun, the developer of the Misery Index, found that a country’s gross domestic product (GDP) must grow at about a 4% rate for one year to achieve a 1% reduction in the rate of unemployment.

Former Federal Reserve Chairman Ben Bernanke followed an updated version of Okun’s Law. Bernanke noted: “According to currently accepted versions of Okun’s law, to achieve a [1%] decline in the unemployment rate in the course of a year, real GDP must grow approximately [2%] faster than the rate of growth of potential GDP over that period.”

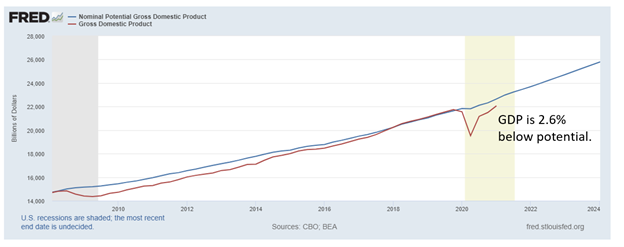

Potential GDP is an estimate of economic output assuming growth is steady, and inflation is also stable and low. The most recent data shows that GDP is significantly below potential.

GDP Is Below Potential Despite Reopening

Source: Federal Reserve.

Low GDP Potential Signals Continued Unemployment

GDP was below potential from the 2008 recession until the beginning of 2018. GDP slipped back below potential in the first quarter of 2020, before the pandemic-induced recession. Now, after a government spending frenzy, GDP remains 2.6% below potential.

The unemployment rate will determine whether or not economic growth gets back to its long-term trendline.

Politicians are debating whether wages are high enough to pull the unemployed back into the workforce. They are debating whether higher wages will lead to inflation. It does seem likely that higher wages will lead to inflation.

It also seems likely that without higher wages, many jobs will go unfilled. This will lead to lower economic output — meaning supply chain shortages could continue, and inflation will increase.

For now, it appears higher inflation is certain. Okun’s Law tells us that, because of low potential GDP, higher unemployment is also likely.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.