Traders often follow the presidential cycle. This is a four-year pattern in prices tied to the election.

The logical pattern is appealing. Presidents usually take action at predictable times during their terms to boost the economy and help their reelection prospects.

Their first quarter in office, for example, is often spent complaining that problems are bigger than anyone realized because the previous administration wasn’t honest enough. That leads to below-average stock returns.

The president then proposes solutions that require spending, and the stock market often responds well to that. Important White House speeches lead to ups and downs in the market.

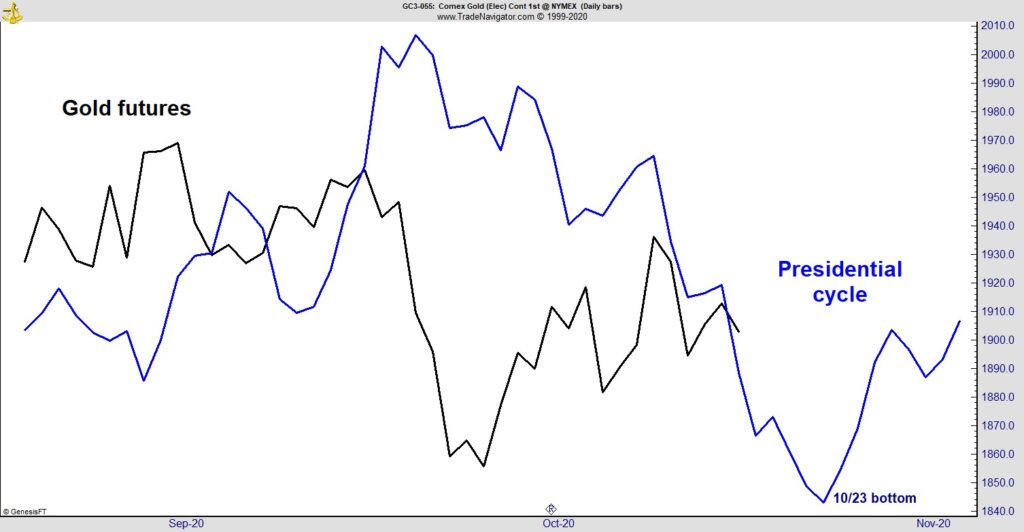

This cycle is usually applied to the stock market, but it can also be applied to other markets. The chart below takes a short-term look at the gold market with the presidential cycle.

Gold and the Presidential Cycle

Source: Trade Navigator.

The blue line is the four-year cycle applied to gold futures. This data goes back to 1974 and includes 11 complete cycles. It’s not a definitive guide to trading, but it serves as one indicator to help identify trading opportunities.

Invest Before the Presidential Cycle Fuels Gold Higher

According to the presidential cycle, a bottom is expected on Friday, October 23. Then, gold could move sharply higher with a peak on November 5.

These dates coincide with what could be the maximum period of uncertainty associated with the election.

This is a short-term trade, and traders could use leveraged instruments to make the most of the opportunity.

Leveraged investments include call options on SPDR Gold Shares (NYSE: GLD) or exchange-traded funds (ETFs) like Direxion Daily Gold Miners Bull 2X Shares (NYSE: NUGT) or ProShares Ultra Gold (NYSE: UGL). Both ETFs are designed to move twice as much as the price of gold on any given day. For periods longer than one day, they may not precisely track the trend in gold.

Leveraged funds or options are ideal for short-term trading but may not be the best choice for long-term investors. In this case, with a trade open for about a week, they could work well. However, there is always a risk of loss in any trade.

P.S. If you are looking for a longer-term gold play, my colleague Adam O’Dell’s collection of “A9 gold stocks” may be the perfect fit for your portfolio. Learn more about it here.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.