Unintended consequences sum up 2020. COVID-19, no matter how it started, was an unintentional pandemic. Shutdowns to flatten the curve set off cascading unemployment and were followed by start and stop recoveries.

No one could have planned the first ten months of 2020. Likewise, no one planned an innovation crash because bars shut down during Prohibition.

Shutting down bars was intentional. A drop off in innovation was not expected. But, research published in “Bar Talk: Informal Social Interactions, Alcohol Prohibition, and Invention” showed that was the case.

Patents are widely used as an indicator of innovation. That research found vibrant communities lead to new ideas and patents are a measure of those ideas.

As Prohibition swept the nation in the early 1900s, different states banned the consumption of alcohol at different times. This allowed researchers to study patent history in counties as alcohol was banned.

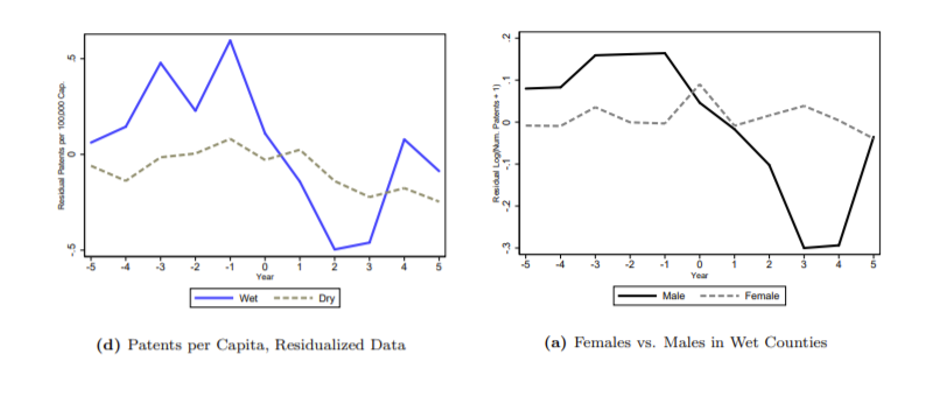

What they found was that fewer patents were issued in counties that prohibited alcohol ahead of national Prohibition. The impact was large and is shown in the chart on the left. The blue line shows a drop in innovation that coincides with Prohibition. The grey line is a control group consisting of areas that previously banned alcohol.

Patents Decreased as Prohibition Ramped Up

The chart on the right shows this decline in innovation was limited to men, shown as the black line. Women, the grey line, didn’t show a change in behavior when Prohibition was introduced.

The research doesn’t say alcohol is good for innovation and technology. Bars were an indicator of social interaction. More bars were associated with more interaction in the community and as bars closed, people changed their social behavior.

Over time, innovation and productivity returned to their previous levels.

This is timely since bars are closing again. Cities will lose productivity as shutdowns drive people away from urban areas to rural areas where there are fewer opportunities for interaction.

Less innovation will yield fewer technology disruptions. In the long run, this could result in a shift from high growth to low growth in the economy, and in the stock market.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.