A headline caught my eye: “Home prices cooled in July at the fastest rate in the history of the S&P Case-Shiller Index.”

That sounds like a bear market.

CNBC backed up the headline by stating:

U.S. home prices cooled in July at the fastest rate in the history of the S&P CoreLogic Case-Shiller Index, according to a report released Tuesday. Home prices in July were still higher than they were a year ago, but cooled significantly from June gains. Prices nationally rose 15.8% over July 2021, well below the 18.1% increase in the previous month, according to the report.

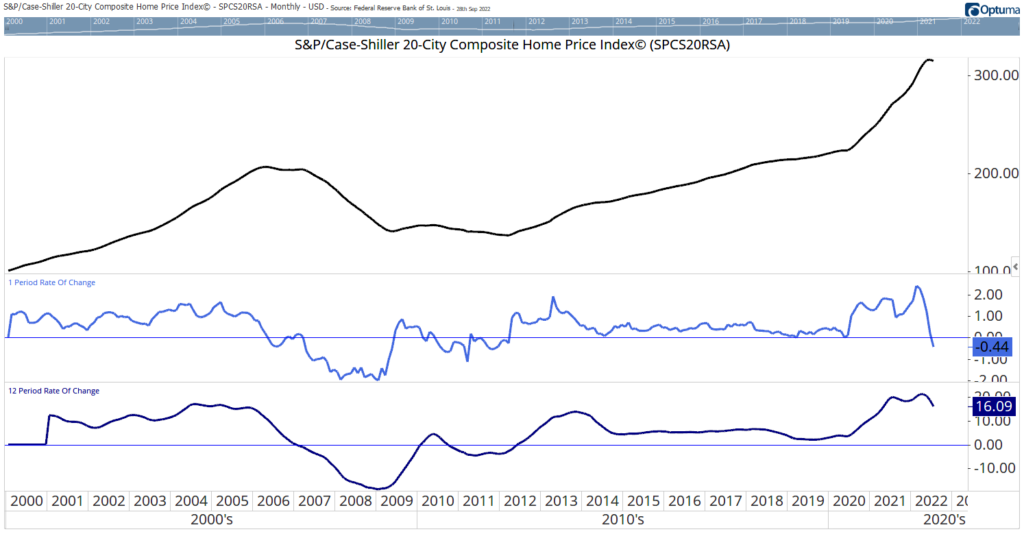

But the chart below doesn’t look like a bear market.

There is a small dip in the most recent data.

Prices in July fell 0.4% compared to January.

But home prices are still up 16% (dark blue line) compared to a year ago.

Home Prices Up 16% From 2021

The decline mentioned in headlines refers to the drop in the rate of change.

Rate of Change Is Falling

Yes, that number is falling.

But that means prices aren’t going up as fast.

Homes are still expensive compared to a year ago.

At the end of the year, they will still be expensive.

There is an important caveat: Home price data is reported with a lag.

The most recent data is from July.

At the beginning of October there are anecdotal reports that the market is slowing.

But prices remain high.

Potential buyers are hoping to see the type of decline we experienced in the mid-2000s.

That’s unlikely because the supply of homes for sale is low and many existing owners are reluctant to sell into the market environment.

An environment that now includes high mortgage rates.

Google reports that rates are above 7% in some parts of the country.

With rates over 7%, there will be few buyers.

But there will also be a lack of sellers.

The chart of home prices may stabilize for months as the market exists in a state of equilibrium.

Bottom line: It’s not the equilibrium buyers or sellers are happy with, but it’s a market where the few buyers won’t have many options to choose from.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.