Many things take the blame for global financial crises.

But there tends to be one underlying cause.

Federal Reserve policy is almost always the reason other nations suffer crises.

The Mexican peso crisis in 1994 followed this familiar pattern.

The Fed started raising rates in late 1993.

In November 1994, the Fed raised rates 0.75%. This was an out-of-character move for then-Chair Alan Greenspan, who favored 0.25% rate changes.

The peso fell 50% one month later.

Inflation soared.

U.S. officials organized a $50 billion bailout package by January to stabilize the peso.

A Strong Dollar Explained

The problem is one of simple economics.

Investors place money where they can receive the highest safe return possible.

When the U.S. raises rates, many international investors move money to the U.S.

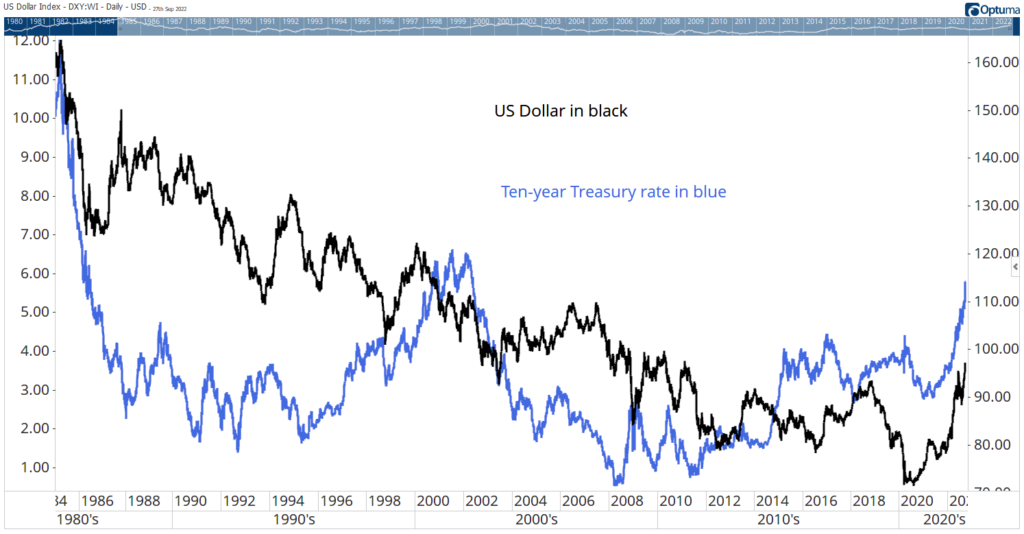

This is evident in the chart below.

The blue line is the interest rate available on 10-year Treasury notes.

The black line is the Federal Reserve’s trade-weighted dollar index.

Higher rates lead to a stronger dollar.

Higher Interest Rates Create a Strong Dollar

The currency’s value rises as international investors buy dollars to invest in the U.S.

What Strength of the Dollar Means for the Global Economy

When the dollar has a sharp rise, other countries don’t have time to prepare.

This leads to problems in the economies of other countries, where weak currencies and high inflation are an issue.

Over the past 12 months, the dollar increased by more than 20%.

That’s about the level seen in 1994 when the peso crashed.

It was also at that level in 1997 when many Asian countries faced an economic crisis.

And again in 2000, when the dot-com bubble popped, a global recession began.

The level was visible during the 2009 global financial crisis and in 2015 when the Greek debt crisis threatened the euro.

Bottom line: We are at the edge of a crisis that can occur anywhere in the world.

While it will be an international crisis, we will feel the effects in America.

Click here to join True Options Masters.