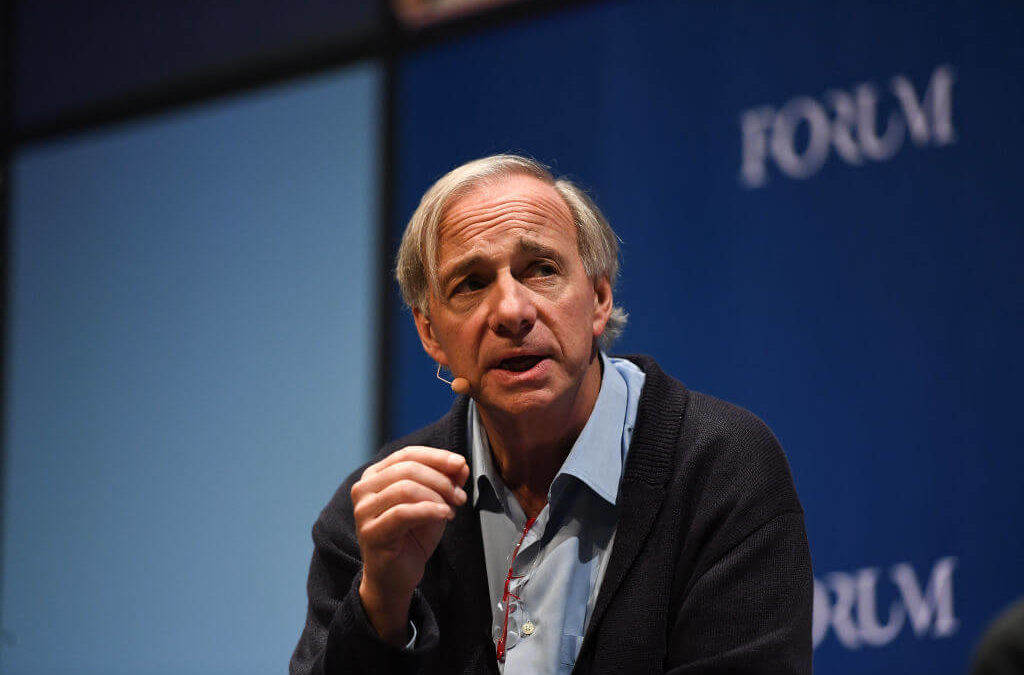

Billionaire hedge fund manager and founder of Bridgewater Associates Ray Dalio thinks now is the time to jump into markets, and investors should be dumping cash and instead working to diversify their portfolios.

“Cash is trash. Get out of cash. There’s still a lot of money in cash.”

“Everybody is missing out, so everybody wants to get in,” Dalio said on CNBC’s “Squawk Box” while attending the World Economic Forum in Davos, Switzerland, on Tuesday.

Dalio thinks the real winning investors in today’s markets are the ones with well-diversified portfolios, and the ones who are getting out of cash.

“Cash is trash,” Dalio said. “Get out of cash. There’s still a lot of money in cash.”

It’s not the first time Dalio has made a call for investors to dive in while the markets are more friendly. In 2018, the Bridgewater founder said anyone holding cash was “going to feel pretty stupid” for missing out on opportunities to make some solid returns. That was of course before the markets were rocked at the end of 2018 as the S&P 500 lost 13.9% in the fourth quarter of that year.

Dalio joined his firm’s CIO, Greg Jensen, in backing gold as a top investment for diversifying a portfolio.

“You have to have balance … and I think you have to have a certain amount of gold in your portfolio,” Dalio said.

But Bitcoin is too speculative for the billionaire who oversees $160 billion in funds at his Bridgewater firm.

“There’s two purposes of money, a medium of exchange and a store hold of wealth, and bitcoin is not effective in either of those cases now,” he argued.

As far as his outlook for the year, Dalio is optimistic there won’t be a recession in 2020. But he thinks one may arrive after the presidential election at the end of the year. And the next recession will be much worse because the Federal Reserve doesn’t have as many tools to fight one off.

“If you get a downturn — and there’s a good probability in the next (presidential) term you’ll get a downturn — and you don’t have effective monetary policy and you have people at each other’s throats, I’m worried about that,” Dalio said.

Dallas Federal Reserve Chief Robert Kaplan recently admitted that the Fed is already inflating assets with a “derivative” of QE in the repo markets.

“It’s a derivative of QE when we buy bills and we inject more liquidity — it affects risk assets,” Kaplan said. “This is why I say growth in the balance sheet is not free. There is a cost to it.”

Dalio thinks the Fed will have to launch even more quantitative easing, and warns that interest rates can only go so low.

“We’re going to have larger deficits which we’re going to print money for. At a point in the future, we still are going to think about what’s a storeholder of wealth,” Dalio said.

“Because when you get negative yielding bonds or something, we are approaching a limit that will be a paradigm shift.”