This week we dive deeper into our dividend discussion.

I’m joined as always by Research Analyst Matt Clark, and today is all about yield on cost. We illustrate this powerful dividend concept using one of my favorite real estate investment trusts (REITs): Realty Income Corp. (NYSE: O).

Let’s get the ball rolling.

Check out the highlights from our conversation below.

What Is Yield on Cost?

Matt: We’ve discussed dividend yield and growth in the last two weeks. This week’s question comes from Joanna, who asks about another factor in dividends and what you look at in terms of dividends and that is yield on cost. Joanna asks:

What is yield on cost?

Charles: First off, I love this metric. It’s not what you look at when choosing what to buy ahead of time, but more of a conceptual way to think about dividend growth.

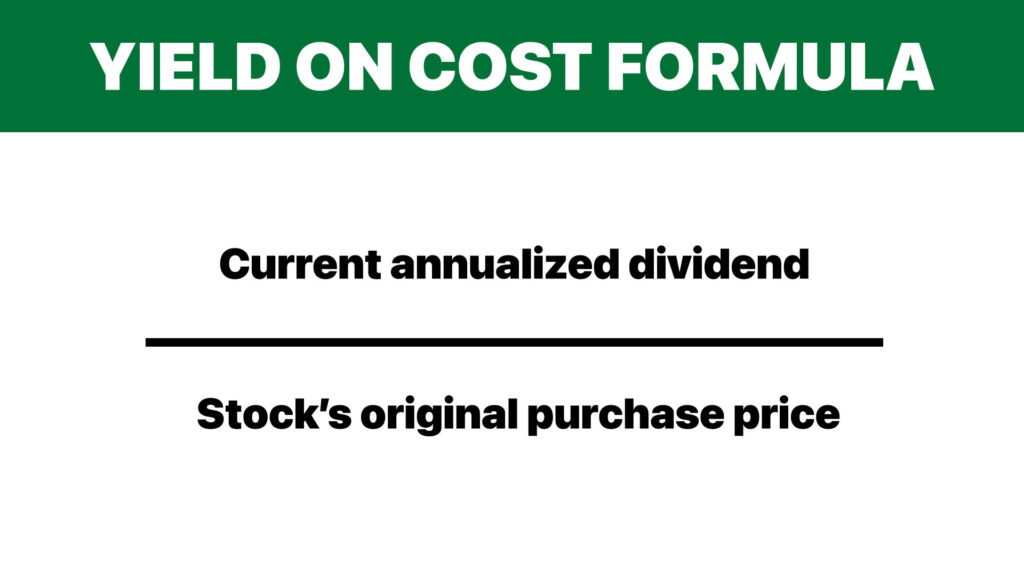

Yield on cost takes the current annualized dividend and divides it by the purchase price of the stock when you bought it. Whether it was last week, 10 years ago or whatever other time you bought that stock.

The price you first bought that stock for, you compare it to the current dividend, which gives you a yield based on that original price.

If you have a stock that has been growing its dividend, that yield on cost looks larger over time. That’s what it’s supposed to do.

The takeaway is that it doesn’t tell you what to buy today, but gives you a framework to see how dividend growth works.

Realty Income’s Impressive Yield on Cost

Matt: Can you give a specific example of yield on cost and how it can work?

Charles: I picked a stock that is a mainstay in dividend portfolios. It’s popular with income investors because it pays a good yield. It’s bond-like in its operations. And it has a long history of raising its dividend. It raises its dividend about four times a year and has for about a decade now. It’s been a long stretch of raising that dividend every quarter.

The stock is Realty Income Corp (NYSE: O), a conservative, triple-net REIT.

This is a fine example because it regularly raises its dividend. That yield on cost looks great over time.

Based on today’s prices, the dividend yield is 4.6%. That’s good. That’s a great yield in today’s environment.

In June of 2012, the dividend yield at the time was not too different from what we have today. It was about 4.2%. If you had initiated a position 10 years ago, you would’ve gotten a 4.2% dividend yield right off the bat. If you held those shares today, your dividend today compared to that original purchase price would give you a 7.3% yield.

Well, now we’re talking.

That’s better than just about anything you’ll find in the market today without taking on more risk.

Take it a step further. Let’s go back 20 years. That sounds like a long time. But if we retire in our late 60s or early 70s and survive to 90 — that’s 20 years in retirement. That’s a realistic time frame.

If you bought Realty Income in June of 2002, you would’ve gotten a 6.2% dividend yield at that time, which is super. Those kinds of yields barely exist today.

But your yield on cost would be 16.6%! That’s almost a 17% yield on the original investment.

Does that mean you have to buy Realty Income today?

Well, it’s a good dividend stock. I think you would be well served if you did, but it’s more that this shows the power of dividend growth.

Realty Income is not a stock that raises dividends by 10% to 20% a year. It raises its dividend by 4% to 5% a year. And even at 4% to 5% dividend growth, that’s the kind of yield on cost you can realize.

Use Yield on Cost to Assess a Dividend’s Future

Matt: Here’s a little curveball before we break away. Are there any pitfalls to using yield on cost to measure a stock?

Charles: The only pitfall would be if you’re trying to gauge a stock’s future potential.

So this is what it would’ve looked like over the last 10 or 20 years… Is that a reasonable assessment of what it’s going to look like over the next 10 or 20 years? You have to look at the company’s health.

Is this a healthy company? Is it able to raise its dividend at the levels it has in the past?

If the answer is yes, this company looks as good today as it did 10 years ago, I would expect the dividend growth to look similar going forward. Then the yield on cost could be a good estimate of what kind of future yield on cost you could enjoy.

Matt: Give me the summation.

Charles: Yield on cost is a nice way to put dividend growth in real terms.

If I’m a dividend growth investor and I want to stay ahead of inflation and I want to get a little bit richer every year, then yield on cost can be a good way to estimate what that’s going to look like moving forward.

Matt: Stay tuned for next week when we discuss something big in the news with the recent market downturn.

You may have guessed it — we’re talking about bonds. Charles and I will do a deep dive into bonds and answer any questions you may have.

Where to Find Us

Coming up this week, Matt will have more on his latest episode of The Stock Power Podcast, so stay tuned.

Don't forget to check out our Ask Adam Anything video series, where Chief Investment Strategist Adam O’Dell answers your questions.

You can also catch Matt every week on his Marijuana Market Update. If you are into cannabis investing, you don’t want to miss his weekly insights.

Remember, you can email my team and me at Feedback@MoneyandMarkets.com — or leave a comment on YouTube. We love to hear from you! We may even feature your question or comment in a future edition of Investing With Charles.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.