Economics is a young field of study.

Adam Smith explained modern economics in his 1776 book, An Inquiry into the Nature and Causes of the Wealth of Nations. It influenced Alexander Hamilton’s work in building the U.S. economy.

Hamilton understood the importance of economics while serving as Secretary of the Treasury. The young country was already experiencing its first recession.

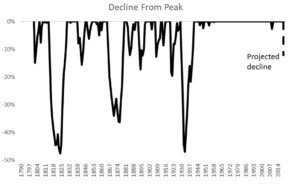

The chart below shows estimates of the depth of recessions back to 1790. It measures declines in per capita output from the previous peak. It shows how the economy affected the quality of life of Americans.

Recessions of the Past

Source: Data from MeasuringWorth.com

Prior to 1950, downturns were common and steep.

In the 1820s and 1930s, economic output dropped 47% from its peak. A 36% decline occurred in 1876. For more than 150 years, Americans faced a constant boom-and-bust cycle with busts being deep and prolonged.

How Recessions Changed After World War II

Relative stability and uninterrupted growth are unique to the post-World War II era. That’s because the United States enjoyed a special position in the world economy.

The U.S. was the only power to emerge from the war with its industrial base intact. It became the manufacturing hub of the world. That led to the steady economy we now take for granted.

The Federal Reserve also aided postwar stability. Fed policy supported growth by slowly inflating prices. A slow and steady erosion of the dollar’s buying power ensured stability.

In recent months, the Fed reversed course. Its policy turned aggressive. Proponents argue the Fed had no choice. Its action saved the country from a deep depression.

Of course, there’s no proof Fed policy has worked yet. In fact, there’s mounting evidence the economy has stalled out. Further declines cannot be ruled out.

A return to the 1800s is unlikely. But so is a return to decades of steady expansion.

P.S. To find out how you can use my “Strike Zone” Indicator to see gains of 364% in 12 days, 323% in 18 days, 496% in 4 days and more, sign up for this FREE broadcast.

- Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

- Follow him on Twitter @MichaelCarrGuru.