The COVID-19 pandemic has wreaked havoc on America’s landlords.

I never thought I would see a time in which real estate investment trusts (REITs) reported “percent of monthly rent collected” to their investors, but that’s where we are today.

Those trends are looking a little better, by the way.

NAREIT, an industry body representing REITs, reported that apartment REITs collected only 89.9% of their rents in April. As of last month, that number had improved to 97.5%.

Shopping center REITs collected just 45.9% of their rents in April, and that bumped to 60.5% in June.

It’s still not great, but it’s a lot less bad than it was a couple of months ago.

I wrote about REITs back in April, noting that the sector’s stock prices had been obliterated. I also told you that, sector-wide, the damage to the underlying businesses was overstated.

I wrote then: “High-quality real estate that was in demand before the coronavirus blow-up will still be in demand a year from now.”

REITs: A Deeper Dive

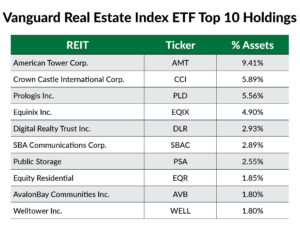

Let’s do a deeper dive today. We’ll pick apart the Vanguard Real Estate Index Fund (NYSE: VNQ).

The Vanguard exchange-traded fund (ETF) is a cap-weighted index ETF. That just means that the largest REITs make up the largest holdings.

A couple of things should jump right off the page. To start, this is not your grandfather’s real estate.

We could debate whether some of these are really real estate companies at all:

Cell towers: The top two holdings, as well as the sixth, are cell tower REITs. American Tower Corp. (NYSE: AMT), Crown Castle International Corp. (NYSE: CCI) and SBA Communications Corp. (Nasdaq: SBAC) own sprawling empires of cellphone towers and are major players in 5G infrastructure.

Their “properties” largely consist of poles with telecom equipment on top. These cell tower REITs together make up nearly a fifth of the entire ETF.

Warehouses: Prologis Inc. (NYSE: PLD) is a logistics REIT that owns warehouses and distribution centers. Amazon is its largest tenant.

Data centers: Moving down the list, Equinix Inc. (Nasdaq: EQIX) and Digital Realty Trust Inc. (NYSE: DLR) are data center REITs. Their tenants are servers, not people.

Storage units: Public Storage (NYSE: PSA) rents self-storage units.

You have to get all the way to the eighth stock on the list — apartment REIT Equity Residential (NYSE: EQR) — to find a REIT that actually caters to live human beings.

Here’s a breakdown of VNQ’s portfolio:

- 8.8%: Retail REITs.

- 8.2%: Office REITs.

- 2.5%: Hotel and resort REITs.

- 80.5%: Properties that are pretty close to COVID-proof.

I say “pretty close” because nothing is 100% insulated.

If the economy gets bad enough due to the lingering effects of the virus and lockdowns, then virtually everyone’s business suffers. Regardless, REITs as a sector have a lot less exposure to COVID risk than most investors realize.

Cheap Compared to the Alternatives

The Vanguard REIT ETF is still about 20% below its 52-week highs and pays about 4% in dividends at current prices.

But looking at the bigger picture, the fund trades at prices first seen in 2007.

I can’t say REITs are “cheap” today. Very little in this market is cheap by any traditional valuation metric.

But I can say that they look cheap relative to the alternatives. In a world in which the 10-year Treasury yields just 0.6%, a 4% dividend is pretty attractive.

• Money & Markets contributor Charles Sizemore specializes in income and retirement topics, and is a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.