Retail sales reached a record high last month. According to the Census Bureau, retail sales reached $619.1 billion in March, up 9.8% compared to the previous month and a 27.7% increase compared to March 2020.

There were month-over-month gains in every category tracked. The biggest gains were in clothing sales, restaurants, sporting goods and autos. Each of these categories was up at least 13% in the month. Clothing sales are 101% higher than they were in March 2020, when the economy almost completely shut down.

The gains show that consumers are anxious to get back to normal.

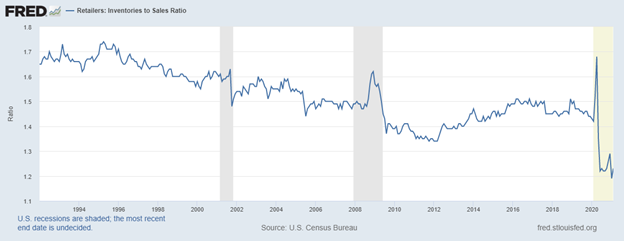

Another report from the Census Bureau shows that retailers have work to do to prepare for a return to normalcy. This report showed inventory levels at retailers are near record lows.

Retail Sales To Retailer Inventory Ratio

Source: Federal Reserve.

Despite Higher Retail Sales, Long Term Investors Will Face Challenges

This is a chart of the inventory to sales ratio for retailers. This ratio measures the amount of inventory the company is carrying compared to the number of sales made.

For the four years before the pandemic, the ratio averaged about 1.45, indicating stores had enough inventory on hand to restock shelves. The ratio now stands at 1.23.

Retailers should be placing orders with suppliers to replenish their depleted inventories. Manufacturers should be increasing production to meet demand. This all indicates the economic boom should continue for at least a few months.

As summer draws to a close and an end to expanded unemployment benefits reduce the money available for consumption, the pace of economic activity should slow. But economic data and corporate earnings for the current quarter ending in June and data for the third quarter ending in September should be strong.

This strength, as unsustainable as it is, does justify higher stock prices in the short run. In the long run, investors will face challenges as consumers pull back and the federal government finds limits to the amount of debt it can issue.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.