Federal Reserve Chair Jerome Powell has acknowledged that inflation will increase in the coming months. In calculating inflation, this year’s prices will be compared to prices a year ago. In 2020, the economy shut down. Now that consumers are returning to stores and restaurants, prices appear to be rising. Powell, and evidently the White House, believe we should ignore the data.

The official policy of the Fed is that the increase in inflation will be temporary and not enough for the Fed to change its policies.

There’s a reason for that.

Future inflation depends on what consumers and business owners believe inflation will be. If they expect higher prices, they spend more in the short run and create inflationary pressures. Powell is trying to manage inflation expectations.

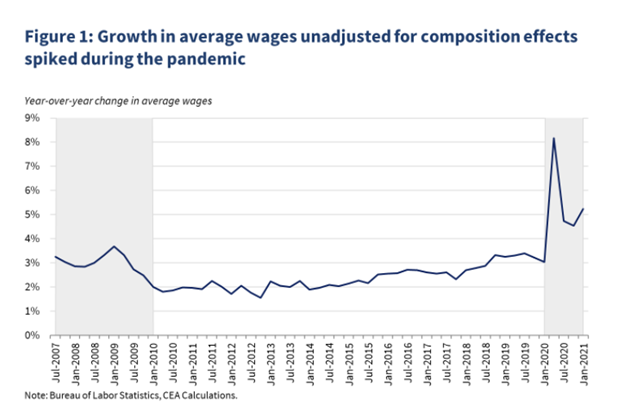

Economists at the White House are also asking us to ignore date. In April 2020, the Bureau of Labor Statistics reported that year-over-year growth in average hourly earnings was up about 8%. The latest data shows an increase of about 5%.

Unadjusted Wage Growth Increased 5%

Source: WhiteHouse.gov.

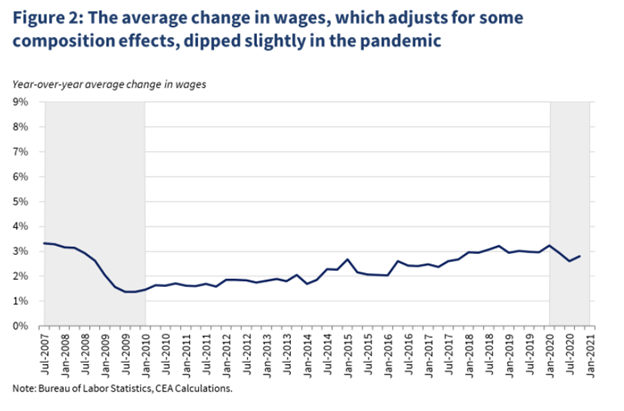

The White House Says Wage Growth Is a Quirk

White House economists say the apparent increase in wages is a statistical quirk. With a few adjustments, they can get the result they prefer. The next chart shows that increase can be eliminated by adjusting for some composition effects. The paper does not document why only some effects were accounted for.

Adjusted Wage Growth Shows Negative Growth

Source: WhiteHouse.gov.

White House Economists’ Adjustments Could Increase Risks

Later in the paper, the White House suggests that wage growth is actually negative. This result helps make a case for stimulus spending and a $2 trillion infrastructure package since the economy needs that money to deliver good jobs.

The truth on inflation and wage growth is that the data is almost certainly wrong.

Official data has long been subject to adjustments. New adjustments to the historic adjustments allow policymakers to explain outcomes they don’t like. But those changes most likely increase risks and could lead to adjustments in stock prices later this year.

While I didn’t exactly design the internet, I can take full credit for this.

I’ve created a first-of-its-kind innovation in the financial markets. It allows everyday traders to get ahead making one simple trade per week.

Click here to see how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.