Bull markets climb a wall of worry, according to a popular Wall Street saying. This applies to broad market averages and individual sectors — and for now, the most worrisome is the retail sector.

Online sales are a concern for brick-and-mortar retailers. In fact, many retailers and investors worry traditional stores may not survive this threat.

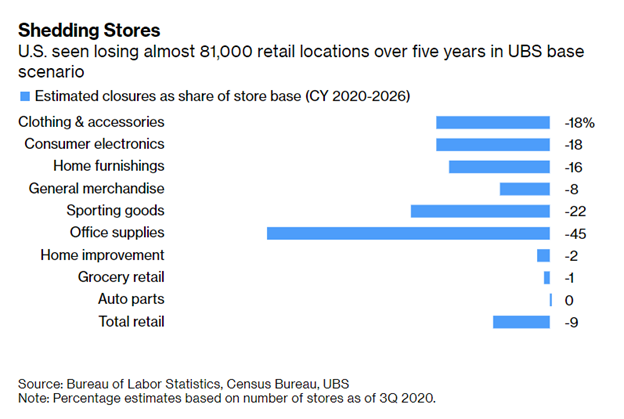

Analysts with UBS recently confirmed those fears. They found: “Roughly one in every 11 stores will close in the next five years, with office supply, sporting goods and clothing retailers among the hardest hit, according to the base case… In the most dire scenario, more than twice as many stores — about 150,000 in total — could close over that span.”

Retail Sector Could Shed Thousands of Stores

Source: Bloomberg.

Adaptation Is Key to Retail Sector Bullishness

For investors, this trend has important implications. Store closings will be a reason to worry about some companies in the retail space. But closing could help other companies.

Malls will be hurt by the shift. According to Bloomberg: “Even the [retailers] that haven’t been distressed are being hurt by the lack of foot traffic in the mall,” said David Berliner, head of the restructuring and turnaround practice at BDO.

Some are talking about relocating stores from malls to nearby centers anchored by merchants like Walmart Inc. “because they’re going to get more foot traffic than they’re getting at the mall now.”

Some retailers may increase profit margins by reducing their costs. They may also increase sales by offering products where consumers are more likely to see them.

Overall, this could be bullish for the retailers that succeed in navigating the current environment. Of course, there will be some retailers that are unable to adapt.

Stocks of these companies will also offer opportunities to traders who short stocks or trade put options. These strategies benefit from decline.

When analyzing retailers, it will be important for traders to remember there will be winners and losers. Headlines will focus on the losers. For those willing to dig deeper, a little research into how store closing affects profits could be rewarding for investors.

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.