Public gatherings are restricted. Cities and states are closing places like bars, clubs and restaurants early.

As the U.S. continues to respond to the impact of the coronavirus or COVID-19, its spread is having a massive impact on just about every sector of the economy.

While the travel and restaurant industries suffer due to rapidly declining demand and a halt on people going out to eat, there is another sector taking a beating: retail.

Overall, markets have fallen as investors come to the realization that consumer spending is going to take a massive hit as the coronavirus, more specifically known as COVID-19, pushes people to stay home. The U.S. retail index has fallen nearly 500 points since the end of February.

This is compounding the expectation of added economic uncertainty in the retail market even before the impacts of the virus were felt in the U.S. The Commerce Department reported retail sales were already down 0.5% in February, even before the virus took hold in the U.S.

According to a 2020 retail outlook from Deloitte, the sector already needed to prepare for a potential recession and were still reeling from the fallout from the recent U.S.-China trade war.

“When it comes to how the next 12 months will play out, uncertainty is the name of the game,” the report said.

Retail Stocks Hit Hardest by Coronavirus

1. L Brands

Market Capitalization: $3 billion

Annual Sales (2019): $12 billion

Annual Dividend: $1.30

On Monday, L Brands Inc. (NYSE: LB) announced it is temporarily closing all Bath & Body Works, Victoria’s Secret and Pink stores in the U.S. and Canada.

It also decided to draw down nearly $1 billion from its credit facility and pulled its quarterly guidance for the first quarter.

In terms of share price, L Brands has been rocked with the news that it’s selling off its Victoria’s Secret business while Bath & Body Works will operate as a standalone company. As part of the restructuring, longstanding CEO Leslie Wexner is stepping down.

Since early February, L Brands shares have trended downward. But in March, the stock has plummeted by 52% to hit a 52-week low.

With stores closed until the end of the month, don’t expect its share price to move anywhere but down anytime soon, making it one of the retail stocks hit hardest by coronavirus.

2. Nordstrom

Market Capitalization: $2.6 billion

Annual Sales (2019): $15 billion

Annual Dividend: $1.48

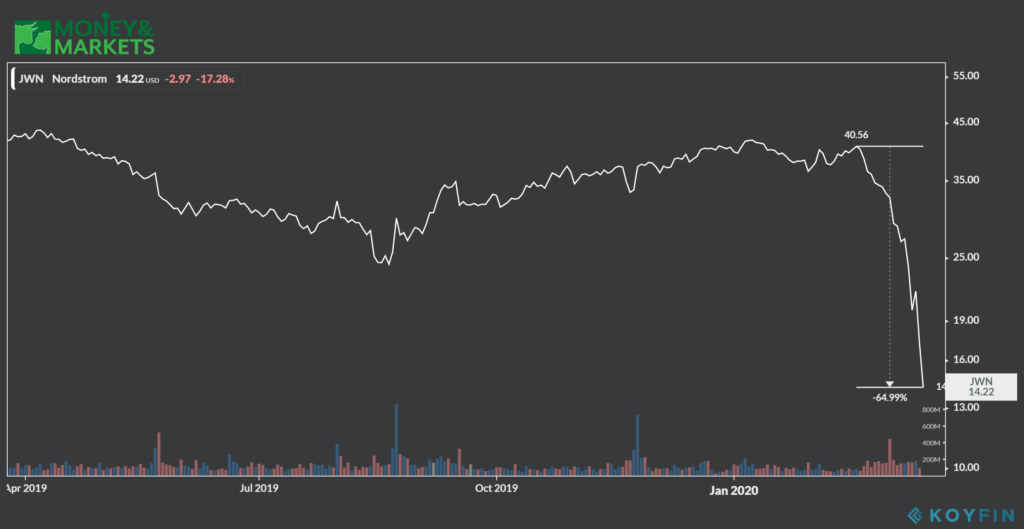

Like L Brands, high-end retailer Nordstrom (NYSE: JWN) announced it is closing all 380 stores for two weeks to help curb the spread of the coronavirus.

It also announced it is pulling its annual financial guidance, “noting a slowdown in consumer demand.”

In its Q4 earnings report, the company said its net sales decreased 2.2% and its fiscal 2019 earnings were about $0.20 lower than the company’s outlook.

Since hitting more than $40 per share on Feb. 20, Nordstrom has dropped almost 65% to a new 52-week low.

Already facing sales headwinds spilling over from the fourth quarter, Nordstrom is likely to see additional pressure due to closures, making it one of the retail stocks hit hardest by coronavirus.

3. Macy’s Inc.

Market Capitalization: $2 billion

Annual Sales (2019): $25 billion

Annual Dividend: $1.51

Macy’s Inc. (NYSE: M) elected to shut down its stores Tuesday afternoon due to the outbreak.

The company did say it is providing additional cleaning staff in each store to ensure “more frequent cleaning of heavily trafficked areas.”

Macy’s decline didn’t just start with the outbreak of the coronavirus. It has been a steadily declining track since 2018.

But the coronavirus did spur a massive drop that actually started in early January. Since then, the share price has fallen almost 64% to trade at a 52-week low.

Macy’s is likely to continue taking body blows as more and more consumers elect not to go out and shop, making it one of the retail stocks hit hardest by coronavirus.

4. Dick’s Sporting Goods

Market Capitalization: $1.8 billion

Annual Sales (2019): $8.7 billion

Annual Dividend: $1.10

A retail chain that has elected not to close is Dick’s Sporting Goods Inc. (NYSE: DKS).

The company has, however, revised its store hours and has closed some stores in three states.

In 2019, shares of Dick’s were trading relatively flat with a brief uptick in the fourth quarter of the year. Its Q4 sales jumped 5.3% and its quarterly earnings were up 3% year over year.

However, since the beginning of 2020, the stock has started to nosedive to the tune of a 62% drop. The company projected flat same-store sales in 2020, but that was before the coronavirus took hold.

With that in mind, you can expect lower sales for at least the next quarter despite Dick’s stores remaining open, making it one of the retail stocks hit hardest by coronavirus.

5. Bed Bath & Beyond

Market Capitalization: $773 million

Annual Sales (2019): $12 billion

Annual Dividend: $0.68

Bed Bath & Beyond (Nasdaq: BBBY) has been struggling since Christmas.

A sluggish Q4 sales report didn’t help matters as the company said its same-store sales dropped 5.4% in December and January. Additionally, its Cyber Monday sales were off by 13% year over year.

That came off the news that company CEO Mark Tritton dumped six senior company executives in the middle of the holiday season.

Shares of Bed Bath & Beyond did bounce up before the Christmas holiday, but all of those gains were erased by March, and BBBY stock has fallen 66% since the end of January.

Like Dick’s, Bed Bath & Beyond has implemented additional cleaning procedures at its stores but has not elected to close any of them.

But don’t expect keeping stores open to have a positive impact on its share price anytime soon, making it one of the retail stocks hit hardest by coronavirus.

Despite several retail outlets taking a hit, there have been some that have seemed to weather the storm. Target Corp. (NYSE: TGT) and Walmart Stores (NYSE: WMT) have seen volatile moves both up and down, but they have not seen the declines others on our list have.

All told, while there are some stores making it through the coronavirus scare, you can expect to see an overall decline in the retail sector so long as the spread persists.

With sales expected to be sluggish this quarter, the retail stocks hit hardest by coronavirus are likely to get worse.