Robert Shiller won a Nobel Prize in economics for identifying that it is “possible to foresee the broad course of [stock] prices over longer periods, such as the next three to five years.”

Shiller has made several bad market calls, but his opinions still carry weight, especially when he introduces new stock market indicators.

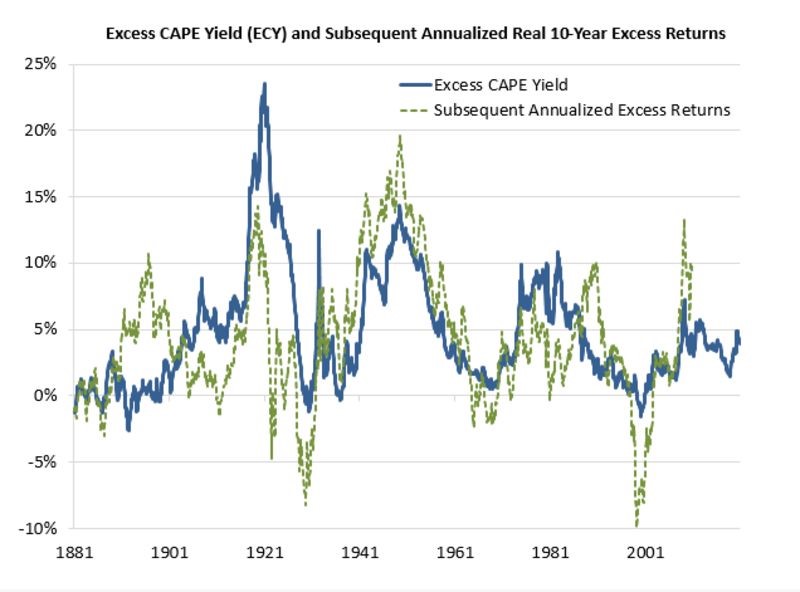

Recently, Shiller unveiled the Excess CAPE Yield (ECY), an indicator that looks at stock market valuation in the context of current interest rates. ECY shows a strong correlation with returns over the next ten years.

Right now, ECY is saying investors should expect reasonable returns from the stock market in the 2020s.

CAPE, or the cyclically adjusted price-earnings, is Shiller’s metric for valuation that averages inflation-adjusted earnings over ten years. CAPE has indicated that stocks are overvalued for almost all of the last 15 years.

What Excess CAPE Yield Indicates

In researching this, Shiller noted that stocks should have higher valuations when interest rates are low. ECY captures that idea by converting CAPE to an earning yield and then subtracting the interest rate on ten-year Treasury notes from that yield.

The earnings yield is simply the inverse of CAPE. If CAPE is 20, for example, the earnings yield is 5%.

Based on ECY, average returns for U.S. stocks should be acceptable to long-term investors. But Shiller found even better returns overseas:

The ECY is close to its highs across all regions and is at all-time highs for both the U.K. and Japan. The ECY for the U.K. is almost 10% and around 6% for Europe and Japan. Our data for China do not go back as far, though China’s ECY is somewhat elevated, at about 5%. This indicates that, worldwide, equities are highly attractive relative to bonds right now.

In other words, Shiller is saying that instead of worrying about valuations, investors should consider increasing exposure to foreign markets.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.