Earnings are unusually bullish this quarter.

With about two-thirds of companies in the S&P 500 reporting results for the second quarter, 84% of companies beat analysts’ expectations. Earnings are 21.8% above estimates on average.

For context, the five-year average beat rate is 72%. Over the past 20 quarters, actual earnings beat estimates by an average of 4.7%.

Analysts seem unusually bad at their jobs this quarter. But it’s really an extreme example of the earnings game that analysts and company managers play.

Near the end of every quarter, analysts call managers to ask how they did. Managers often try to lower expectations for the quarter. Analysts react by reducing their earnings estimates. Then, companies announce earnings and beat the lowered expectations.

Stock prices tend to jump when companies beat earnings. Maybe that’s why analysts and management play the earnings game every quarter.

But individual investors seem to have caught on to this trick this week.

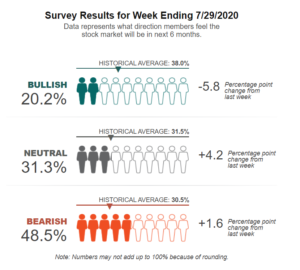

Below is the latest data from the American Association of Individual Investors (AAII) weekly sentiment survey.

This survey dates back to 1987. In an average week, 38% of investors are bullish, 30.5% are bearish and 31.5% are neutral.

Last week, there was a significant decrease in the number of bulls.

Bullish Investors Go Into Hiding

Source: AAII

Most investors are bearish or neutral.

Investors Think Earnings Are Too Good to Be True

Over more than 40 years, this survey has shown that the majority of investors are usually wrong. When the number of bulls is low, prices in stocks tend to go up.

There’s a simple explanation for this. If it were easy to find profits, every investor would be rich.

But trading is a difficult task, and we should expect most investors to be wrong. Survey data confirms that.

Despite strong earnings, economic news is bearish. Negative headlines are driving pessimism among investors. The AAII survey confirms this.

Investors seem to think that earnings are too good to be true. But maybe they aren’t. Maybe prices are heading higher.

AAII’s data is bullish for stocks.

It seems that many individual investors expect a pullback. So there is cash on the sidelines.

Investors are likely becoming frustrated that they are missing out on gains of the recent rally. They could push prices higher by moving cash into the market.

Individual investors could power a surge that marks the end of the rally. But that’s a potential concern for next month as the market focuses on the short run.

- Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.