It seems only earnings season could put a damper on the run U.S. markets have had through late-2019.

Well, without further ado … it’s earnings season, but market bulls are singing a different tune.

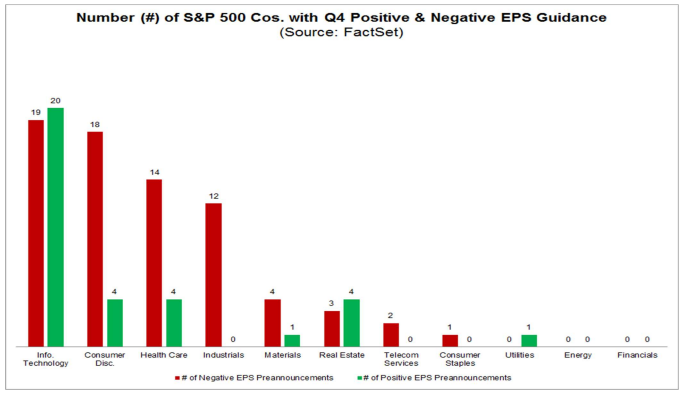

The expectations are already pretty low as companies nearly went out of their way to lower guidance for the fourth quarter.

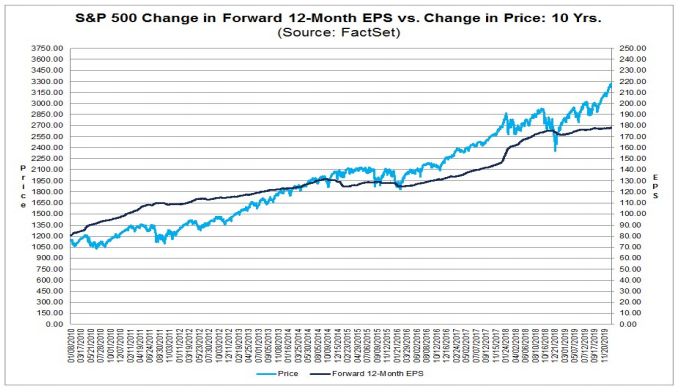

While markets have been setting records, earnings have severely lagged behind. The gulf between the S&P 500 index and earnings per share is vast. The S&P 500 is trading at nearly 19 times the expected earnings per share.

For context, the average P/E ratio for the S&P 500 in the last decade is around 14.9. Many analysts suggest the S&P 500 is already overvalued.

The Big Sell-Off?

Usually, the current market conditions, coupled with an expected earnings decline of 2% for the S&P 500, according to FactSet, spells a market sell-off.

Not so fast, analysts suggest.

“We expect to see a 2% beat in 4Q earnings. Estimates have reset sufficiently, in our view,” wrote Bank of America Securities stock strategists, according to CNBC, adding estimates are down 5% over the past three months. “Consensus expects the biggest margin drop since 4Q18 (when tariffs started to hit), which we think is too bearish.”

Traditional market bull and CFRA Research’s Sam Stovall said he expects earnings season to validate the strong upward movement of the equities market, starting this week.

“The bar for the fourth quarter is actually set relatively low,” Stovall told CNBC’s Trading Nation Monday. “I always like to say it’s very hard to injure yourself falling out of a basement window.”

Earnings Projected Lower in Q4

FactSet’s senior earnings analyst John Butters wrote the estimated earnings for the fourth quarter declined by 4.7% from September 2019 to December 2019. That’s a larger decline than the five-year average of 3.3%, the 10-year average of 3.1% and the 15-year average of 4.4%.

And S&P 500 companies lowered that bar, as Stovall said, to the tune of nearly 70% of companies who have issued guidance for the quarter.

Refinitiv research suggests earnings per share on Wall Street for Q4 will be 0.7% lower than Q4 2018 earnings. As of Jan. 1, earnings were already down 0.3%.

Even Stovall said that’s just a blip on the radar.

“Q3 was the 31st consecutive quarter in which the reported EPS change exceeded the estimated EPS change. In addition, in those prior 31 quarters, actual results outpaced forecasts by an average 3.8 percentage points,” Stovall wrote in his earnings outlook research note. “So should history repeat itself in Q4, and there’s no guarantee it will, EPS growth may come in closer to a 2.0% advance than a 2.0% shortfall.”

He added a near 10% jump for the S&P 500 by years-end.

Earnings Beats Already Happening

U.S. investment bank JPMorgan Chase & Co. (NYSE: JPM) reported a 21% jump in profit Tuesday and posted the best year for any U.S. bank in history, according to Bloomberg.

Its annual earnings were $36.4 billion — a record — thanks to a rebound in trading. The earnings beat Wall Street analysts by nearly $1 billion.

“They are really hitting it out of the park,” said Alison Williams, an analyst at Bloomberg Intelligence. “The other key positive, which looks more sustainable, is that interest income looks like it’s stabilizing. That was a big worry last year.”

Additionally, Citigroup Inc. (NYSE: C) blew away analysts’ estimates for both earnings and revenue.

The end result for earnings season will play out just like Stovall suggests — earnings up and the market highs justified.

So far, that’s exactly the path the S&P 500 is currently on.

Welcome to the earnings season.