We have a saying here in Florida: “If you don’t like the weather, wait 15 minutes.”

The same can be said for the price of oil if you’re a bull: If you don’t like the price, wait for the Saudis to support the price.

Oil’s fundamentals are terrible. They have been all year. But amidst this, Saudi Arabia has spent billions trying to keep the price from collapsing, which the global/macro picture deteriorates.

And the closer we get to what is likely to be the biggest IPO in history for now just 1.5% of Saudi Aramco, the more the market for oil loses touch with reality. And this Saudi Aramco IPO has been one of the biggest melodramas in capital markets for the past three years.

What started as a $400 billion IPO for 20% of Aramco is now a shadow of that after U.S. and European book runners couldn’t scare up enough suckers investors to buy into a company on the handshake of the immensely corrupt Saudi royal family.

Eventually the Saudis had to produce something akin to a financial report for underwriters to sign off on, and the result has been valuation ranges hovering around $1 trillion in scope with a median price near $1.7 trillion, down from the $2 trillion Crown Prince Mohammed bin Salman wanted.

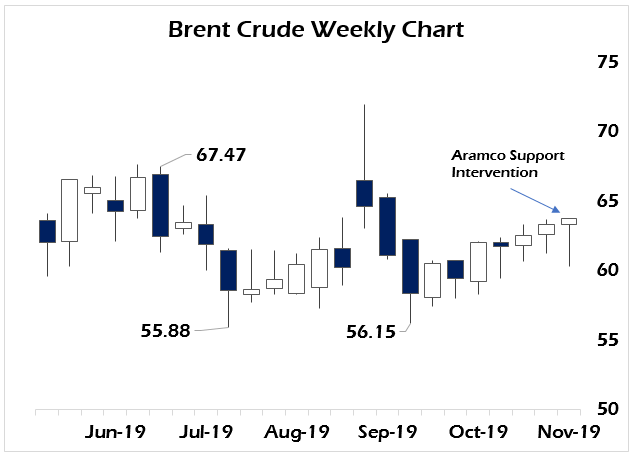

On Wednesday, Brent Crude futures round-tripped down toward $60 and rallied on Thursday to hit a high of $64.02. Also on Wednesday morning, the four-week rally in oil prices was in technical trouble. By Thursday, despite a bevy of conflicting statements about a U.S.-China trade deal happening and a rising U.S. dollar while stocks, bonds and gold all treaded water, oil was looking to make new highs.

It’s almost enough to make a Saudi Prince put his left foot in, shake it all about and do the hokey pokey.

The reasons for the rally are numerous and, ultimately irrelevant. The main one making the rounds of the financial press being that Russia will support OPEC in whatever decision it makes in extending production cuts from last year through the first half of 2020.

Like anyone looking at a chart of oil or U.S. shale production couldn’t have predicted that.

Seriously, we are staring at a global slowdown at best, and a financial crisis in Europe drying up dollar liquidity around the world that will make Lehman Bros. look like an Amish barn raising at worst.

There’s little doubt that oil prices will be under serious pressure in dollar terms in 2020.

So, the Dec. 5-6 OPEC meeting will likely confirm what we already know. Aramco will price somewhere around $1.6 to $1.7 trillion. It won’t list here in the U.S. because the U.S. banks pulled out of the roadshow and it will wind up being a mostly bespoke affair.

Countries like China and Russia will likely support it via proxies to smooth over geopolitical tensions while publicly eschewing it in their sovereign wealth funds.

Remember, it is the Saudis who came to Putin over the summer to invest in a number of oil and gas projects, notably the Arctic 2 LNG project with Novatek (NYSE: NOVKY) while Putin met recently with the Saudi royals signing deals worth billions to shore up their relationship long term.

The Aramco IPO is incredibly important to the future of Saudi Arabia, but at this much smaller size is now more about prestige than it is about the money itself. The Saudis have lost the trust and respect of the world community and now have to prove themselves to the world that they can play by the new rules governing geopolitical affairs.

That people didn’t come begging them for a piece of their crown jewel at whatever price they demanded has been simply one humiliation after another.

But, at the same time, the major players like Putin and U.S. President Donald Trump do not want to see the Saudi Kingdom become a failed state and fall to insurrection, which, in my opinion, is richly deserved.

So, there is considerable support for them still. Trump just announced sending more troops and missile defense infrastructure to protect the oil fields so that a repeat of September’s attack by the Houthis is not replicated.

And Putin will signal to oil markets that the price needs to be supported here to get the Aramco IPO off the ground.

As an oil investor I would take this reprieve as temporary, a six-to-eight-week swing trade at best.

This uptrend off the double bottom formed at $56 per share (chart above) is already seven weeks old. It will last until at least the week of Dec. 5 on a buy the rumor/sell the news dynamic.

In order for this rally to be real we’ll need a number of things to go right, including a signed deal between the U.S. and China, a resolution to Brexit in Europe’s favor, Angela Merkel to survive the party congress season in Germany, and there to be no systemic shocks or a surprise rate cut from the Fed.

At this point a Fed rate cut would be an admission that there is something truly wrong, not just, as Fed Chair Jerome Powell termed, “a mid-cycle adjustment.” So, if you’re an oil bull don’t wish for that. All that will do is create a blow-off top that the shorts will pile onto.

The lesson here is that to support the Aramco IPO, oil is being pumped up, pushing a concentration of people onto the wrong side of the trade when the long-term chart is bearish amid a bearish global/macro picture and supply/demand imbalances.

That’s not going to change in the next six weeks and when there is a weak rally like this without confirmatory fundamentals, the reversal will be sharp and painful.

But, the Saudis will have their money.

• Money & Markets contributor Tom Luongo is the publisher of the Gold Goats ‘n Guns Newsletter. His work also is published at Strategic Culture Foundation, LewRockwell.com, Zerohedge and Russia Insider. A Libertarian adherent to Austrian economics, he applies those lessons to geopolitics, gold and central bank policy.