A study from Insider Intelligence found that Americans spend an average of 4 hours and 23 minutes every day on our mobile devices.

We spend a bulk of that time listening to music and podcasts. Another growing category is shopping online.

Looking up the best deals and product information — even making major purchases online — is becoming the norm:

The chart above illustrates the growth of the mobile payment market in the U.S.

In 2021, the U.S. market’s value increased 35.5% over the previous two years.

By 2025, the market will grow 105% from 2021 — and retailers are taking note.

To make the mobile shopping experience easier, retailers use scannable barcodes and QR codes to show information about products.

Folks can purchase from those codes, and businesses get a ton of information about their customers.

Today’s Power Stock is a leader in data capture from barcode technology: ScanSource Inc. (Nasdaq: SCSC).

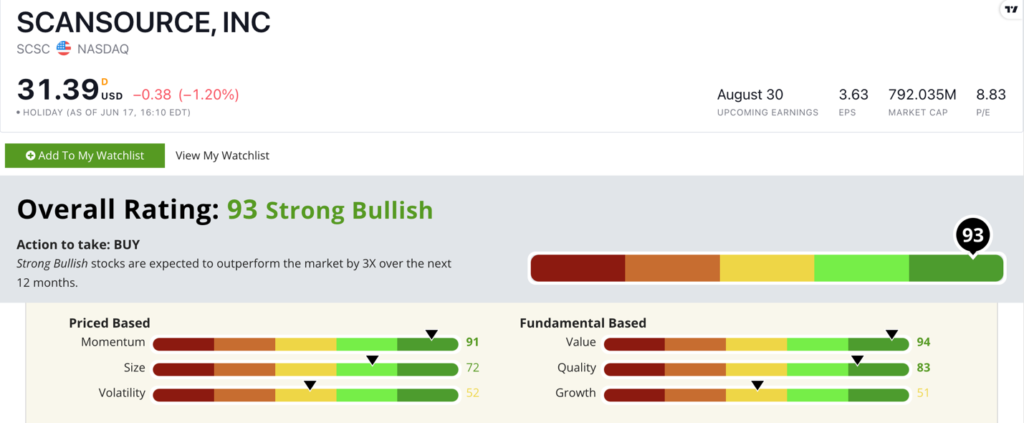

SCSC Stock Power Ratings in July 2022.

ScanSource provides data it captures from barcodes, as well as tech to process payments.

Its data capture and point-of-sale technology help automate payment collection and processing for everything from retail sales to warehouse management.

ScanSource stock scores a “Strong Bullish” 93 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

SCSC Stock: Outstanding Tech Value Play

SCSC is on track for a strong sales year:

- In 2021, the company had $3.1 million in total sales. Through the first three quarters of its fiscal 2022 year, SCSC’s $2.6 million is on track to beat revenue from last year.

- Every quarter of 2022 has been better than the same quarter a year ago.

SCSC’s price-to ratios are excellent.

Its price-to-earnings ratio is a reasonable 8.7 — well under the IT distribution industry’s inflated average of 22.7.

Its price-to-sales ratio is almost half that of its industry cousins.

ScanSource’s return on equity is 12% … better than the industry average of 8.9%.

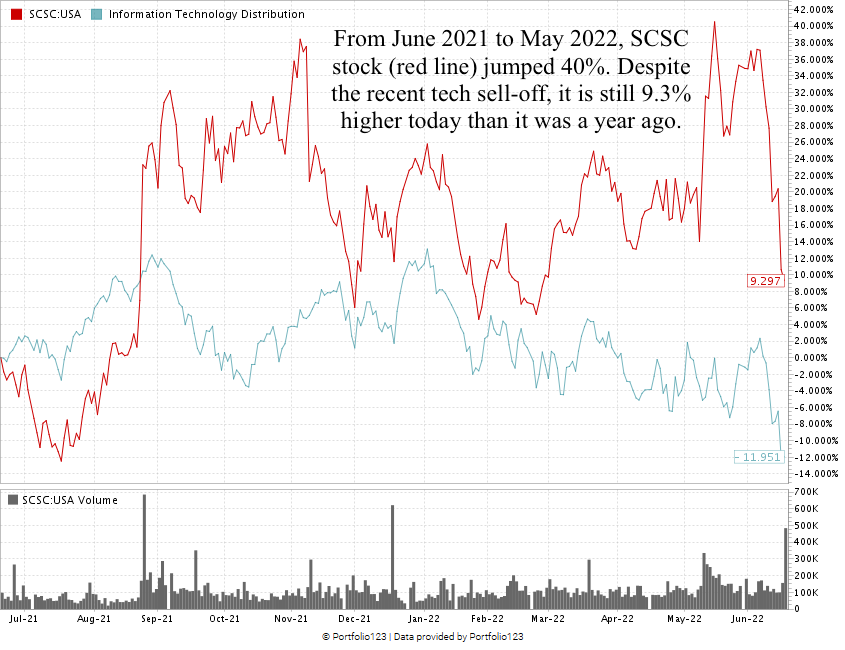

Before the tech sell-off in May 2022, SCSC stock climbed 40% from June 2021.

Despite the sell-off, the stock is still 9.3% higher than it was a year ago and is outpacing its industry peers — which are down 12% over the same time.

ScanSource Inc. stock scores a 93 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Mobile purchasing is growing more common. As retailers adapt to this change, scannable barcodes and QR codes ease the online shopping experience.

This is one reason ScanSource Inc. is a smart addition to your portfolio.

Stay Tuned: Mobile Audio Semiconductor Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an innovative Austin-based mobile audio company.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach my team and me anytime at Feedback@MoneyandMarkets.com.