The Securities and Exchange Commission (SEC) is coming after Elon Musk … again.

Last week, the embattled Tesla Inc. (Nasdaq: TSLA) CEO tweeted, “Tesla made 0 cars in 2011, but will make around 500k in 2019.”

That’s quite a bold statement, and Musk hurriedly tweeted a correction: “Meant to say annualized production rate at end of 2019 probably around 500k, i.e. 10k cars/week. Deliveries for year still estimated to be about 400k.”

The problem is that Musk violated his prior agreement with the SEC. You see, after the whole “funding secured” fiasco, the SEC has to approve of such tweets. And late yesterday, they took legal action.

“Musk did not seek or receive pre-approval prior to publishing this tweet, which was inaccurate and disseminated to over 24 million people,” the SEC wrote in its court filing.

As part of Musk’s settlement for the “funding” tweet, he was slapped with a $20 million fine, had to relinquish his role as Chairman and is required to get pre-approval for all future tweets regarding Tesla.

Musk violated that agreement with last week’s tweet, prompting the SEC to ask a judge to hold Musk in contempt.

“For all the reasons stated, the SEC respectfully requests that the Court enter an order to show cause why Defendant Elon Musk should not be held in contempt of the Court’s October 16, 2018 Final Judgment,” the SEC’s filing concluded.

The tweet was apparently doubly bad for Tesla, as general counsel Dane Butswinkas left his position the very next day. Butswinkas was replaced by former vice president of legal, Jonathan Chang.

You can read the entire SEC filing by clicking here.

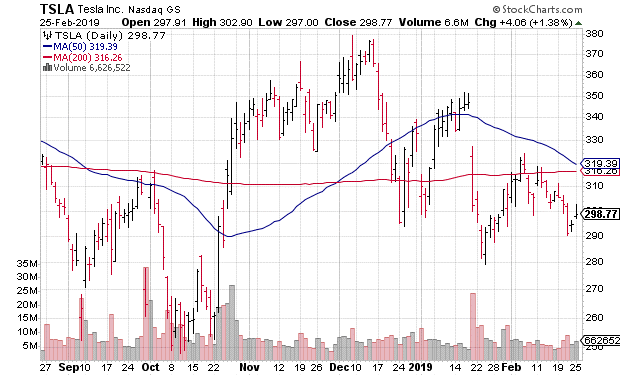

Following the news, TSLA stock plunged more than 8 percent in pre-market trading. As of yesterday’s close, TSLA was down nearly 30 percent from it’s 52-week high of $387.46.

But there’s a bigger problem for Tesla investors. The stock’s recent weakness has drawn it’s 50- and 200-day moving averages toward a bearish cross.

In technical trading, such a cross is known as a “death cross.” Such indicators are often seen by technical traders as significant sell signals.

In other words, TSLA stock could be on the verge of even heavier losses over the short term.