It’s difficult to find winning stocks right now.

Even with last week’s rallies, all three major indexes are down for the year.

But that’s what our proprietary Stock Power Ratings system is for. We can use it to find outperforming companies, even in market downturns.

In March, I came across a “Strong Bullish” shipping stock. The company transports iron, coal, grain and other materials worldwide.

It’s a boring (but profitable) business model in today’s market.

And its stock has taken off:

- It jumped 41% from late January to the middle of March.

- It soared another 28% to a fresh 52-week high after I told you about it.

I thought the stock would go higher, and Diana Shipping Inc. (NYSE: DSX) didn’t disappoint.

Let me tell you why this stock will continue going up.

Shipping Costs Continue to Rise

The Baltic Dry Index is a bellwether of the broader shipping market.

It tracks the cost of current freight on various shipping routes. As you can see from the chart below, the index dropped after reaching a high in September 2021.

The index hit above 5,000 points in September 2021 — when shipping prices reached a peak.

It pared off close to 4,000 points through January of this year. But from January to April, the index has climbed 69.5%.

That led me to target that momentum with an outstanding shipping stock.

DSX: Stock Momentum Keeps Climbing

Diana Shipping is a Greek global transportation company with a fleet of 34 dry-bulk vessels operating around the world.

It transports cargo that is necessary for the global economy:

- Iron ore.

- Coal.

- Various grains like wheat, soybeans and corn.

COVID-19 hammered the global shipping industry.

Diana Shipping’s total revenue dropped from $220.7 million in 2019 to $169.7 million in 2020 — a 23% year-over-year decline.

As COVID-19 subsided in 2021, the global shipping industry found its sea legs (pun intended), and DSX’s total revenue reached $214.2 million last year — a 26% increase from 2020.

Estimates call for a massive jump in the company’s annual revenue. Projections suggest DSX could hit $290.1 million total revenue this year. That would be a new high for the company and 70% higher than where it was during the worst point of the pandemic.

When I recommended DSX in March, it was down slightly from its 52-week high, but still up more than 75% over the previous 12 months.

That dip was short lived:

DSX Hits New 52-Week High Since March

Since my recommendation, the share price has jumped another 28%. Congratulations on those gains if you bought it back in March!

But I don’t think DSX is done yet.

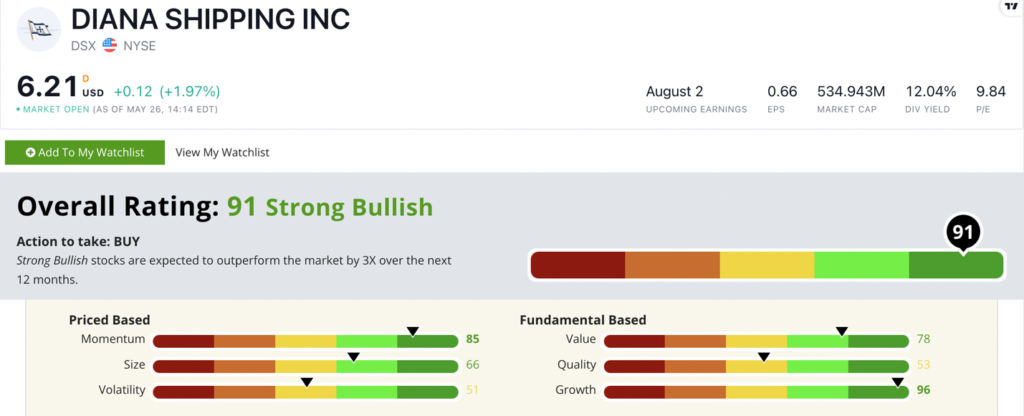

Diana Shipping Inc. Stock Rating

DSX continues be a top-rated stock in Adam’s proprietary Stock Power Ratings system.

It scores a 91 overall, meaning we are “Strong Bullish” and expect it to beat the broader market by at least three times over the next 12 months.

DSX continues to rate in the green on four of our six ratings factors:

- Growth — In the last quarter, DSX reported an earnings-per-share growth rate of 594.8% and a sales growth rate of 61.4%. That earns Diana Shipping a 96 on growth.

- Momentum — Since I recommended the stock in March, its share price has jumped another 28%. DSX scores an 85 on our momentum factor.

- Value — The run-up in share price has changed Diana’s value metrics, but the company still trades with price-to-earnings and price-to-book ratios below the cargo transportation industry’s averages. DSX earns a 78 on value.

- Size — Diana Shipping’s market cap has increased by $100 million since March, but it is still a great size to give us even more room to grow our gains. Smaller stocks tend to outperform larger stocks with similar ratings on the other five factors of Adam’s system. DSX scores a 66 on size.

The stock still rates neutral on volatility (60) and quality (54), but it’s important to note that those two ratings are higher than when I recommended DSX earlier this year … so those metrics are getting better.

My bottom line remains the same: Imports and exports drive the economy no matter what else is going on in the world. Demand continues to grow.

Reliable cargo transportation around the world will keep all of these goods moving.

DSX is a Strong Bullish shipping stock with incredible growth, strong value and solid momentum.

And this global shipping stock is still a great addition to your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist/editor for 25 years, covering college sports, business and politics.