Just when we’d had enough infectious disease madness, another virus is spreading across the U.S.

We used to mainly find monkeypox in African nations.

In May, however, countries including the U.S. began reporting outbreaks.

This latest outbreak shines a light on the antiviral drug market around the world:

This chart shows the steady increase in the value of the antiviral drug market through 2026.

That market value will rise 11.5% by 2026.

Today’s Power Stock is a $1 billion player in antiviral drug development: SIGA Technologies Inc. (Nasdaq: SIGA).

SIGA Stock Power Ratings in July 2022.

SIGA develops drugs to combat infectious diseases in the U.S. Its lead product, TPOXX, is an antiviral drug that treats smallpox. TPOXX’s use is expanding to treat monkeypox.

The company has partnered with Cipla Therapeutics to develop and produce drugs used against various biothreats.

SIGA Technologies stock scores a “Strong Bullish” 93 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

SIGA Stock: Strong Momentum + Quality

I dug deeper into SIGA, and here’s what I found:

- In the first quarter of 2022, SIGA reported total revenue of $10.5 billion — a 8% increase in revenue over the same period a year ago!

- It received $13 million in orders for TPOXX from three countries, along with a $7.5 million order from the U.S. Department of Defense.

According to our Stock Power Ratings system, SIGA has strong momentum and low volatility.

But the stock’s quality is a high point as well. SIGA knows how to turn a profit!

Its return on equity is 48.1%, which blows away its industry peers’ average of negative 64.4%.

Even more revealing about SIGA’s quality:

The company’s operating margin — the profit on a dollar of sales after taking out production and wage costs — is a massive 64.3%.

Its industry peers average negative 1,194.3%. That’s not a typo, folks!

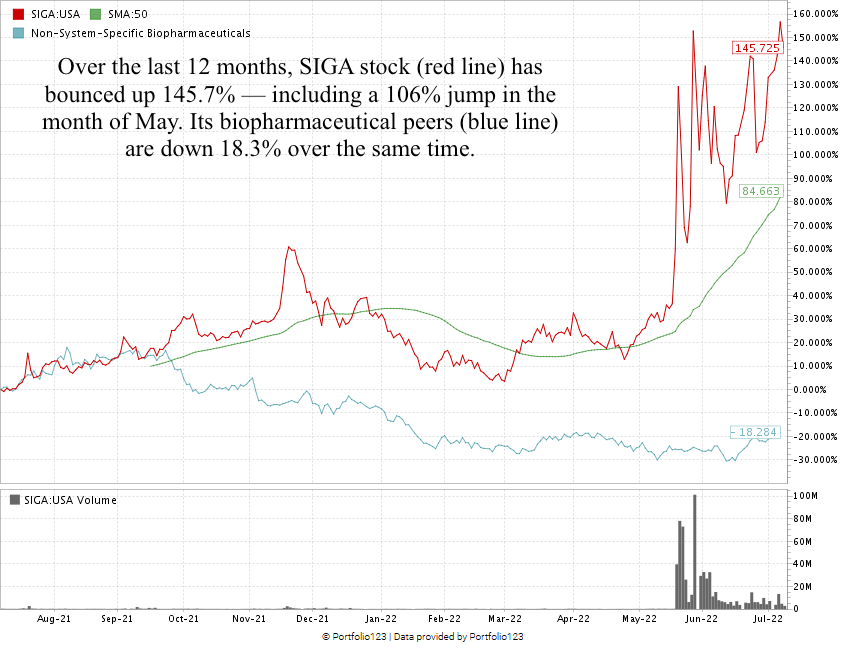

In May, SIGA stock jumped 106% on the heels of its outstanding quarterly report. It’s maintained those gains and even reached a new 52-week high in July.

The stock is kicking the tails of its biopharmaceutical peers, which are down 18.3% over the last 12 months.

SIGA Technologies Inc. stock scores a 93 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

On the heels of the ongoing COVID-19 pandemic, we’re battling another infectious disease.

SIGA has developed the groundwork to combat monkeypox, and it’s a strong contender for your portfolio.

Stay Tuned: “Strong Bullish” Logistics Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a compelling logistics stock to consider.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.