What do all successful businesses have in common?

A dedicated staff and excellent insurance.

Companies need to protect everything: their vehicle fleets, buildings, staff and even their ideas.

The chart above shows the value of commercial insurance in the U.S.

From 2013 to 2020, that value vaulted up 34.7% to a record $314.7 billion, according to the Insurance Information Institute.

I have high conviction the commercial insurance industry will grow from here.

Today’s Power Stock underwrites commercial insurance: W.R. Berkley Corp. (NYSE: WRB).

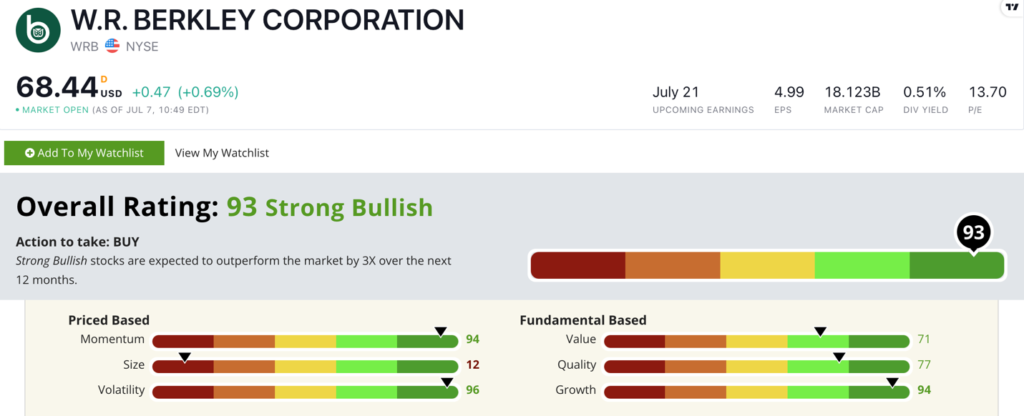

WRB Stock Power Ratings in July 2022.

WRB underwrites company property, automobile and liability insurance in the U.S.

W.R. Berkley stock scores a “Strong Bullish” 93 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

WRB Stock: High Momentum & Growth

W.R. Berkley just set a massive record in its quarterly report.

Details include:

- Wrote $2.9 billion worth of premiums in the first quarter of 2022 — a 15% jump from the same quarter a year ago!

- Operating income reached $306.9 million for the quarter — increasing 52.1% from first-quarter 2021.

WRB earns a “Strong Bullish” 94 on growth.

It grew earnings per share (EPS) by 158.3% from the fourth quarter of 2021 to the first quarter of 2022. The company’s one-year annual EPS growth rate is 95%.

The company grew its total sales by 35.2% from fourth-quarter 2021 to first-quarter 2022.

Now, about its momentum and volatility:

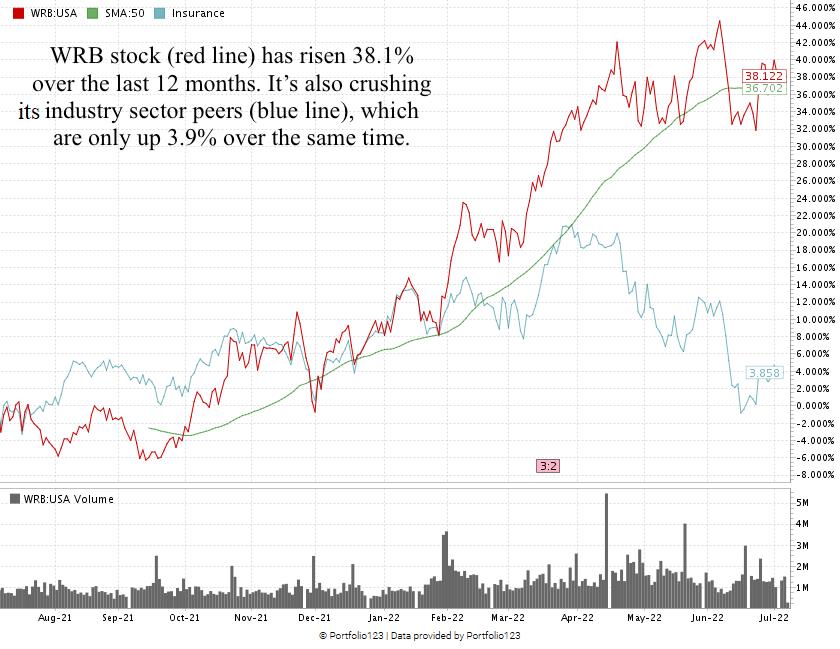

In the last 12 months, WRB stock gained 38.2% and is blistering the insurance industry — which is up just 3.9%.

The stock’s upward movement came with low volatility — leading to its 96 rating on the metric.

W.R. Berkley Corp. stock scores a 93 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Businesses need insurance to protect from accidents, natural disasters and even product liability.

This industry grew to new highs during the COVID-19 pandemic, and that growth is far from over.

W.R. Berkley stock’s market-busting momentum and growth are strong reasons to add it to your portfolio.

Bonus: The company’s 1.3% forward dividend yield translates to a $0.90 per share, per year payout if you own the stock.

Stay Tuned: Terrific Pharma Power Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an excellent pharmaceutical stock to buy.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.