At the close on Friday, the S&P 500 was lower than the week before. That was a historic event.

It marked the seventh consecutive down week for the Index. With data dating back to 1928, this was just the fourth time there has been a losing streak of that length.

While the sample size is small, it helps to consider history.

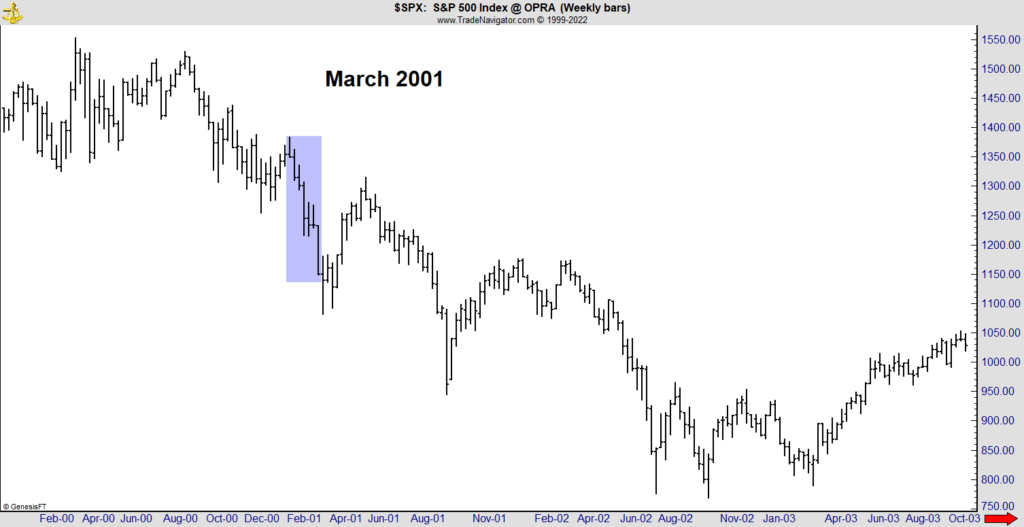

One prior streak occurred in 2001. That was in the midst of a historic bear market.

Early 2000s Bear Market Was Historic

The losses came about a year after the bear market began. Despite a rally after the losing streak, the bear market lasted another 18 months. The selling pressure in early 2001 was just part of the trend.

We’ve Seen This Before in the S&P 500

Before that, we have to go back to 1980 to find a similar losing streak. That was in April 1980. The S&P 500 was in an uptrend at that time.

The sell-off in stocks coincided with the silver market crash after the Hunt brothers’ corner failed.

The Hunt brothers were wealthy oil barons who wanted to own as much silver as possible. They used futures markets and borrowed money to amass a large position. Their scheme collapsed when they failed to meet a margin call.

The silver sell-off bled over into the stock market, making this a unique case.

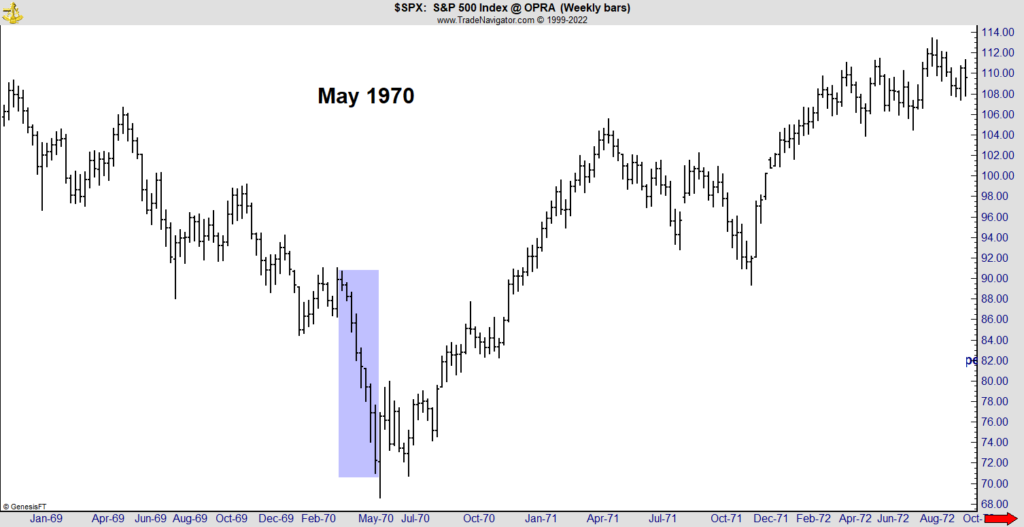

The first seven-week losing streak ended in May 1970.

The End of the Losing Streak

Inflation was rising at the time. The White House was assuring investors it had a plan. But traders didn’t believe that story. The Nixon administration entered office in January 1969 and failed to deliver on the economy.

Flash-forward to May 1970. Deeply divided politically, the nation prepared for midterm elections less than six months away.

This all sounds familiar. Switch Nixon with Biden, update the dates and you could be talking about today.

Bottom line: There are differences, but there is room for optimism based on history — a rally in stocks is near.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.