Last week, both stocks I covered in Earnings Edge, HCA Healthcare Inc. (NYSE: HCA) and T. Rowe Price Group (NYSE: TROW), fell on earnings.

It came as HCA and TROW tried to hold a key support.

At this point, look for them to break down even further from here.

This is why I recommended playing a straddle on these two stocks, which could have turned a profit in both cases.

HOOD Proves: Don’t Bet on Beaten-Down Stocks

No matter how oversold it is, we should never bet on a beaten-down stock to bounce.

We can find no better example than Robinhood Markets Inc. (Nasdaq: HOOD) last week.

Shares of the brokerage stock have fallen since the second week after its initial public offering, down 85% from their August peak.

But even after this massive and lengthy decline, shares dropped another 10% at the open last week because of its earnings report.

So, if you ever wonder if things can get any worse … avoid that stock.

Things can always get worse.

The ultimate floor for any stock is $0. Until a stock hits that level, it has plenty of room to drop.

Today, with the craziness we’ve seen in the market, we’ll keep our eye on two stocks that have avoided the weakness in recent weeks and now are set to break out: Regeneron Pharmaceuticals (Nasdaq: REGN) and Sirius XM Holdings (Nasdaq: SIRI).

Earnings Edge Stock No. 1: Sirius XM Holdings (Nasdaq: SIRI)

Earnings Announcement Date: Tuesday, before the open.

Expectations: Earnings at $0.07 per share. Revenue at $2.24 billion.

Average Analyst Rating: Outperform

Shares of Sirius XM, the satellite radio company, have been flat after the post-lockdown rally in 2020.

The stock has hovered between $5.50 and $6.50. It now trades right around $6.10.

I don’t expect this range to hold up forever, though.

At some point, it will break. The stock will either trend lower or begin to climb.

And earnings are always a pivotal point to watch.

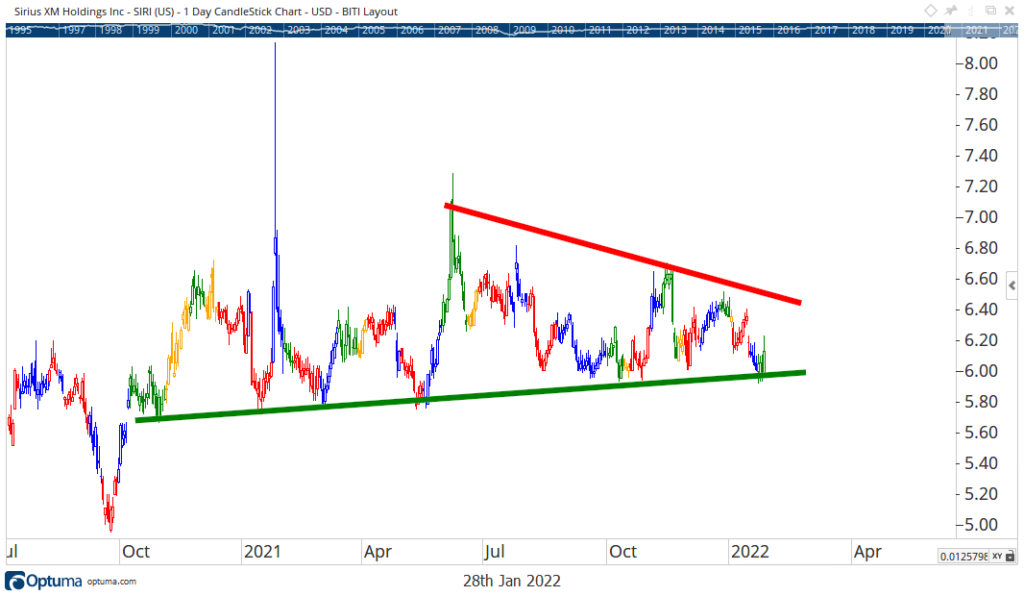

You can see on the chart below how the price hasn’t done much over the past year.

But those two key levels have emerged.

Now that they are converging, we’re getting closer to a breakout.

SIRI: Key Levels to Converge

Even with a narrow price range, the stock trades in volatile sessions. It surges double digits only to fall double digits in the days that follow.

The options market has caught on to this, though.

The market is currently pricing in nearly a 6% move on earnings this week.

That’s a decent move in just a week’s price action. It means the stock has to jump more than 6% for you to make a profit trading options this week.

That’s entirely possible with an earnings announcement.

However, we also need to get the direction right. That part is a lot tougher.

Instead, I’ll watch the stock and wait for it to break one of the key trends, then hop in and ride the wave — higher or lower.

Earnings Edge Stock No. 2: Regeneron Pharmaceuticals (Nasdaq: REGN)

Earnings Announcement Date: Friday, before the open.

Expectations: Earnings at $19.25 per share. Revenue at $4.43 billion.

Average Analyst Rating: Outperform

At the end of the week, pharmaceutical stock Regeneron reports its latest earnings. I expect a few fireworks with this one.

Talk about a tight consolidation!

This stock has barely budged in the weeks leading up to the earnings report. With the share price coiling up, a breakout on earnings is almost guaranteed.

Options on this stock only have monthly expirations, so we have to look out to February 18.

Even then, the market is only pricing in a 3.2% move over the next couple of weeks.

That seems unlikely given the tight consolidation and an earnings report.

This stock drifts between 2% and 3% in a normal week.

With earnings, I expect moves of 5% to 10% by the time the options expire.

Just look at the tight price range over the last couple of weeks. The stock has stayed right around the $610 price mark. It’s now set for a clear breakout.

REGN: Set for Breakout

It won’t take much news to move this stock past a key level, so I think earnings will do the trick.

I’ve mentioned options straddles before in Earnings Edge, and REGN is a prime candidate this week.

With a straddle, you buy one call option and one put option at the same strike, with the same expiration date.

So, if you spent 6% in premiums, you’d need the stock to move more than 6% in either direction to make money.

This is a smart way to avoid predicting how the stock will move. You’ll make money as long as it makes a big move in either direction.

Regards,

Chad Shoop

Editor, Quick Hit Profits

Click here to join True Options Masters.