In futures markets, the “smart money” tells us exactly what they are doing; gold is no exception.

Futures traders buy contracts when they expect prices to rise. When they expect a decline, they sell contracts, creating a short position.

Traders in stocks can also take short positions but rarely do so because shorting is expensive. In futures, going short is common because the costs are the same as a long position.

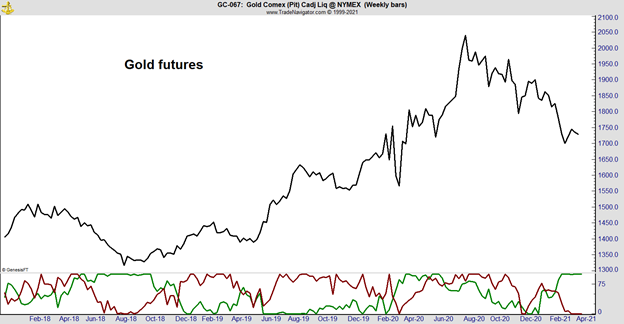

This information can be summarized in an indicator. In the chart below, the indicator at the bottom shows whether different groups of traders — with smart money in green and small traders in red — are bullish or bearish on gold.

Gold Technicals Show Bullish “Smart Money” Trend

Source: Trade Navigator.

Smart Money Is Acting on Gold Right Now

This indicator is based on an obscure report issued by the Commodity Futures Trading Commission. The Commitments of Traders (COT) report tells us who is buying gold, soybeans, and other commodities like palladium.

Analysts call one group “smart money.” This group tends to be right about major trends more often than not. In the report, this group is called commercials.

For gold, commercials include mining companies, jewelers and other manufacturers who use gold. Buying and selling futures allows commercials to reduce risks associated with changes in the price of the metal.

The COT report also shows the positions of small traders. They are often wrong in the futures markets.

In the chart, the lines show degrees of bullishness or bearishness over the past six months. High values are bullish.

Now, when commercials are the most bullish they’ve been in six months, small traders are at their most bearish.

This tells us smart money is bullish while not-so-smart money is bearish. In the past, smart money has usually been right when there’s a difference of opinion like this.

To side with the smart money, investors should buy gold. While futures are not the best choice for many investors, SPDR Gold Shares (NYSE: GLD) could be attractive.

While I didn’t exactly design the internet, I can take full credit for this.

I’ve created a first-of-its-kind innovation in the financial markets. It allows everyday traders to get ahead making one simple trade per week.

Click here to see how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.