Forecasting recessions is difficult, but not impossible. Federal Reserve economists developed a model with an admirable track record.

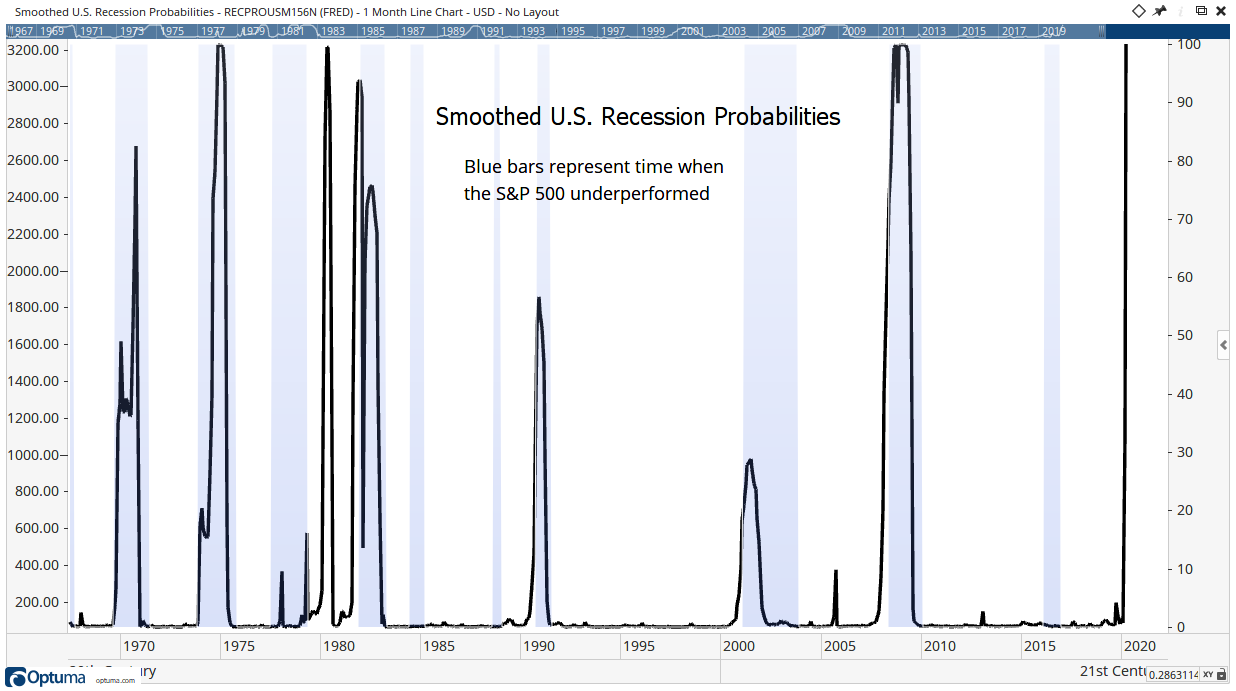

Called “Smoothed U.S. Recession Probabilities,” this model has no false signals. Every time the probability topped 20% since 1967, the U.S. was already in recession.

There are problems with the model. One is the fact that economic data takes time to gather and report. The most recent data for this model was available on May 1. Because of delays, it shows the probability of a recession for March.

Not surprisingly, the probability of recession was 100% in March.

That’s important for economists and policy makers. It turns out that this is also important information for investors.

Smoothed US Recession Probabilities

The Smoothed U.S. Recession Probabilities chart below shows recession probabilities as a black line. Times when the S&P 500 delivered disappointing results are highlighted with blue shading. All recessions coincided with subpar performance in the stock market.

Source: Optuma

For those wanting details on the probability model, “A Comparison of the Real-Time Performance of Business Cycle Dating Methods” can be downloaded from the Fed’s website.

In brief, “smoothed recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales.”

For the chart, I defined S&P 500 underperformance as times when the index declined for at least six consecutive months.

Not all periods of underperformance are associated with recessions. And the double-dip recession of the 1980s included short bursts of strong gains in stocks. However, there are enough bad markets associated with recessions that investors should take notice.

The Fed’s Smoothed U.S. Recession Probabilities data says the economy entered a recession in March. History shows stocks deliver below average returns, and even losses, during recessions.

Combined, these facts should lead investors to cautious approaches in the next few months.

If this time is different and a bull market accompanies the recession, there will be time to buy stocks later. If this is a bear market, as is likely, losses that result from ill-timed buys can never be recovered.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru