While home prices continue to attract attention, another part of the real estate market is becoming unaffordable.

Zillow, the website that offers Zestimates tracked by many homeowners to track the value of their homes, also offers information on rental prices.

According to Zillow:

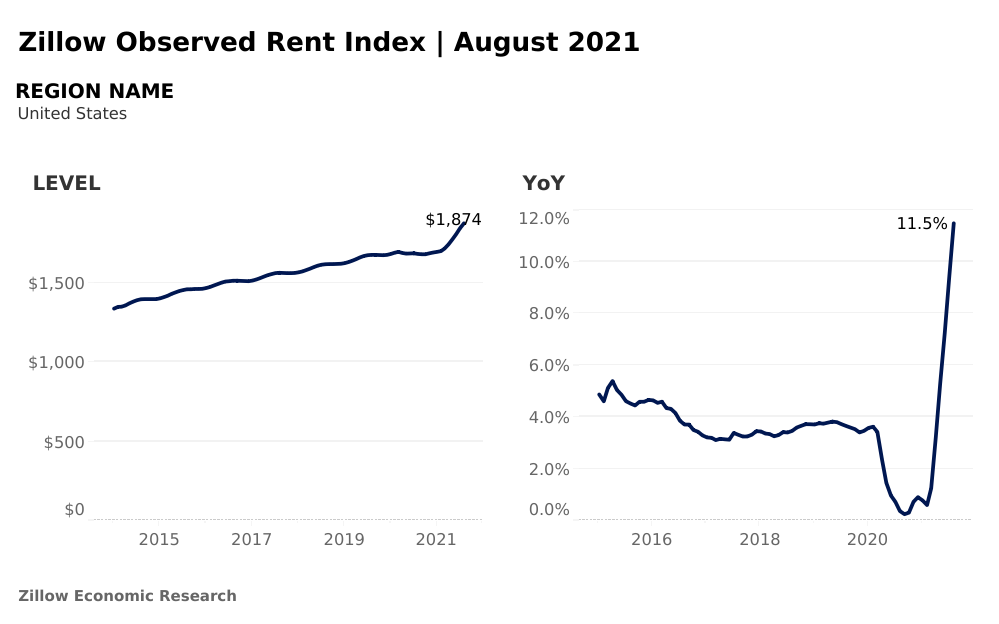

Typical U.S. rents measured by Zillow’s Observed Rent Index (ZORI) were $1,874 in August, almost $200 more than in August 2020. The rental market demonstrated similar dynamics as the for-sale market in August, including the timing of the initial slowdown in appreciation. Like the for-sale market, month-over-month rent growth had been accelerating since January before cooling in August, slowing to 1.7% from a record high 2% in July.

But again, like the for-sale market, annual growth hit new highs, rising 11.5% year-over-year, the fastest in Zillow records dating to 2015.

Source: Zillow.

Rising rents could accelerate a crisis for lower-income households. According to the National Low Income Housing Coalition:

The U.S. has a shortage of 6.8 million rental homes affordable and available to extremely low-income renters, whose household incomes are at or below the poverty guideline or 30% of their area median income.

Only 37 affordable and available rental homes exist for every 100 extremely low-income renter households. Extremely low-income renters face a shortage in every state and major metropolitan area, including the District of Columbia.

Almost 60% of households with income under $40,000 are renters. Higher housing costs will squeeze their budgets especially hard. An 11.5% jump in rent could be unaffordable or could force the household to cut back significantly in other spending.

Politicians Want Action but Do Little About Rental Prices

There isn’t a quick fix to this problem. Tight supply and high demand will continue to drive rental prices higher. Rising rents and lower affordability will attract the attention of the media, which will generate stories that something must be done, including demands from politicians.

It’s likely that politicians contributed to the problem over the years with regulations that made building more expensive. They are unlikely to take actions now that improve the situation.

This is a crisis that will get worse and is likely to have major implications for the economy in the next few years.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking. Follow him on Twitter @MichaelCarrGuru.