What a difference a year makes.

During the pits of the COVID-19 bear market, you couldn’t give mortgage REITs away. Investors were worried — and not without justification — that the wave of lockdowns would lead to a wave of missed rent payments … which in turn would lead to a wave of missed mortgage payments, defaults and forced liquidations.

It never got that bad. But by the time the Federal Reserve stepped in to backstop the mortgage market, the damage had already been done to the mortgage REIT space.

Several REITs, particularly those exposed to mortgage securities not backed by Fannie Mae or Freddie Mac, were forced to sell performing assets at fire-sale prices to meet margin calls. Investors, preferring not to be surprised, erred on the side of caution and dumped virtually the entire sector. They threw out the baby with the bathwater.

As a case in point, take a look at Starwood Property Trust (NYSE: STWD). Pre-COVID, the stock traded over $25 per share. By the time the dust had settled, the shares sold for as low as $7.59.

Well, a funny thing happened. When it turned out that the world wasn’t ending and that most commercial tenants would, in fact, continue to pay their rents, Starwood rallied. It took over a year, but the REIT clawed back all of its COVID-19 losses and is now trading slightly higher than it was before the pandemic.

So, how do the shares look today?

Not bad. At current prices, they yield a competitive 7.3% in dividends. And Starwood kept its payout intact through the pandemic. It didn’t have to suspend or reduce it like many of its peers.

I have a love-hate relationship with mortgage REITs. The yields are enticing, but you have to be careful because they are, in effect, highly leveraged bond funds that can be sensitive to changes in interest rates.

Well, Starwood is no ordinary mortgage REIT. It’s the sister company of the much larger private investment firm Starwood Capital Group. Yes, it has a large portfolio of commercial mortgages. But it also has an actively-managed property portfolio and a direct loan business.

A 7.3% yield in a commercial real estate company that survived the worst pandemic in a century with its payout intact is attractive. But let’s see how Starwood stacks up on our Green Zone Ratings system.

Starwood Property’s Green Zone Rating

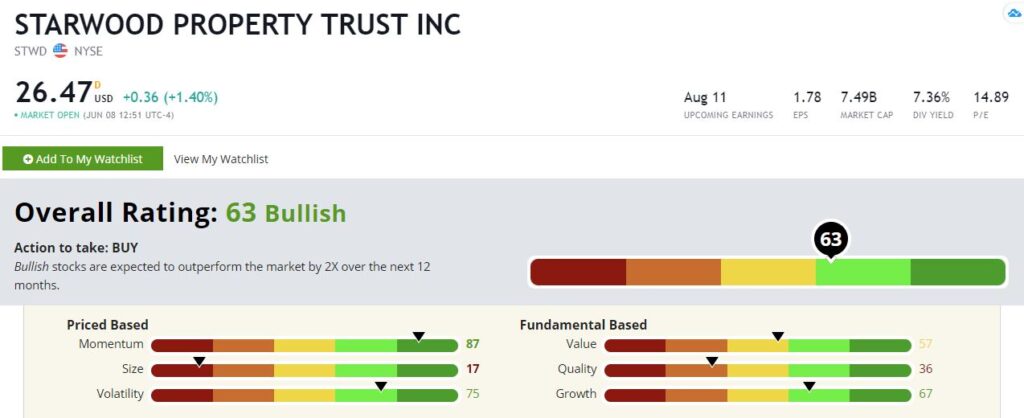

Starwood rates a 63 overall, which puts it in “Bullish” territory. Bullish stocks in our model have outperformed the market by two times on average.

Starwood Property Trust's Green Zone Rating on June 8, 2021.

Let’s see what drives this rating.

Momentum — Starwood rates highest on momentum at 87. It’s not too hard to see why. After bottoming last March, shares ripped higher, gaining hundreds of percent. That kind of rip-your-face-off momentum won’t last forever. But it’s safe to say that investors have warmed to the stock and that new money pouring in continues to push the shares higher.

Volatility — The past year notwithstanding, Starwood is a low-volatility stock. That is reflected in its volatility rating of 75, meaning the stock is less volatile than all but 25% of the stocks in our universe. Under normal, non-pandemic conditions, we should expect Starwood to be a low-drama stock.

Growth — But despite the stock’s low-volatility profile, it’s no slouch on growth, with a 67 rating. This isn’t a hyper-growth tech stock. It’s a mortgage REIT, for crying out loud. But slow and steady wins the race, and Starwood is anything if not a steady grower.

Value — Starwood is also reasonably cheap, with a value rating of 57. The shares were a lot cheaper a year ago. But even at today’s prices, they are by no means expensive. Its price-to-earnings ratio is just under 15, which is well below the market average of 36.7.

Quality — Most REITs don’t rate well on quality. High debt levels and non-cash expensespunish them. That’s just the way the math works out, and Starwood is no exception. It rates a below-average 36 on this metric.

Size — Starwood isn’t a mega-cap stock, but it’s still quite large with a market cap (outstanding shares times current share price) over $7 billion. The REIT rates a 17 on size.

Bottom line: Starwood Property Trust is not the highest-rated stock I’ve recommended. But it sports a respectable Bullish rating and a 7.3% dividend to boot. COVID-19 hit this stock hard, and it came roaring back over the last year, all while keeping its yield intact. That’s a good sign for anyone who wants to pad out their income portfolio.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.