Social Security’s minimum retirement age is 62, and a good chunk of seniors opt to start receiving their benefits checks at that age. But there’s a small surprise for those turning 62 in 2020.

A law that went into effect 35 years ago that was meant to address financial difficulties within the Social Security program is changing how much individuals who are eligible for benefits in 2020 will receive.

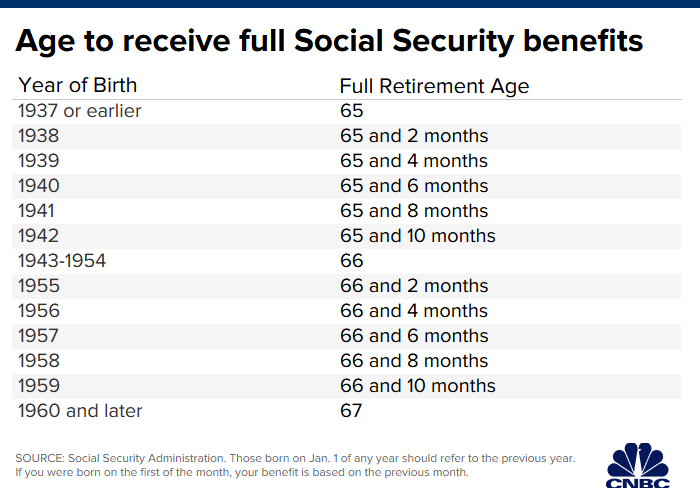

Congress, way back in the early 1980s, decided to gradually raise the full retirement age to 65, and the program has continued to implement incremental increases to the full retirement age. Here’s a chart showing the gradual increase in full retirement age over the years, per CNBC:

Turning 62 in 2020 means your full retirement age goes up by two months to 66 and eight months, and those two extra months mean a slight cut to your benefits.

The cut isn’t huge, hence the word stealth, but it will add up over time. Here’s an example for someone turning 62 in 2020 with their full benefits being $1,800, per USA Today:

Because your full retirement age is 66 and eight months, retiring at 62 means that you’re getting your benefits 56 months early. That will result in your getting a Social Security check each month equal to 71 2/3% of your full retirement amount, or $1,290.

But someone retiring at 62 in 2019 means they called it quits only 54 months early, and they qualify for 72 1/2% of their full benefits, which comes out to $1,305 per month. So that’s only $15 extra per month — but that comes out to a few thousand dollars over the years.

And delaying your Social Security until a later date won’t eliminate that slight cut either. Waiting until 70, the latest you can delay Social Security to maximize benefits, means you’ll receive 40 months worth of delayed benefits, boosting your check by 26 2/3% if you turn 62 in 2020.

Retirees who reached 62 in 2019 are entitled to 42 months of retirement credits in the same situation, which is a 28% boost. So there’s really nothing that can be done to recover some of that loss.

The hits will keep coming, too. Anyone hitting 62 in 2021 or 2022 will see another two month increase in full retirement age until it maxes out at 67, and some lawmakers are mulling the possibility of increasing the full retirement age even more.

So while this won’t be a huge cut, it’s still nice to know what to expect as you draw nearer to retirement.

• You can find all of the latest and most important news about Social Security here on Money and Markets.

For our friends: Anyone who wants to grow and protect their money in retirement needs to hear this. For the first time publicly, Bill O’Reilly comes clean about what happened to his money.