In an appearance on CNN last week, President Joe Biden made an extraordinary claim supporting the $1.9 trillion stimulus package winding its way through Congress.

He said, “This is the first time in my career — and as you can tell, I’m over 30 — the first time in my career that there is a consensus among economists left, right and center that is over — and including the IMF and in Europe — that the overwhelming consensus is: In order to grow the economy a year or two, three and four down the line, we can’t spend too much. Now is the time we should be spending. Now is the time to go big.”

Fact-checkers labeled this claim mostly false. It’s probably not good economic policy to rapidly spend trillions of dollars under any conditions.

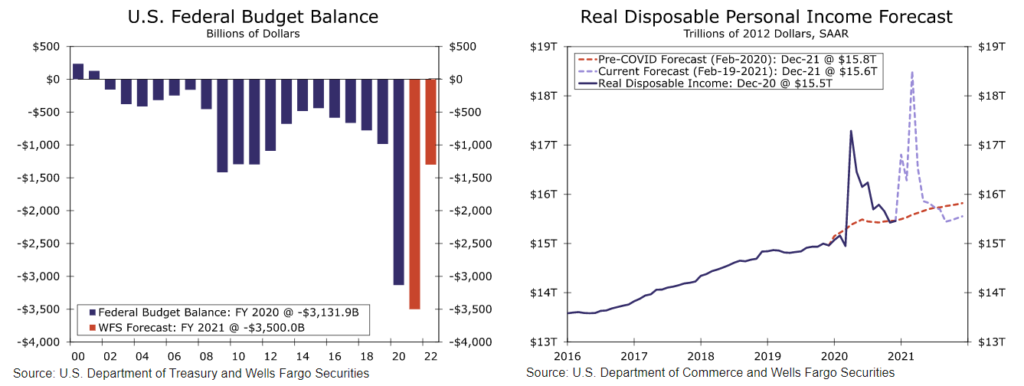

This spending will result in a record-high level of deficit spending for the government. It will be the second straight year of $3 trillion deficits. The charts below show it might not even be needed.

Impending Deficit and Predicted Personal Income Effects

Source: Wells Fargo.

Broad Stimulus Won’t Fix the Economy

The federal budget deficit is on the left side of the chart. Consumer disposable income is on the right. Disposable income is the amount of money households have to spend or save after deducting income taxes.

The first stimulus package came as disposable income was dropping — there was no doubt that the economy needed a boost. The chart, however, shows the stimulus’s poor design.

Disposable income soared and crashed. Now that the indicator is back to its trendline, the second package is designed to repeat the performance of the earlier, ineffective program.

There is no doubt that targeted relief is needed. But checks to more than 90% of households when the employment rate stands at 93.7% is likely inflationary.

While stimulus will provide a short-term boost to the economy, it will not make long-term improvements.

Instead of sending money to everyone, Congress could design a broader safety net or target aid at those facing permanent job loss.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.