Back in September, I dug into U.S. automakers amid ongoing industry strikes.

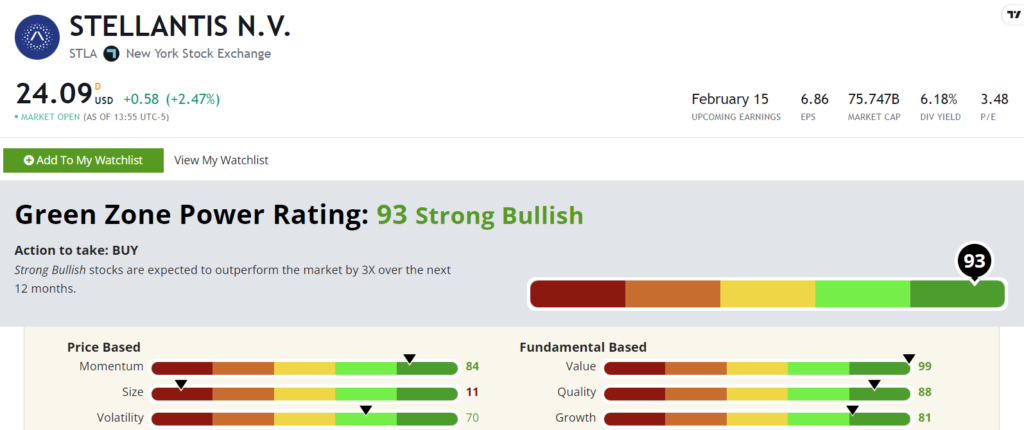

I wanted to know what Adam O’Dell’s Green Zone Power Ratings system said about these stocks as potential investments.

In moments, I was able to go to our homepage (www.MoneyandMarkets.com), type some tickers in our search bar and see how those stocks looked.

And I landed on what I called a “ratings surprise” at the time. Stellantis NV (NYSE: STLA) was nowhere on my radar…

Now, almost five months later, the “Strong Bullish” stock is up 24%!

I wanted to circle back around on this stock, not because of that solid gain, but because it highlights that strong ratings on certain factors can be a massive benefit for the underlying stock.

Read on to see where STLA rates now, and how three factors were a massive contributor to its recent outperformance.

A Ratings Surprise

I was expecting a stock with a low rating when I typed STLA into the search bar. That was because Ford (NYSE: F) and General Motors (NYSE: GM) rated “Neutral” or worse at the time. But I was met by a Green Zone Power Ratings surprise!

Stellantis NV (NYSE: STLA) rates a “Strong Bullish” 93 out of 100. Strong Bullish stocks are set to beat the market by 3X over the next 12 months.

There’s one thing that separates Stellantis from its Detroit neighbors. The company is actually based in the Netherlands. While its U.S. presence is strong (popular brands such as Jeep, Dodge and Ram Trucks fall under its umbrella), I’d argue Stellantis is a step ahead on the electric vehicle and tech front.

STLA rates a 99 on Value. Its price-to-earnings (P/E) ratio is 3.4. That’s lower than its Detroit Three counterparts — GM sports a 5.2 P/E ratio, while Ford’s is more than four times higher at 11.9! The broader automotive industry is sitting at a 20.3 P/E ratio.

Looking at its stock price action, STLA has gained more than 48% over the last year. That’s reflected in its 84 rating on Momentum. With a heavy focus on innovative tech, that price action makes sense amid the ongoing tech rally.

This stock still has potential, according to Green Zone Power Ratings. In fact, its rating has improved since September due to increased momentum.

STLA was a ratings surprise back in September … in a good way. And our system says to expect more from here.

Until next time,

Chad Stone

Managing Editor, Money & Markets

P.S. Momentum, Value and Quality are at the core of Adam’s Infinite Momentum Alert. Each month, his AI-driven algorithm targets the 10 stocks that are set to outpace the rest of the pack. He just released his model portfolio for the next month-long trading period, so now is the perfect time to jump in and join in on these trades.