Since 2009, stock market bulls pointed to the Federal Reserve. They stopped worrying about earnings. Economic growth didn’t matter. All that mattered was the Fed.

Their argument is a simple three-step philosophy:

- The Fed creates money through quantitative easing, or QE.

- That money somehow ends up in the stock market.

- Stock prices go up.

The specifics of Step 2 are as mysterious as the gnomes’ underpants business model on Comedy Central’s long-running show “South Park.”

Stock Market Bulls Beware

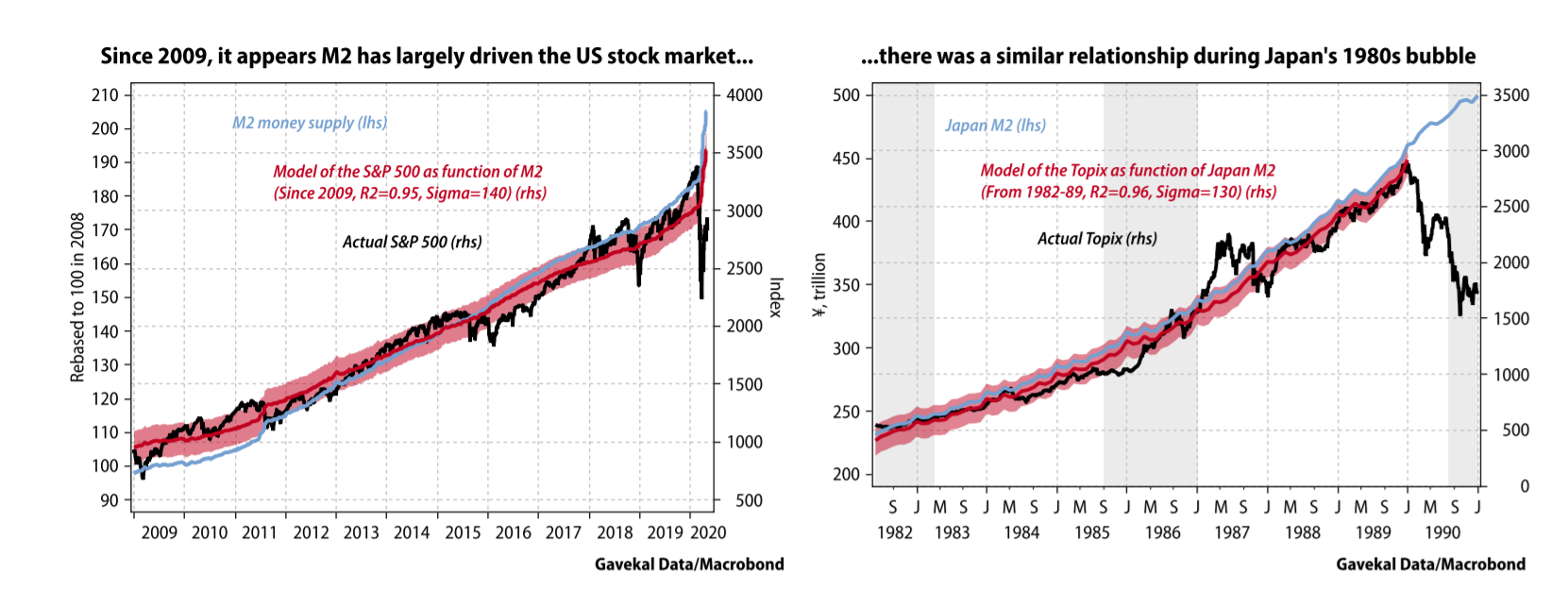

Recent research from economists at Gavekal show the Fed model of gains is likely to break down soon.

Quantitative easing is measured with M2, the amount of money in circulation plus checking and savings accounts.

Mathematically, regression analysis quantifies the relationship between two variables. In this case, the analysis is done on stock prices and M2.

R-squared (R2) is the name of the regression variable that defines the relationship. It shows how closely the two data series line up. R2 ranges from -1.0 to +1.0, with +1.0 being a perfect fit. Values above 0.70 or below -0.70 are generally tradable.

Good traders know all relationships change over time. Eventually, high R2 trades stop working. That’s exactly what Gavekal found.

They wrote:

“Since the 2008-09 financial crisis, the S&P 500 has had an R2 of 0.95 with the level of US M2. When in March, the market nosedived from a level above where it “should” have been, the Federal Reserve reacted by printing money.”

The S&P 500 duly bounced to 2,831 as of last Friday, on its way — according to the model, at least — to a new record high of 3,524.

Great, no need to worry then — except …

The right-hand chart below shows the same model but for Japan, with the Topix modeled as a function of Japanese M2 between 1982 and 1989. R2 was 0.96, much the same as in the U.S. today.

“And yes, for years the model worked like a dream. But then, suddenly it stopped working, and in 1990 the Japanese market entered (a bear market) of historic proportions, even though M2 continued to go up.”

Source: Gavekal Research

This is bad news for stock market bulls.

If earnings are important, stock prices are too high. If the economy is important, stock prices will fall.

Only the Fed’s QE pushed stocks up. Japan’s experience shows that won’t work forever. Stock market bulls face a day of reckoning. Investors face large losses when that day comes.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru