Unless you’ve been under a rock, in a coma or living in a remote location entirely detached from news the past few months, you’re well aware of the coronavirus pandemic and ensuing lockdown that led to the fastest stock market crash in history.

When the closing bell rang on Wall Street to end the day’s trading on Feb. 19, the benchmark S&P 500 sat at a new all-time record high of 3,393 (the Nasdaq also closed at an all-time record that day).

Then, just 22 days later, 30% had been wiped off the books, the quickest such stock market crash in history. The second-, third- and fourth-fastest declines came amid the infamous Great Depression that began in 1929 and lasted well into the 1930s.

All told, the S&P 500, still down about 5% on the year, bottomed — unless there’s another bottom, known as a W-shaped recovery — at 2,237 on March 23. And here we are at the beginning of June, back above 3,000, a 37% rebound.

And the stock market’s upward movement the past week comes against the backdrop of major social unrest, mass protests and even some looting sweeping across the country after another unarmed African-American man was killed in police custody. The man’s death was videotaped by bystanders and broadcast for the entire world to see.

The ensuing protests have so far led to more than 4,500 arrests, and a protest Monday evening outside the White House was broken up with tear gas and rubber bullets.

And yet the stock market has largely continued its upward movement.

Stock Market Rally a Fed-Fueled Boom

So exactly what exactly is going on? How is this possible? Is it sustainable, or are we on the precipice of falling into a double-bottom (where the W comes in from a W-shaped recovery)?

Banyan Hill Publishing Chartered Financial Analyst and Chartered Market Technician Clint Lee, an expert in investment psychology, said one thing that stands out to him about the current rally is fund flows into big tech and health care stocks. In fact, Lee said, the traditional buy-and-hold philosophy that has served investors well through the years appears “dead.”

“When you take a look under the hood and see where the money is going, there have been huge outflows from broad-based stock funds and ETFs that track indexes like the S&P 500,” Lee said. “Now I know that seems counter-intuitive with the rally, but investors are selling these broad exposure vehicles and instead picking up very select sectors, like technology and health care.

“That tells me that the buy-and-hold psychology that’s worked well for the decade leading into 2020 is dead. Investors have plowed money into mega-cap tech stocks, and that has helped prop up indexes like the S&P 500 because of their large weighting.”

From a historical perspective, we can look back at what the stock market did amid previous periods of social unrest.

However, economist and economic historian Ted Bauman, who works with Lee on the The Bauman Letter, said civil unrest hasn’t historically made a big difference in Wall Street machinations.

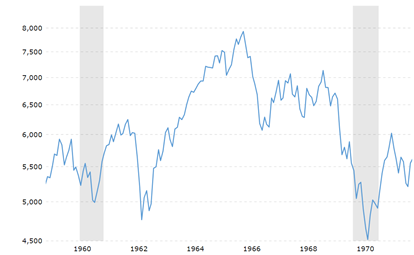

“In fact, during the second half of the 1960s the Dow was on a bit of a tear (see below),” Bauman wrote via email. “When the stock market did turn down it was because of domestic economic conditions in the U.S. and global trade and monetary imbalances.”

However, Bauman notes, conditions now are quite different than they were in the 1960s (aside from the social unrest, it seems) — mainly that there’s one constant reality interfering in today’s stock market — the U.S. Federal Reserve.

“Back in the ’60s, people generally treated the stock market as a place to buy and sell discounted future earnings from companies that operated in the real economy. Nowadays it’s more of a casino, with many investors speculating on future earnings that might happen — or might not,” Bauman explained. “Partly that’s a function of the rise of digital media, which spreads memes about individual stocks the same way it does about everything else.

“But most importantly, it reflects the fact that in the casino that is today’s stock market, the house, in the form of the Fed, has loudly and publicly tipped the scales in favor of the gamblers. As long as that remains the case, the stock market can remain detached from any reality.”

From a technical perspective, Chartered Market Technician Michael Carr, who writes our highly educational and informative Chart of the Day stories here on Money & Markets, says the data agrees with Bauman’s point that the overall stock market can remain detached from reality for an extended period of time.

“The buying pressure is extreme and that indicates we are likely to see additional gains. As an example of the extreme buying, look at common momentum indicators like stochastics,” explained Carr, the editor of One Trade. “This indicator has been at high readings for most of the past month. In the past, when this happened, on average the Dow was higher six months later.

“It won’t be straight up, but there is a likelihood of higher prices in the short run.”

So, no matter the chaos, it seems the Federal Reserve has investors’ backs, tipping the house’s hand via massive stimulus. But how long can it last?

Editor’s note: Considering all of the factors going on in the world today, are you surprised the stock market keeps rising? Assuming the Fed can’t keep pumping up stocks forever, do you see catastrophe in the future for Wall Street and investors? Share your thoughts below.