Oil traded for less than zero Monday. At least in the oil futures market. That’s important to remember. Negative oil prices only existed in the futures markets. And that price existed in just one very specific part of the futures market. Oil is not priced at negative values in the real world.

Oil trades in a futures market. That means I can buy a contract for 1,000 barrels of oil to be delivered at some point in the future. These contracts expire every month.

In futures markets, contracts aren’t usually delivered. Almost all contracts are sold before expiration because the buyer doesn’t really want 1,000 barrels of oil. Buyers really just wanted the right to benefit from any price moves that unfold while they own the contract.

Typically, the contract is a financial invention rather than a concrete item.

At expiration, anyone owning a futures contract is required to either sell or accept delivery of 1,000 barrels of oil. Wall Street firms know this. That means expiration days are often volatile. Traders needing to sell will face challenges as the few firms wanting to accept delivery realize they have the upper hand.

Oil Futures Go Negative

On Monday, that upper hand led to negative prices. The firms willing to accept delivery refused to pay for contracts. They made the owners of the contracts pay to close their positions. By the end of the day, the price of oil was quoted at more than minus-$30 a barrel.

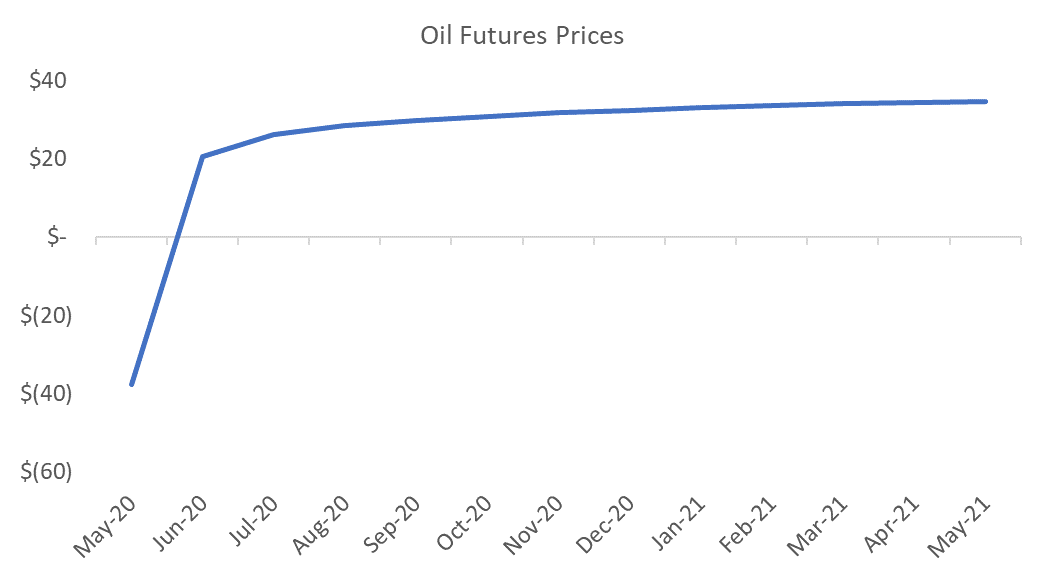

This only affected contracts expiring on April 20. All other expiration months traded at prices above zero. Contracts for the next year are shown in the chart below.

Source: CME Group

Prices for contracts over the next year are trading at about $30 a barrel. That’s about half the one-year average price of $60 a barrel. But it’s not zero.

In the real world, oil prices are low because demand is down. Shutting down global economies to fight the pandemic reduced the demand for oil. But there is still some demand, so negative prices exist only in one very specific financial market.

This doesn’t mean there’s nothing to worry about. In the next few weeks, we will probably learn about a financial firm that went broke trading in this market. If it’s a big firm, that will create a new financial crisis. We should know in a few weeks how big this crisis is.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru