CNBC reported last week that major stock market averages enjoyed their best week since October 1974. For many financial professionals, that brief tidbit passes as analysis.

It is a relatively simple process to dig deeper. Newspaper archives are online and with little effort it’s possible to learn what was happening when stocks had that big week in 1974.

It turns out that the Chairman of the Federal Reserve believed that the economy was in a “recession.” He added that the situation had “no precedent in history” according to The New York Times.

In Congressional testimony, Chairman Arthur Burns said, “the Federal Reserve would make every effort” to assure that the growth of the money supply would be “significantly” faster than the annual rate of 1.3 per cent that has prevailed since June.”

Stocks Enjoy Best Week Since 1974, When This Happened …

Source: The New York Times

The Fed did increase the rate of growth in the money supply, for a time. And stocks rallied for a short time. By the end of the year, the Fed was worried about inflation again and eased up on the growth of money supply.

The stock market followed the trend in the money supply.

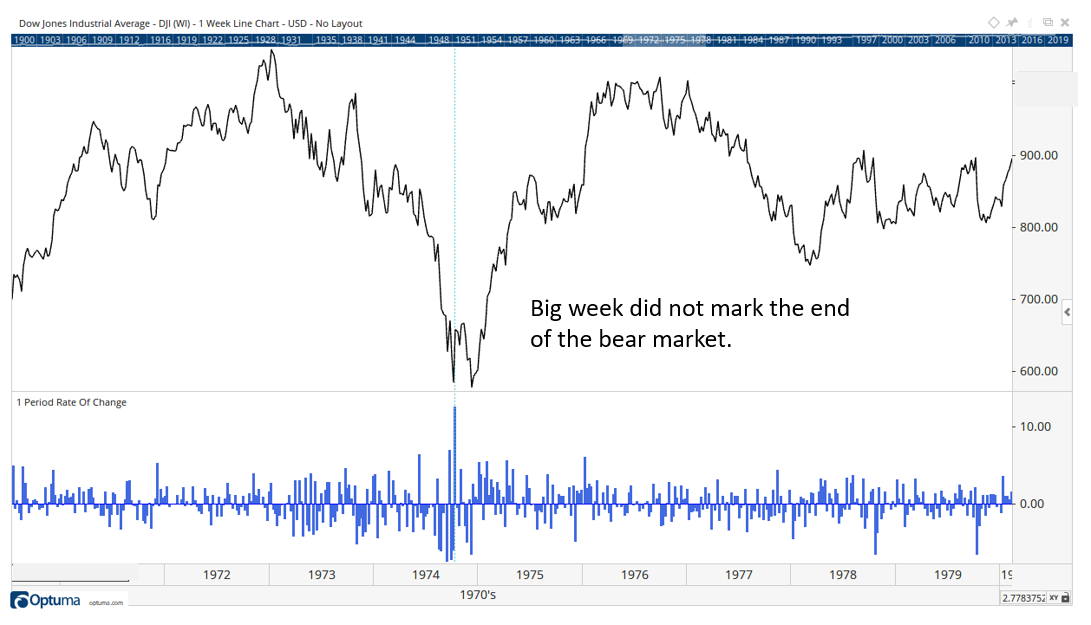

The chart below shows the Dow Jones Industrial Average in 1974 with the one-week rate of change (ROC) at the bottom of the chart. The big change in the ROC, highlighted by a thin vertical line, was followed by a brief rally in the stock market.

When the Fed reversed course later that year, the market fell back to earlier lows.

History tends to repeat. Although the repetition is rarely exact, history offers a guide as to what to expect under similar conditions in the future, like when stocks see their best week since 1974.

History tells us the most important factor for the stock market in the coming weeks is the Federal Reserve. If the Fed continues increasing the money supply, we should expect gains in stocks. If the Fed reverses course, expect new lows in stocks.

Investors should watch M2 money stock, which the Fed updates every Thursday at this link. This will tell them if history repeats the 1974 experience or if the Fed is determined to push stock prices up.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru