We are in a coronavirus crisis right now. That’s one thing every investor, analyst and economist agrees on — COVID-19 caused this crisis. It’s shut down business and rocked stock markets around the world.

Within weeks, it will be clear the alphabet soup of Fed programs isn’t enough to combat 20% unemployment.

Like all crises, this was sudden and unexpected. But stock prices are rallying and that indicates many believe the worst of the crisis is behind us.

Looking at history, it’s possible to argue the crisis hasn’t even started. The Federal Reserve has responded admirably as the economy shut down over the past few weeks. A variety of lending programs provide hope that businesses, states and cities will survive and be thriving within months.

Can the Fed Withstand the Coronavirus Crisis?

If the Fed succeeds, then this crisis will prove to be simply a bump in the road. In a real crisis, central banks don’t have tools to reverse the damage.

The classic example of an economic crisis occurred in Germany after World War I.

Hyperinflation devastated Germany between 1921 and 1923. At the height of the crisis in October 1923, monthly inflation was 29,500%. That’s an average daily rate of inflation of 20.9% with prices more than doubling every four days.

At the grocery store, that means a loaf of bread that cost about 160 marks in 1922 cost 200 billion marks by the end of 1923.

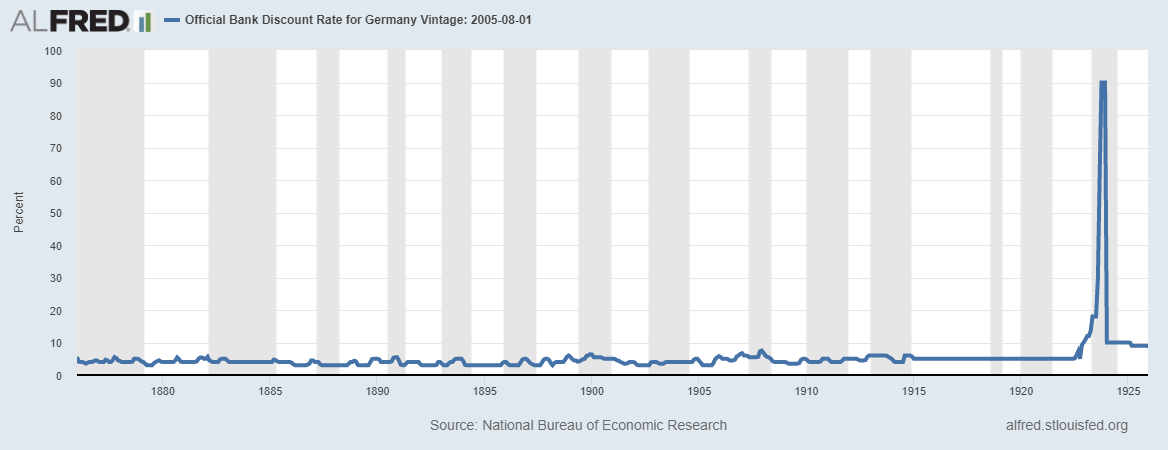

With inflation roaring, the German central bank raised interest rates. That’s the standard way to fight inflation. The chart below shows the interest rate rose quickly, peaking at 90% in November 1923.

Source: Federal Reserve

From 1876 to the beginning of World War I, the interest rate moved between 3% and 6%. During the war, the rate was set at 5%. After the war, the rate rose quickly as the economy spiraled out of control.

Rate increases failed to stop inflation. The German central bank was powerless in the face of the crisis. Every central bank in history has struggled when a true crisis strikes.

The simple fact that the Fed is holding its own for now shows us this coronavirus crisis is just starting. Within weeks, it will be clear the alphabet soup of Fed programs isn’t enough to combat 20% unemployment.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru