General Electric makes a business play, Bed Bath & Beyond will spread some cash around and stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Morning Open

U.S. markets opened up, looking to go into the last part of the week on a high note.

As of 10 a.m. Eastern time, the Dow Jones Industrial Average was up 0.2%. The S&P 500 reached a new record by opening up 0.3% and the Nasdaq Composite capitalized on its Tuesday rally by moving up 0.7%.

The Top Story

In an effort to stem the tide from slumping sales from one of its biggest customers, General Electric Co. (NYSE: GE) is looking elsewhere.

As Boeing Co. (NYSE: BA) continues to pullback amid its 737 Max production issues, GE said it’s in talks with Boeing’s largest competitor, European-based Airbus SE (Over-the-Counter: EADSY). General Electric is seeking to design and sell an engine variant for the Airbus A330neo, according to The Wall Street Journal.

Boeing has temporarily stopped production of its popular 737 Max after it was grounded following a pair of crashes in March.

General Electric has been hurt by the grounding of the Max aircraft and is supplying Airbus with engines for its A320neo aircraft.

Currently, Airbus is using Rolls-Royce Holding PLC ADR (Over-the-Counter: RYCEY) to supply engines to its latest plane, but said adding GE to the mix may make it “more attractive to a wider basket of airline customers.”

Stocks to Watch Today

Blue Apron Holdings Inc. (NYSE: APRN) — The meal kit maker said it was exploring strategic options, including a sale of the company or merger after posting losses in revenue and earnings. Shares of Blue Apron were down 8.4% Wednesday morning.

Garmin Ltd. (Nasdaq: GRMN) — Shares of the GPS technology company were up 8.1% in premarket trading after reporting beating earnings estimates by $0.25 per share. Garmin also raised its quarterly dividend by $0.04 per share to $0.61.

Tesla Inc. (Nasdaq: TSLA) — The electric automaker’s stock got a boost after Piper Sandler analysts increased their price target for the company to $928 per share from $729. Shares of Tesla moved up 7.2% in the premarket session.

In the News

Home goods retailer Bed Bath & Beyond Inc. (Nasdaq: BBBY) said it plans to spend nearly $1 billion in store remodels and debt reduction in an effort to turn around the fledgling business.

The company said it will spend about $400 million on store remodels and supply chain upgrades. It will spend another $600 million on share repurchases and debt reduction.

Bed Bath & Beyond shares were sent reeling last week after it reported a 5.4% quarterly drop in same-store sales. Shares immediately plummeted 26%.

However, the company has started to rebound, closing up 5.3% Tuesday and starting Wednesday’s premarket session up 4.7%.

Chinese Companies Say They Can’t Afford to Pay Workers

As the coronavirus continues to roll across China, some Chinese companies have cut wages, delayed paychecks or stopped paying staff.

Some companies said the economic toll of the coronavirus has forced businesses to take drastic payroll measures.

Electric automaker NIO Inc. recently delayed paychecks by a week while employees at Foxconn Technology Group’s Shenzhen factory are quarantined in dorms and getting paid about one-third of what they’d earn if they were working, according to Bloomberg.

U.S. Judge Rejects Huawei Lawsuit Challenging Ban

The federal government scored a win against Chinese tech company Huawei Technologies on Tuesday.

U.S. District Court Judge Amos Mazzant rejected a lawsuit brought by Huawei, challenging the constitutionality of a law banning federal agencies from buying its products.

In his ruling, Mazzant said, “the court finds Huawei’s arguments unpersuasive.”

Other Morning Reads

Bloomberg Unveils Plan to Reign In Wall Street, Tax Market Trades (Money and Markets)

SpaceX Plans to Sell Rides Aboard Its Spacecraft (CNN Business)

Virgin Galactic Skyrockets. Here’s Why Now Is the Time to Take Profits (Money and Markets)

Earnings Report

Here are the companies releasing earnings reports today:

Blue Apron Holdings Inc. (NYSE: APRN)

Dish Network Corp. (Nasdaq: DISH)

Fiverr International Ltd. (NYSE: FVRR)

Garmin Ltd. (Nasdaq: GRMN)

Magnachip Semiconductor Corp. (NYSE: MX)

Chart of the Day

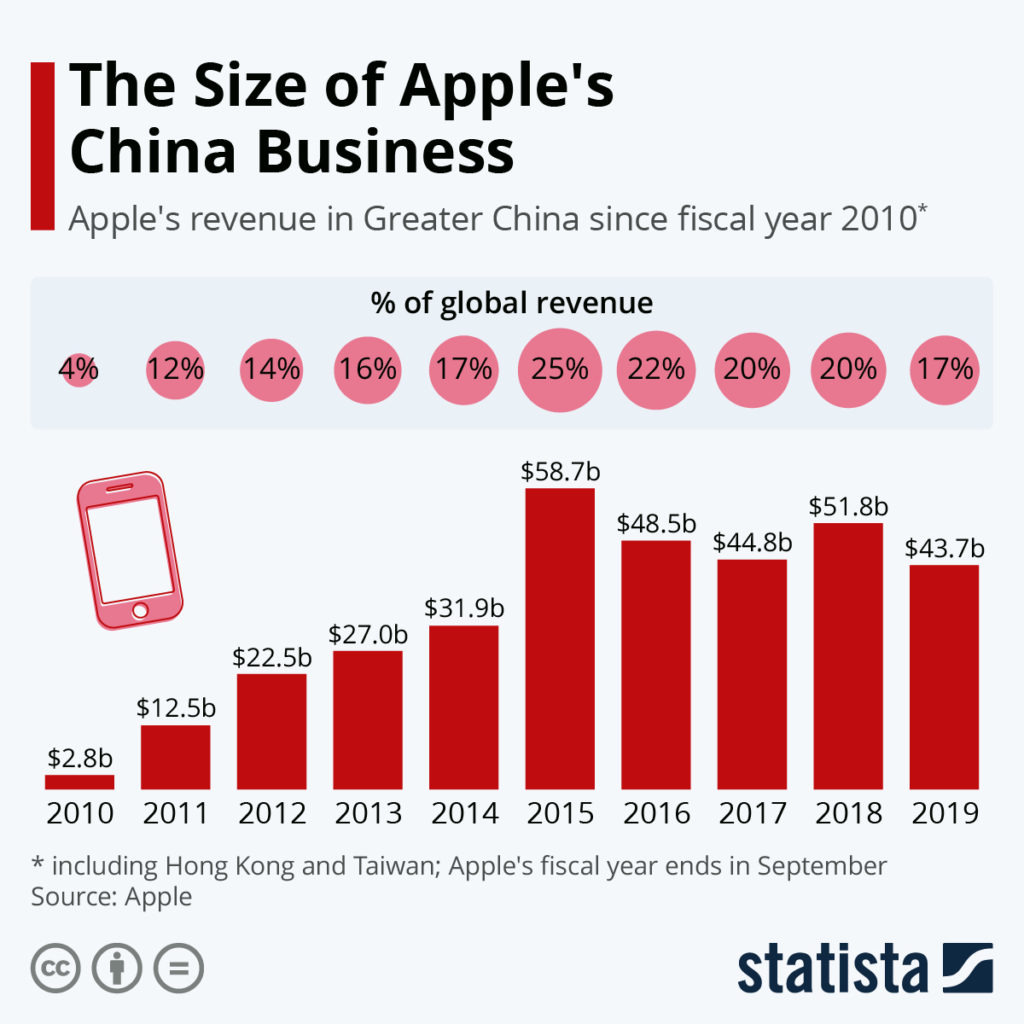

Yesterday, we told you that Apple Inc. (Nasdaq: AAPL) said it would not meet its quarterly revenue projections because of the coronavirus outbreak in China.

To understand the impact of the virus on Apple’s sales, it’s important to understand how valuable China is to the company.

According to Apple’s data, China made up 17% of its total revenue in 2019. That translates to about $43.7 billion. That number could go down sharply, depending on how long it takes for virus issues to calm.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.