Some FAANG stocks are making big market moves Thursday, plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Morning Open

U.S. markets opened lower Thursday amid news of more deaths attributed to the coronavirus.

As of 10 a.m., the Dow Jones Industrial Average was down 0.2%. The S&P 500 was down 0.4% and the Nasdaq Composite dropped 0.2%.

In other market news, the U.S. gross domestic product grew 2.1% in the fourth quarter of 2019, according to the U.S. Bureau of Economic Analysis.

That capped a year where the U.S. economy experienced it’s slowest growth pace in three years. In 2019, the economy grew 2.3%, lower than the 2.8% growth in 2018 and the 2.4% growth in 2017.

The Opening Bell

Facebook Inc. (Nasdaq: FB) CEO Mark Zuckerberg said he doesn’t want the company to be “liked.”

On a call with analysts Wednesday evening, Zuckerberg said the social media platform is OK doing things the public doesn’t like — such as political advertising policies — so long as the public understands.

“One critique of our approach for much of the last decade was that because we wanted to be liked, we didn’t always communicate our views as clearly because we were worried about offending people,” Zuckerberg said on the call.

Facebook reported a 25% increase in revenue over the last three months of 2019 with a $7.3 billion profit. It also boasted an 8% increase in monthly users globally.

Despite that, its revenue growth was down from a 30% year-over-year jump in the same quarter a year ago and a 47% increase two years ago.

Stay with us today as we will analyze earnings from Tesla Inc. (Nasdaq: TSLA) and Microsoft Corp. (Nasdaq: MSFT) today.

Stocks to Watch Today

Microsoft Corp. (Nasdaq: MSFT) — Shares of the tech giant moved up 3% in premarket trading Thursday after the company reported beats in both quarterly revenue and earnings.

Tesla Inc. (Nasdaq: TSLA) — The electric automaker reported quarterly earnings and revenue well above analysts’ expectations. As a results, Tesla shares moved up 10% in premarket trading.

Facebook Inc. (Nasdaq: FB) — After reporting weaker year-over-year revenue growth and a jump in expenses, shares of the social media giant were down 7% in Thursday premarket trading.

In the News

U.S. equity markets were down in premarket trading Thursday as concerns over the spread of the coronavirus mount.

Chinese officials reported the death toll from the virus jumped to 170 and Indian officials reported their first confirmed case.

Asian markets were mostly down. Shanghai’s Shenzhen was down 3.1% while Hong Kong’s Hang Seng dropped 2.8%. Japan’s Nikkei dropped 1.7% and South Korea’s Kospi was off 1.7%.

As of 8 a.m. EST, Dow Jones Industrial Average Futures were down more than 200 points. Nasdaq Composite futures were off 0.6% and S&P 500 futures were down 0.7%, indicating a potential down day for the markets.

Samsung Profits Are Down, But They Could Reverse Trend

On Thursday, South Korea tech giant Samsung reported a 34% drop in its operating profit.

The company said it made $6 billion in profit in the last quarter of 2019 as sales jumped 1% — $50.5 billion — beating analysts’ expectations.

Regardless, shares of the company closed down 3.2% in South Korea’s Kospi.

Even with the Q4 decline, Samsung said it expects to reverse the trend in 2020 with “increasing demand from data center companies” for its memory chips along with a rollout globally of 5G-capable smartphones.

Japan Issues Arrest Warrants in Ghosn Escape

Japanese officials issued arrest warrants for a former U.S. special forces soldier and two others for aiding the escape of former Nissan CEO Carlos Ghosn.

According to Reuters, warrants were issued for former Green Beret Michael Taylor along with George-Antoine Zayek and Peter Taylor. Officials also issued an arrest warrant for Ghosn for illegally leaving the country.

Ghosn fled Japan to Lebanon amid charges of misappropriation of company funds, breach of public trust and under-reporting earnings. He denies all of the allegations.

Other Morning Reads

What Is the Yield Curve and How Does It Work (Money and Markets)

SoftBank Leads Latest Alto Pharmacy Funding Round at Over $1 Billion Valuation (Reuters)

Social Security Ramps Up Fight Against Scammers With New PSA (Money and Markets)

Earnings Report

Here are the companies releasing earnings reports today:

Biogen Inc. (Nasdaq: BIIB)

Deutsche Bank AG (NYSE: DB)

Electronic Arts Inc. (Nasdaq: EA)

Levi Strauss & Co. (NYSE: LEVI)

Northrup Grumman Corp. (NYSE: NOC)

Chart of the Day

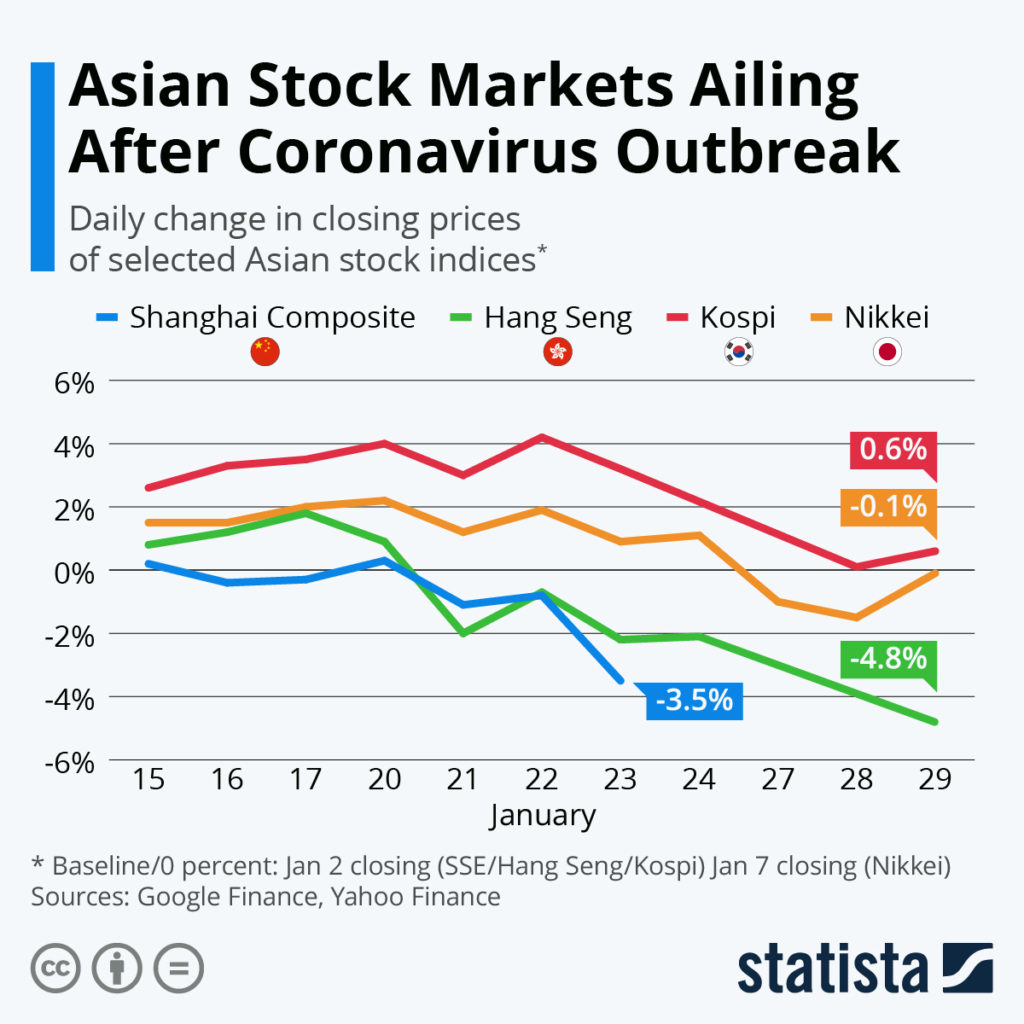

The last half of January has been rough for equities markets in Asia.

Due to the outbreak of the coronavirus, markets returned from the extended Lunar New Year holiday Wednesday ad faced strong downturns. Hong Kong’s Heng Seng Index closed Wednesday down 4.8% and the Shanghai Composite won’t open until Feb. 3, but closed 3.5% lower on Jan. 23.

The news isn’t all bad. Japan’s Nikkei and the South Korean Kospi are both starting to recover from previous dips.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.