Saudi Aramco continues to rise, the Brexit referendum — if and when it ever happens — could be historic for the United Kingdom, plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Wake-Up Call

In just its second day of trading, Saudi Arabian oil company Saudi Aramco hit the $2 trillion valuation mark. It came a day after gaining 10% in valuation, passing Apple as the largest company listed in the world by market cap.

While the valuation is a win for the Saudi royal family, the prospects of being able to sell the stock internationally likely took a hit, Bloomberg reported.

The company’s record-setting initial public offering raised $25.6 billion, passing the previous best mark set by Chinese giant Alibaba, which raised $25 billion in 2014.

The Opening Bell

Stocks have jumped nearly 300 points on early morning trading after President Donald Trump announced, via Twitter, a trade deal with China is “VERY close.”

The S&P 500 and Nasdaq Composite also opened up about 1% on the news. CNBC reported it was the first time since Nov. 27 that all three major averages hit record highs.

Stocks to Watch Today

Lululemon Athletica (Nasdaq: LULU) — While the company posted earnings and revenue beats Wednesday, its premarket trading was down as it revised fourth-quarter guidance. Lululemon reported potential earnings in the fourth quarter of between $2.10 and $2.13 while analysts expected profits of $2.13. The stock was down 3.95% on premarket trading.

General Electric Co. (NYSE: GE) — Following a boost in its price target from UBS, General Electric stock jumped more than 1.6% in premarket trading Thursday morning. UBS analyst Markus Mittermaier upped his price target to $14 and “predicted a 2020 inflection point for the company,” according to The Street.

Starbucks (Nasdaq: SBUX) — The coffee giant received an upgrade from Neutral to Overweight from JPMorgan, according to Seeking Alpha. Analysts at JPMorgan said they believe Starbucks’ sales are on pace for a 5% gain this quarter. JPMorgan also upped its price target for Starbucks to $94. As a result, shares of Starbucks jumped more than 1.7% in premarket trading.

In the News

Interest rates will hold at their current level as the Federal Reserve broke out of its last meeting of 2019, leaving them unchanged.

The Fed also signaled it would hold rates at their present levels — 1.5% to 1.75% — through 2020 (though, that’s always subject to change), as inflation remains low. The decision to maintain rates at their present levels was unanimous.

Historic Day in the U.K.

Today could be a day that shapes the United Kingdom for years to come as voters head to the polls to vote for House of Commons representation.

The election, called by Prime Minister Boris Johnson, is seen as a referendum on Brexit as the House of Commons has been at an impasse over how to break from the European Union. Johnson is hoping his conservative majority expands enough to give him the votes he needs to pass a deal with the EU.

Nasdaq IPOs Raise More Money Than NYSE IPOs

Initial public offerings on Nasdaq Inc. are on track to raise more money than those on the New York Stock Exchange, according to data from Dealogic.

The Wall Street Journal reported total funds from Nasdaq-listed IPOs have been $34.4 billion compared to $26.2 billion for IPOs listed at the NYSE.

It’s the first time since the Facebook Inc. IPO in 2012.

Other Morning Reads

Disney+ Downloads Top 22 Million, App Tracker Says (Money & Markets)

Pelosi Agrees to Expand Drug Price Bill (CNBC)

European Central Bank Holds Rates Steady (CNBC)

Earnings Report

Here are the companies releasing earnings reports today:

Adobe Systems Inc. (Nasdaq: ADBE)

Costco Wholesale (Nasdaq: COST)

The Lovesac Company (Nasdaq: LOVE)

Oracle Corp. (NYSE: ORCL)

Panhandle Oil and Gas (NYSE: PHX)

Chart of the Day

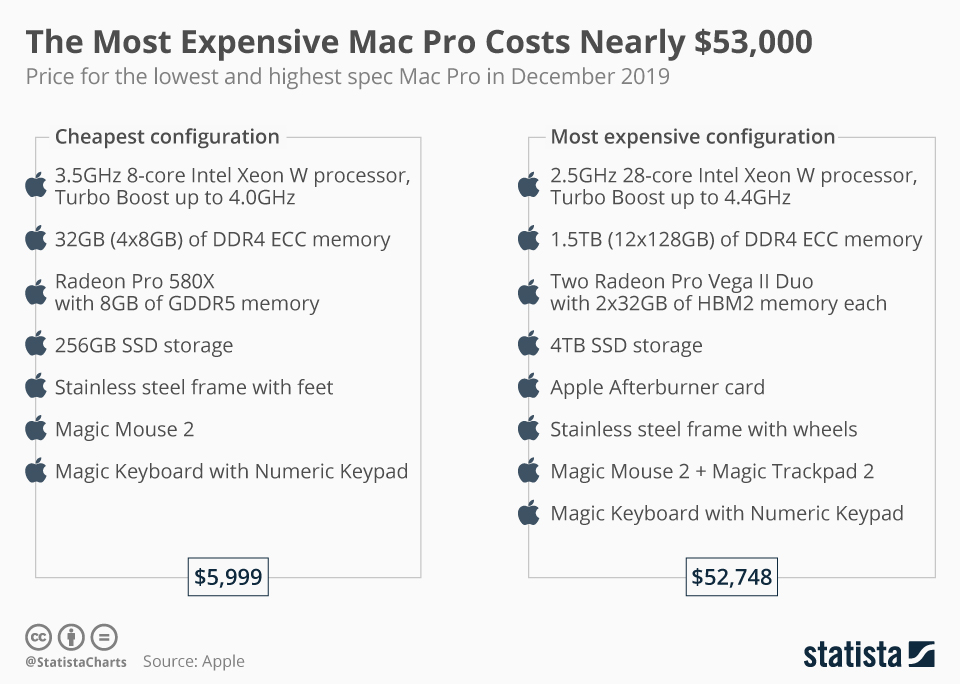

Apple Inc. (Nasdaq: APPL) is selling its new desktop Mac Pro at a base price of $5,999 (without a monitor). However, the price can go as high as $52,748 with all the bells and whistles.

Apple Inc. (Nasdaq: APPL) is selling its new desktop Mac Pro at a base price of $5,999 (without a monitor). However, the price can go as high as $52,748 with all the bells and whistles.

The top-of-the-line model includes massive storage and an impressive amount of memory.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.