This year has favored tech above all else.

Yet one of the best performers of the past quarter is a distinctly old-economy auto part stock.

It’s more than doubled since early October. It’s risen by more than a factor of four since bottoming out in March.

It doesn’t get much more old-economy than auto parts. Strattec Security Corporation (Nasdaq: STRT) manufactures items including auto locks and keys, door handles, and power sliding doors and tailgates.

It counts Fiat Chrysler, General Motors, Ford and Hyundai among its largest customers. But while Strattec’s products aren’t sexy, business has been good.

We can expect it to be even better.

The COVID-19 experience has soured the general opinion toward public transportation, not to mention pushed migration from urban areas to less-dense suburban areas where car ownership is all but mandatory.

Strattec Stock From July to Now

Longtime readers might recognize this stock.

Chief Investment Strategist Adam O’Dell added Strattec to his weekly Money & Markets Watchlist back in July. (Click here to see Adam’s latest watchlist.)

Our colleague and research analyst, Matt Clark, highlighted it shortly thereafter.

At the time, the stock rated a 96 out of 100 in our Green Zone Ratings system. Any stock that rates 80 or higher is one we consider “Strong Bullish.”

Based on Adam’s historical research, we expect Strong Bullish stocks to outperform the market by a factor of three over the 12 months to follow.

Well, Strattec hasn’t disappointed. Since Matt’s recommendation, Strattec is up 124%, while the S&P 500 has eked out a comparatively paltry 14%.

We think more gains are on the way.

When Matt first recommended Strattec, it rated highly based on Value. Well, after it ripped higher by 124%, you might expect that Strattec would no longer resemble much of a value.

And you’d be wrong.

The mauling Strattec took in March and April distorted the stock’s earnings. You might recall that the world’s automakers cut way back on production in order to keep their workers safe from COVID outbreaks.

Strattec Stock Still a Bargain

We can use plenty of other valuation metrics to gauge the company’s bargain status.

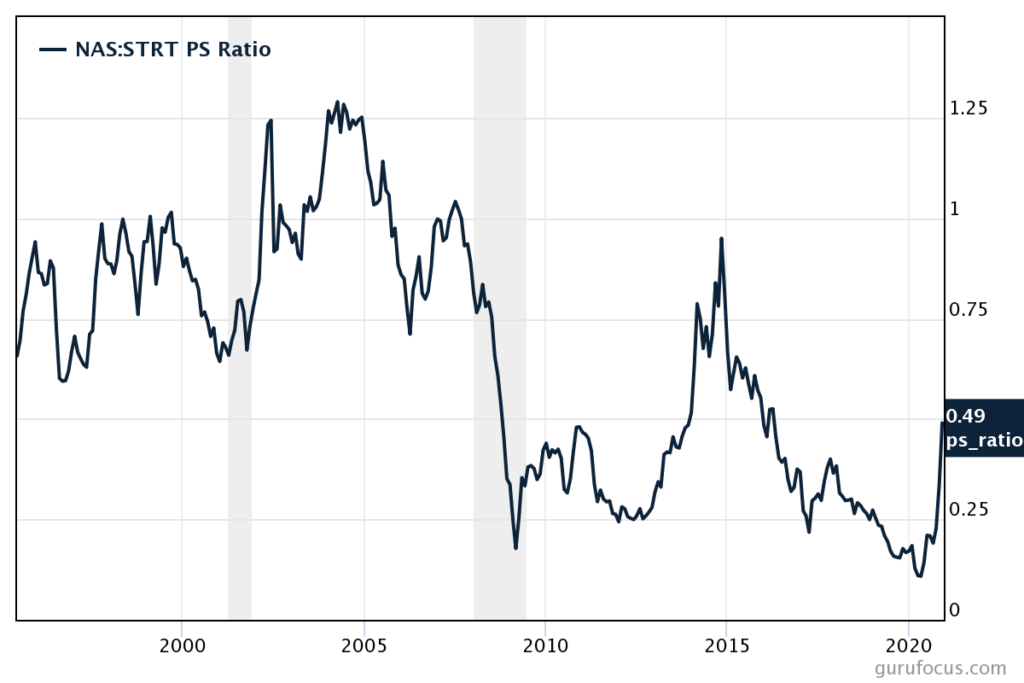

For instance, you can see its price-to-sales ratio over the past two decades in the chart below:

Strattec Price-to-Sales Ratio

The stock trades at 0.44 times sales. For perspective, the S&P 500 trades at 2.7 times sales, the highest valuation in the index’s history.

As recently as late 2014, Strattec traded at 0.96 times sales. For most of the 1990s and 2000s, it traded significantly higher than that.

The price-to-book ratio tells a similar story.

At today’s prices, the shares trade at 1.2 times book value. Just a few years ago, it was trading well over two times book value. In the early 2000s, it was well over three.

I could go on all day, but you get the point. Strattec isn’t as cheap as it was a few months ago. However, it is by no means expensive.

Crisis Tests Companies’ Mettle

Good companies use a crisis to test their mettle and make improvements. Strattec is no exception. As CEO Frank Krejci put it in the last earnings release:

For the quarter ending in June 2020, we had our worst quarter in the history of STRATTEC. Our customers shut down their automotive operations in North America for most of the quarter, which impacted our facilities in Milwaukee, WI and Mexico… [but] this current quarter ending in September 2020, was the second-best in the history of STRATTEC… It was a very welcomed turnaround which made up for most of the losses suffered in the previous quarter.

Sales were about in line with the same quarter in the previous year. But earnings per share popped from $0.33 to a massive $2.11.

Krejci attributes the surge in profitability to layoffs and other cost savings the company put into place during the darkest days of the pandemic.

And it managed to do this while also paying down $5 million in debt.

This puts Strattec in excellent financial health and lays the foundations for greater gains ahead.

This is exactly the sort of under-the-radar opportunity we look for in Money & Markets.

Speaking of which … Chief Investment Strategist Adam O’Dell and I just zeroed in on an even more profitable company that’s set to soar in the New Year!

Its Momentum score is 97. It scores an 88 on Growth. And its Quality score is 99! Go here now to see how to get all the details on this stock, plus receive exclusive access to Adam’s Millionaire Master Class report filled with all his trading secrets for just $1!

To join this elite investing community right now, click here.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business. Follow Charles on Twitter @CharlesSizemore.