Summer travel season kicks into high gear this weekend.

Need proof?

Two off days in May just made it onto the list of Top 5 busiest airport travel days in American history. TSA agents screened more than 2.8 million passengers last Friday and roughly the same amount again on Sunday.

That’s before the madness really kicks off with Memorial Day weekend! AAA expects almost 44 million Americans to travel at least 50 miles away from their homes over the three days.

With everyone antsy to kick off summer, it’s the perfect time to look at travel stocks through the lens of Green Zone Power Ratings.

But first, a look back…

How 3 Travel Stocks Did Since Last Summer

About a year ago, I ran a few travel stocks through Adam O’Dell’s proprietary Green Zone Power Ratings system.

I was curious if any stocks were set up for a strong summer rally. I also wanted to make sure the stocks I was considering weren’t set up for disaster.

But my main goal was to show you how Adam’s system distills pages and pages of financial data into a simple number between 1 and 100.

Let’s review…

American Airlines Group Inc. (Nasdaq: AAL) had just reported solid earnings in June 2023 as we headed into another busy travel season.

But Green Zone Power Ratings was waving the red flag. At the time, AAL stock was rated a “High-Risk” 14 out of 100. It was set to underperform for the months ahead.

The stock peaked at $19.08 in July after a nice summer rally but then quickly headed lower again as the company reported it was dealing with outsized debt. Zooming out, AAL has traded for a 0.2% gain over the last year compared to the S&P 500’s 28% bull market run.

Now, it carries an even lower rating at 4 out of 100!

Moving on to Booking Holdings Inc. (Nasdaq: BKNG)…

When I highlighted this stock, I noted its strong factor rating on Quality (92 at the time) since its diversified portfolio allows Booking to maintain more total assets compared to debt.

The company has been riding the post-COVID travel boom, and its rating has improved to a “Bullish” 66 out of 100.

Over the last year, BKNG has gained 45% as well, reflecting that Bullish rating.

The last stock I looked into a year ago was O’Reilly Automotive Inc. (Nasdaq: ORLY).

My thesis was that as travel costs rose, more people would opt for road trips, which meant more money spent on car repairs.

ORLY rated a “Strong Bullish” 83 out of 100 at the time, and the stock rallied 30% higher into March 2024.

But now, a string of earnings misses, with the company reporting same-store sales falling below expectations, has soured investors on the stock.

It’s still up 10% since my initial report, but the stock now rates a “Neutral” 59 out of 100. That suggests it will perform in line with the broader market from here on out.

All told the Green Zone Power Ratings was on the money with these travel stocks.

So what about one for summer 2024?

Take a Cruise With This Travel Stock?

I live in cruise country, so let’s take to the high seas.

Covid-19 decimated the cruise industry, understandably. If I’m trying to avoid a contagious disease, the last place I want to be is on a boat with thousands of others in the middle of the ocean.

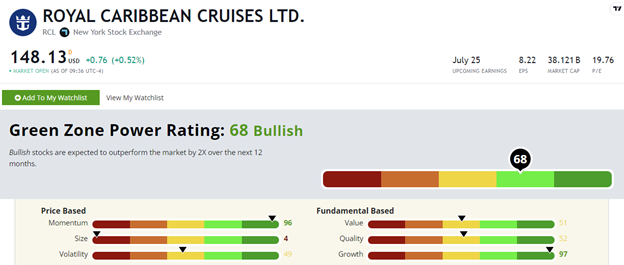

Do things look any better now? Let’s check out Royal Caribbean Cruises Ltd.’s (NYSE: RCL) Green Zone Power Ratings…

RCL stock now rates a “Bullish” 68 out of 100. For reference, the stock was rated 3 out of 100 in June 2020 following the pandemic-fueled flash crash.

Now, Royal Caribbean looks stronger than it has in years…

Looking closer, the stock rates a 96 on Momentum. Over the last year, RCL is up 88%, more than tripling the S&P 500!

Strong growth is driving investors into the stock. For the first quarter of 2024, Royal Caribbean reported an 850% increase in net income to $360 million year over year. It also grew revenues by 29% to $3.7 billion compared to the same quarter a year ago.

That’s why RCL now boasts a 97 rating on our Growth factor.

If you’re looking for a summer travel stock, Green Zone Power Ratings shows RCL is set up for success…

Of course, you could also stick to tech and AI stocks after Nvidia Corp.’s (Nasdaq: NVDA) monster earnings call on Wednesday.

Matt Clark will have more on NVDA in Tuesday’s Money & Markets Daily — watch out for that.

But if you want to know what the AI stock move to make now is, Adam has you covered.

NVDA proved the AI mega trend is here to stay. It just needs one critical resource…

Until next time,

Chad Stone

Managing Editor, Money & Markets