There’s been a surprising shift in U.S. stock market leadership that tech investors should take note of.

Technology — led by the likes of Facebook, Apple, Netflix, Microsoft and Google — has been the darling sector for stock market investors.

Banyan Hill’s John Ross

I don’t need to get into why.

Instead, I am about to show you a graphic that tells us the bloom could soon fall off the rose for tech investors.

Old-world stocks in a hated sector are having their turn in the limelight.

It’s classic sector rotation, and it will create significant profit opportunities for investors who can navigate it.

But be careful not to jump in too soon.

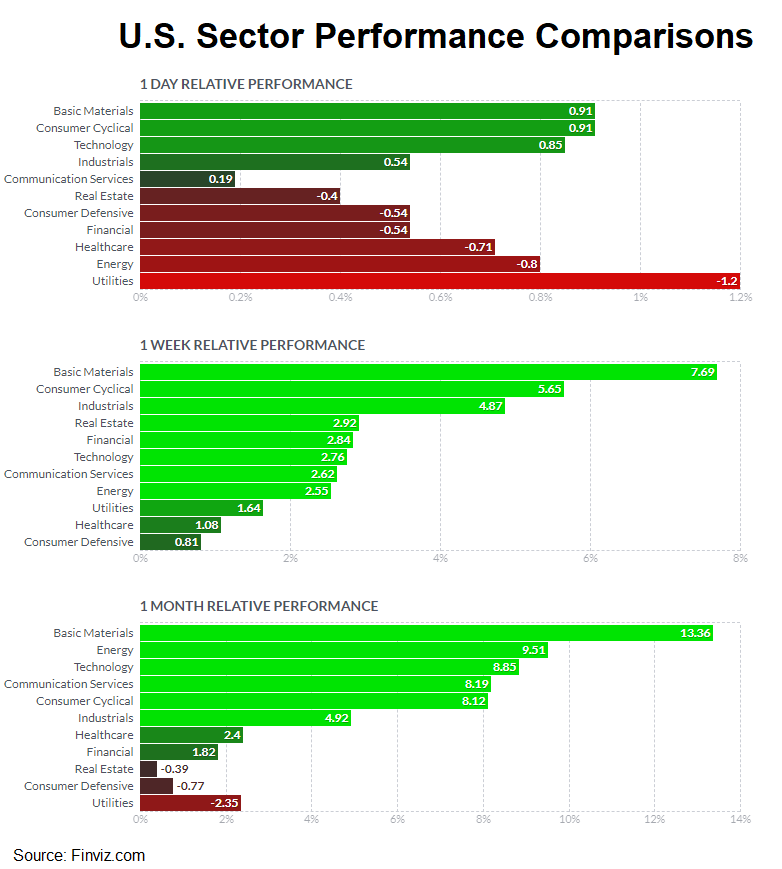

Two screenshots I took from my computer on Tuesday tell us why investors should be extra careful.

This is from a website I frequent that gives a sector-by-sector snapshot of stock market performance over different time frames.

In this case, we’re looking at one-day, one-week and one-month time frames.

There’s a lot of green, which denotes positive performance.

But don’t be fooled.

Notice the top performing sector in each comparison is basic materials.

Basic materials is a sector that’s been left for dead.

The global economy was made tired by a trade war and then kicked between the legs by a coronavirus pandemic that caused supply chains to seize up.

This hammered the flow of tangible goods and associated businesses.

Of course, the pandemic is just the latest reason for investors to ditch basic materials stocks.

Tech stocks promising innovation and solutions for modern economic needs captured the eyes and dollars of investors years ago, and they’ve remained dominant.

But there is good reason this is changing now.

Why Tech Investors Should Respect the Cycle

Make no mistake: Tech stocks are not prone to a bubble-like implosion.

This isn’t dot-com 2.0.

At the same time, basic materials stocks are not about to shoot the moon.

But here is why this is a noteworthy shift …

Economic growth is cyclical, no matter if policymakers are printing trillions of dollars to try to change that.

In an economic cycle, money moves across sectors for reasons beyond things such as sky-pie promises from silicon-valley startups or dampening of U.S.-China trade relations.

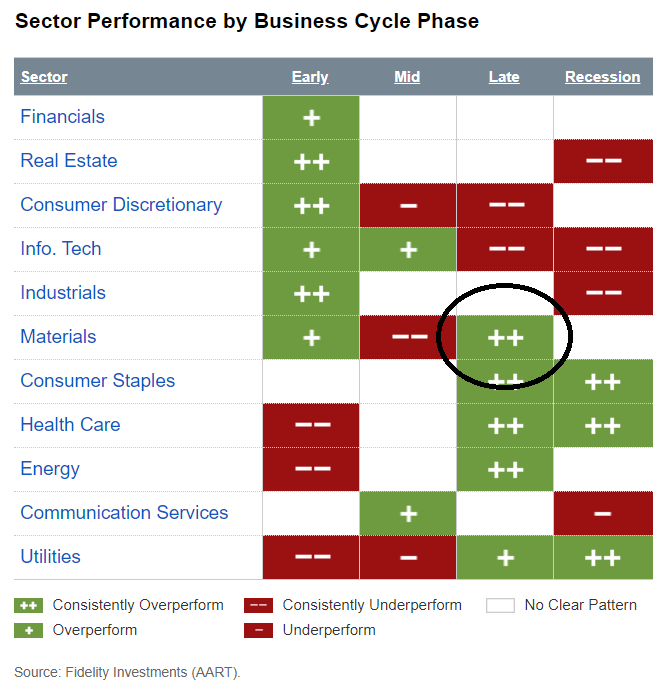

To wit, here’s one more snapshot to consider.

That table shows us the relative performance of market sectors during the four phases of a business cycle.

Tech stocks do well when the economy is in a growth phase. Not so much when it’s heading into recession.

Basic materials tend to perk up in the late phase, just before recession.

That’s what’s happening right now. Inflationary policy from government and central banks is creating a last hurrah for materials stocks.

Suddenly, old-world stocks are the new shiny object of investor affections.

Again, be careful not to jump too soon.

If you must put new money into the stock market, be selective and be careful. There’s a good bit of recession ahead of us.

Keep your risk in check.

Don’t fall into the trap of thinking new life in basic materials is an all-clear for the stock market.

I know it’s not easy to figure out which stocks can weather a recession — and which cannot.

I hope I’ve been able to help.

If you’re looking for more on what to do in this market, my friend and colleague, Matt Badiali, has a proven framework of research and analysis that sifts out the winners from the losers as part of his Real Wealth Strategist service.

Good investing,

John Ross

Co-Editor, Apex Profit Alert

• John Ross is the Co-Editor of Apex Profit Alert for Banyan Hill Publishing, and an expert in global macroeconomics and options trading around natural resources like gold, oil and cannabis. His trading style exploits opportunities created by emotions like fear and greed.

Follow him on Twitter @JohnRossGuru and subscribe to his YouTube channel, Prosperity Research.