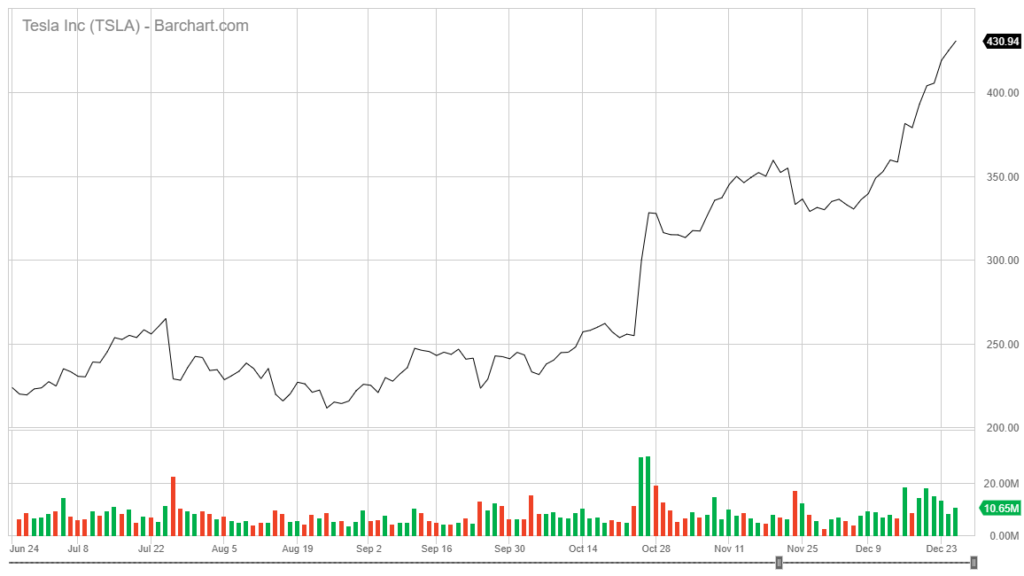

After three fumbling quarters, it’s going to be a good end of the year for Elon Musk and Tesla.

On Thursday, Tesla Inc. (Nasdaq: TSLA) shares hit a new high and continued to climb through Friday afternoon trading above $430.

To his credit, a lot of things have gone Musk’s way this month.

Shares jumped in the middle of December thanks to news of a potential cut in the price of its Model 3 sedan.

The next day, Tesla shares crossed the $400 threshold — more than double its 52-week low of $178 back on June 3.

Today the electric automaker said its first Model 3’s rolling off its Shanghai production line in China will be delivered to employees Monday. Tesla also confirmed a $1.29 billion loan from Chinese banks to help bolster its Shanghai gigafactory.

The company is also close to completing a land deal for its German gigafactory outside Berlin.

Sky-high share price, capital to finish its Chinese factory — with cars ready for delivery despite that factory not being complete — and a European factory closer to fruition.

All things point to a big 2020 for Musk and Tesla.

Something Still Seems Off With Tesla

But not so fast.

To some, it might seem that Tesla is poised for a breakout. Rather than jump for electric car joy, it would be better to exercise a little caution here.

Consider a fact Bloomberg pointed out this week — the price difference between where shares of Tesla are at and where analysts target it is its widest since the company’s initial public offering in 2010.

Shares of Tesla are at $430, but analysts set their price target of around $297.

That should be rather telling to anyone looking to invest. It suggests Tesla share prices are a bubble that will burst at any second.

More Potential Issues For Tesla

For another thing, there is just too much going on at once for this company to keep up with:

- Shanghai factory completion

- Chinese bank loans

- Berlin factory in planning

- New Cybertruck

- Anything related to SpaceX (I know the companies are separate, but as one goes, so could the other)

It just seems too much to keep up with without something going wrong … because, inevitably, it will.

The message here is clear … don’t be too quick to jump on the Tesla bandwagon. This is a good time for Musk and Tesla.

But don’t expect it to last.