Old traders are fans of the saying: “Don’t fight the Fed.”

This could be the most important factor in the stock market right now.

This saying means that the Federal Reserve is strong enough to drive trends in the stock market.

When the Fed follows an easy monetary policy, traders should be bullish.

It’s time to turn bearish when the Fed tightens its monetary policies.

Tight monetary policy is designed to slow overheated economic growth.

Tactics here include interest rate hikes and reducing the money supply.

Easy monetary policies like rate cuts and increased money supply fuel economic growth and often drive stock markets higher.

What Is the Fed’s Monetary Policy Now?

The Fed has been reining in the money supply, an action consistent with a tight monetary policy.

But the Fed may be ready to reverse course after contracting the money supply.

This is a rare action, as the chart below shows:

Fed’s Tight Monetary Policy Triggered a Rare Contraction

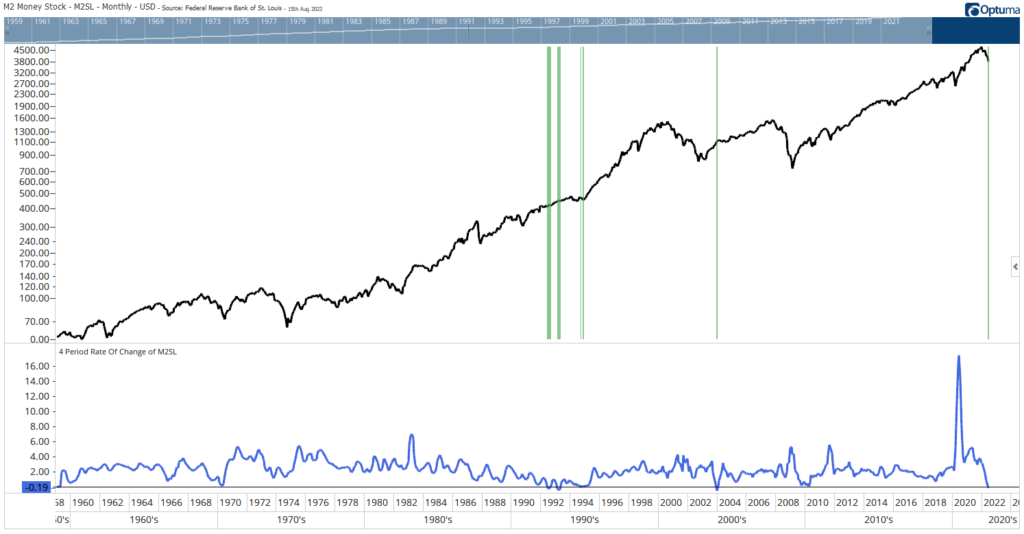

This is a chart of the S&P 500 with the four-month rate of change (ROC) in money supply (M2) shown at the bottom.

M2 includes all cash, money in checking and savings accounts, money market funds and other accessible sources of cash.

Green bars highlight times when the ROC has been negative.

They are rare because the Fed can slow the economy without contracting the money supply.

A slowdown in the growth rate has been sufficient to achieve the Fed’s goals.

On the rare occasions when the Fed has contracted the money supply, the S&P 500 has fared well.

What This Means for the Stock Market

The stock market’s fate might be in the hands of the Fed.

Based on history, the Fed might start adding liquidity to the economy.

In this environment, valuations don’t matter.

All that matters is the Fed.

Bottom line: Traders should remember that old saying and expect gains based on what the Fed does.

Of course, the Fed can change course, so we need to watch the money supply for changes in monetary policy.

But for now, the Fed is bullish for stocks.

If you’re looking for more guidance in this market environment, click here to check out my proprietary “Black Ops” investing strategy. I approached this system with the same military-grade precision that I used while I was a lieutenant colonel in the U.S. Air Force.

This is the approach I used when I managed over $220 million, and I’m ready to share it with you.

For around $4 per month, I’ll help you target 3X better returns than stocks, with 4X less risk.

These are conservative investments, but I’m not talking about boring savings accounts or money-sucking mutual funds.

Click here to see how you can get started with “Black Ops” investing today.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.