Our new obsession with artificial intelligence (AI) rivals our obsession with tabloid headlines about Britain’s royal family.

It’s crazy.

There is a new headline about a breakthrough, investment or use for AI every day.

While I find the infatuation with royals to be silly, our compulsion with AI is certainly justified.

Here’s why:

The revenue from generative AI (think AI that creates new content like text, images, audio and video) will grow 104.4% to $137 billion from 2023 to 2024.

By 2032, that revenue will be $1.3 trillion — an 851.8% jump from 2024.

The amount of money coming out of AI is in a massive uptrend. But to get that money out, investments have to be made.

And some of the biggest names in the tech world are writing massive checks to get their slice of the AI pie.

I’ve already discussed Amazon’s doubling down on AI. After some digging, I found another Big Tech AI story that isn’t getting much coverage.

Let’s dig in…

Microsoft Jumps in With Both Feet

Browsing news this week, I came across something that I couldn’t ignore.

It came in the form of an obscure email from a Japanese media outlet.

I saw the headline and quickly checked to see if American news outlets had picked it up … needless to say, they hadn’t.

The headline that caught my attention was:

Through next year, American tech giant Microsoft Corp. (Nasdaq: MSFT) is spending $2.9 billion in Japan to push more computing power for AI.

This is just one of several massive investments American tech companies are making in support of AI.

You already know about Amazon.com Inc. (Nasdaq: AMZN) and its $4 billion investment in AI startup Anthropic.

And we can’t forget about Microsoft’s $10 billion deal with ChatGPT parent OpenAI.

With its latest investment, Microsoft plans to install AI semiconductors at two existing data centers in Japan and develop an AI-related reskilling program to train 3 million workers over three years.

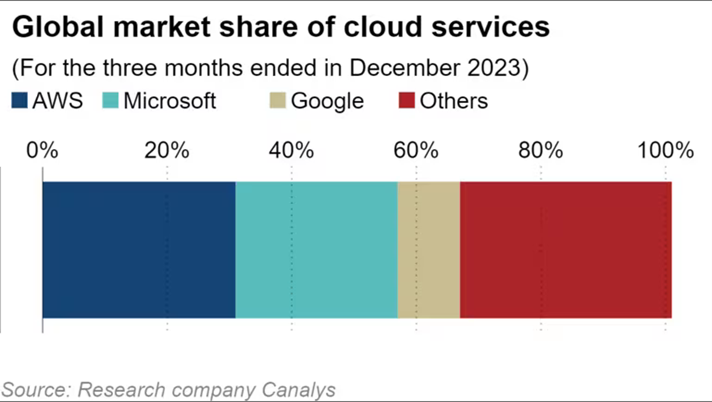

It’s all part of Microsoft’s plan to eat into Amazon’s market share for cloud services.

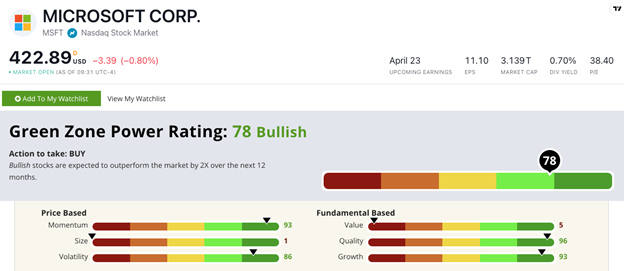

If you were wondering what all of this AI investment has done to Microsoft’s stock, we can turn to Adam’s Green Zone Power Ratings system for the answer:

Its AI strategy is clearly reflected in its “Bullish” overall rating.

And it’s not the only Big Tech company spurring AI development for cloud computing.

Google parent Alphabet Inc. (Nasdaq: GOOGL) announced this week that it will deploy custom-built processors later this year to make cloud computing more affordable.

These custom chips aim to take on larger workloads while reducing the cost of cloud computing, which is becoming more and more important in the AI space.

The Infancy of the AI Arms Race

Folks, this binge of investing in AI is just the beginning.

In addition to tech powerhouses like Microsoft, Amazon and Google, international consortiums are pushing for AI.

France’s Mistral AI — which former Meta Platforms and Google employees founded — is already producing large, open-source AI models for commercial and individual use.

In February, the company announced a partnership with Microsoft and an integration of its models with Amazon.

The United Arab Emirates has quadrupled its AI workforce to 120,000 from 2021 to 2023 and has set up a technology investment firm to target deals in AI and semiconductors that could pass $100 billion.

This tiny Middle Eastern nation is on the verge of disrupting the entire AI marketplace.

The point here is that massive companies and powerful nations recognize the power of AI and are spending boatloads of cash to ensure they aren’t left behind in the new AI arms race.

As I said earlier this month, the AI mega trend is only going to get stronger, and Adam’s latest Green Zone Fortunes recommendation is a testament to that growth.

It’s a company pioneering the field of “Closed AI” and has developed technology that will disrupt the entire AI market. It’s been working with this innovative tech for decades, too.

And if you want to know how today’s “Tech Titan” is behind it all, click here.

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets