From January to July 2016, one market sector outperformed the rest.

This sector posted a 21.5% gain, compared to the S&P 500’s 4.5%.

Going back to 1941, this sector’s 5X margin over the broader market was the highest on record.

The thing is, this sector isn’t sexy.

It isn’t tech or an emerging market.

In fact, it’s plain boring.

The rally cooled as it recorded a 12.5% overall gain for 2016 compared to the broader market’s 11.2%.

Fast-forward eight years later, and after years of underperforming the S&P 500, this same sector is in the midst of a renaissance.

And since September, investors have started putting their foot on the gas…

Today, I’ll tell you what the sector is and why it’s happening. I will also X-ray a popular exchange-traded fund (ETF) in this sector to identify potential buys using Adam’s Green Zone Power Ratings system.

Sexy Isn’t Always the Most Profitable

While this sector blew the doors off the broader market in the first six months of 2016, it started to slump three years later.

Since reaching a zenith at the end of June 2016, it has posted a 44% overall return through the end of last year.

That pales in comparison to the S&P 500’s 127% return over the same time.

Have you picked up on what sector I’m talking about yet?

It’s utilities…

As I said, it is not the sexiest sector in the market, especially considering mainstream financial news has spent the GDP of a small country writing about things like Big Tech and artificial intelligence.

But the proof is in the data:

Since the start of 2024, The Utilities Select Sector SPDR Fund (NYSE: XLU) has posted a 30.5% gain — greatly outpacing the Technology Select Sector SPDR Fund’s (NYSE: XLK) 17.9% return.

Going back a full 12 months, XLU’s 41.6% return beats the remaining sectors of the S&P 500 … even tech and communication services — sectors rooted in the AI space that have experienced huge returns since 2022.

Since the start of the year, XLU returns have crossed above the S&P 500 three times.

After the first two instances, the ETF pared back … but the most recent time is different.

In September, XLU made its third cross above the S&P 500, but it has maintained its momentum this time around.

This is critical as sustaining this upward trend will lead to a further expansion of XLU’s returns … much like it did in 2016.

The Why and Power Ratings for XLU

While utilities have outperformed sectors steeped in Big Tech and AI, this year’s resurgence is rooted in both.

Big Tech and AI have created a swell of demand for electricity used to power data centers, which are critical for AI, automation and machine learning.

The optimism of this increased demand has provided a huge benefit to utilities — the companies that provide that much-needed power.

Other factors contributing to the rise of utilities include:

- Lower volatility — In an up-and-down market, investors are seeking out individual stocks that don’t cause nearly the headaches the broader market has caused in recent months.

- The search for yield — In utility stocks, you have an asset class that is one of the highest income-paying sectors of the market.

This leads me to Adam’s Green Zone Power Ratings system.

I analyzed each of the 30 holdings currently in XLU by using the ratings system and computed an overall score for the ETF:

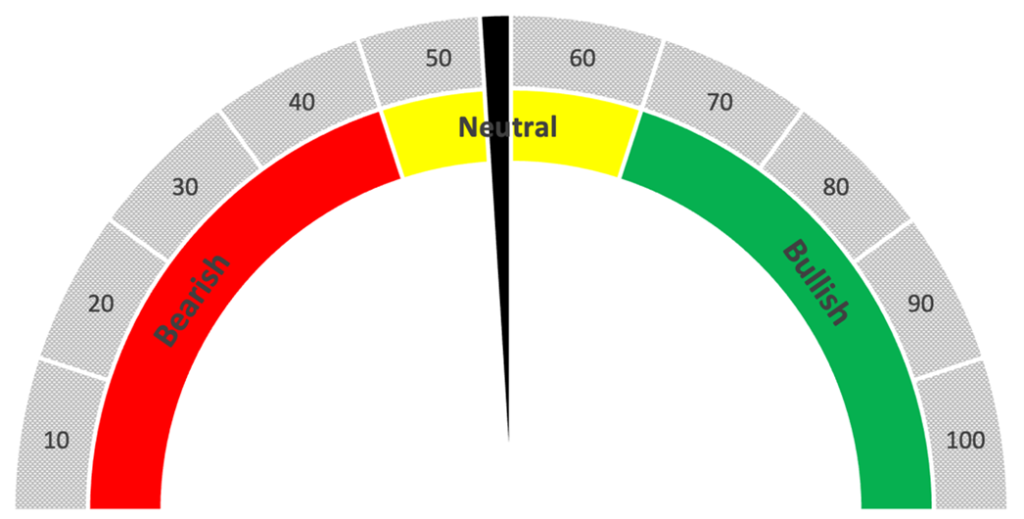

XLU Earns “Neutral” Rating

Overall, XLU was rated a “Neutral” 48 out of 100, but examining the six individual factors of the ratings system paints a more compelling picture.

XLU earns a “Bullish” 80 on Volatility and 74 on Momentum.

This suggests the recent upswing in momentum has a strong chance of continuing, with little volatility to slow it down.

Highest-Rated Stocks in XLU

Seven stocks within XLU are rated “Bullish” or higher, while 12 rate “Bearish” or lower.

More importantly, 21 of the 30 holdings have a “Bullish” or higher rating on Momentum, and 23 are “Bullish” or better on Volatility.

What It Means: We haven’t seen utilities make this kind of run since the bull run of 2015.

Adam’s Green Zone Power Ratings system tells us there is strong momentum with little volatility in the sector.

We don’t know how long this latest run of utility stocks will last, but now seems like an opportune time to kick down the door and find a way in.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets