Last month, I sat on stage for a panel at Banyan Hill’s Total Wealth Symposium.

The topic? Investing in an election year…

Questions ranged from what stocks should you buy if Donald Trump wins the 2024 presidential election to whether the stock market will collapse if Joe Biden keeps his seat.

Even on Monday, in Adam O’Dell’s Max Profit Alert trade room, a subscriber asked how stocks might react to Super Tuesday — the day when presidential and congressional frontrunners emerge.

It’s clear that the 2024 election cycle is on everyone’s minds… whether it’s the race for control of Congress or who will occupy the White House for the next four years.

In today’s Money & Markets Daily, I’ll dive into each of these questions and also show you how to best invest for the 2024 election cycle.

Super Tuesday and Election Year Investing

In short, Super Tuesday — especially this cycle — has little to no impact on the stock market.

That’s because the big winners have been a foregone conclusion for weeks before anyone hit the polls.

Democrats have a clear frontrunner with President Biden, while Republicans — despite a brief challenge from former South Carolina governor Nikki Haley — have latched on to former President Donald Trump.

While Haley came out of Super Tuesday with some delegates, it wasn’t enough to keep her in the race, meaning Trump will secure the nomination in the coming weeks.

We’re on track for another Trump versus Biden showdown in November.

That brings me back to February’s panel discussion. I don’t have my word-for-word answer from that panel, but it went something like this:

Q: Will the market crash if Biden wins reelection?

Matt: No, he’s been in office for three years, and the market hasn’t crashed yet.

While I didn’t have a chance to show the crowd data, there’s research that tells the same story on how the market reacts to general election results.

Republican or Democrat? Doesn’t Really Matter

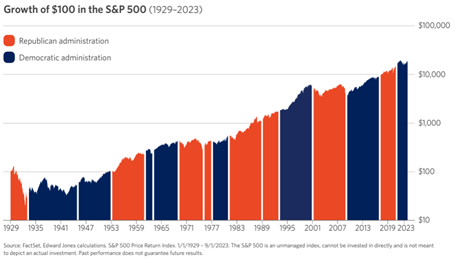

The data going back to 1929 shows that the market increases no matter who the president is.

Edward Jones found that the stock market has increased under every political combination in Washington. The average annual return was just above 10% every year since 1970.

What this tells me is that changes in government policies can have an impact on investment returns, but the market doesn’t really care who is in the White House or Congress.

Moving on to the second question…

Q: What stocks should I buy if Trump wins a second term as president?

Matt: Any stock in a heavily regulated sector (think pharmaceuticals, oil and gas, etc.) could gain more strength under a Trump presidency, given his stance against government oversight.

That still leaves one lingering question: How do you invest in an election year?

I have an answer for that, too…

Remove the Noise From Your Investing Strategy

As we inch closer to November 5, media headlines will start flying with wall-to-wall election coverage.

Some of those headlines may prompt you to change your investment strategy … but they shouldn’t.

It’s hard to predict not only who will win a presidential election but how and if their policy changes will have any impact on the market.

The best solution is to find a time-tested strategy that works in any market condition and stick with it.

Basically, don’t politicize your portfolio.

Our chief investment strategist, Adam O’Dell, has devised the perfect way to do just that… ignore the outside noise and focus on a strategy that works no matter what the rest of the market is doing.

He unveiled his Infinite Momentum strategy last year. It’s a purely systematic approach that finds the 10 highest-quality stocks with momentum that are trading at a fair value every four weeks to maximize your gains.

This strategy has already found stocks that yielded gains of 26%, 17.4%, 16.7% and 14.5%… all while the S&P 500 gained single digits — or actually lost ground — in a matter of a few months.

Tomorrow, he is scheduled to “refresh” the Infinite Momentum Alert model portfolio with new stocks poised to continue this impressive track record.

If you aren’t investing in this strategy (and you should be), click here to see how you can join now.

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets