If you’re stuck with measly dividends from stocks or Treasuries, closed-end funds (CEFs) are the answer.

After all, these funds yield an amazing 7%, on average, and they let you buy in at a discount (most CEFs trade for less than their net asset value, or NAV).

The One CEF Question I Get a Lot (and the Surprising Answer)

A reader or subscriber to my CEF Insider service will sometimes ask me: can I lose money with CEFs?

The technical answer is, yes, of course — as with any investment, you can lose money. Even when you put your money in the bank, there’s a risk of losing it if the bank goes under and the FDIC collapses. The better question to ask is how likely are you to lose money with CEFs?

And here’s where the data tells us there’s nothing to worry about.

Of the near 500 CEFs tracked by CEF Insider, 338 have been around for a decade or more. That’s over 300 funds with long track records that have been through everything, from recessions to bear markets to recoveries.

Over that decade, only three of those funds have lost money on a total-return basis (including dividends).

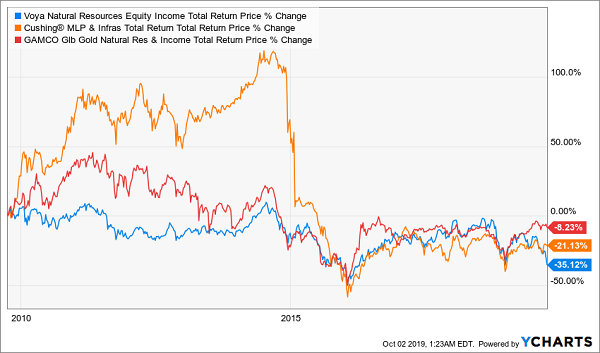

And these funds are easy to spot, because they’re all in the energy sector: the Voya Natural Resource Equity Fund (IRR), the Cushing MLP Total Return Fund (SRV) and the GAMCO Global Gold Natural Resources & Income Fund (GGN) are all down in the last decade due to the collapse in oil prices.

Where Oil Goes, Oil CEFs Follow

If you remember 2014, oil prices tanked (pardon the pun), and they haven’t recovered. This has been a big problem for all energy funds, but it’s particularly difficult for energy CEFs, which tend to be income vehicles. In other words, these CEFs’ need to distribute cash while oil crashed became a vicious circle.

The takeaway? Avoid energy CEFs for the long term.

If you do that, every single CEF has had a positive total return in the last decade. So, according to the data, your odds of losing money are pretty low.

But How Much Can I Earn?

If you’re not likely to lose money, how much could you make?

Back to the data. The average CEF has earned a 7.5% annualized profit over the last 10 years. So if you’d put $100,000 in a basket of random CEFs and ignored the portfolio for a decade and let the dividends reinvest automatically, you’d come back to $206,000 in your account.

To put that in perspective, over the long term, the stock market has earned a 7% annualized return, so CEFs are within that ballpark. This is despite the fact that many CEFs invest in even safer investments that generally return less than stocks — things like preferred stocks, municipal bonds and so on.

A more tactical approach can boost those returns more. A total of 20% of CEFs that have been around for a decade or more have earned double-digit returns over that period. In other words, these funds have made 10% or more, on average, per year. If you’d put $100,000 in them, you’d have come back to over $260,000 after a decade.

How Much Income Can I Make?

As I mentioned earlier, the real appeal of CEFs is their income. With an average 7% yield, CEFs give you much more passive income than an index fund that focuses just on stocks, which right now yields about 1.8%.

That’s the difference between poverty and a sustainable retirement. A $500,000 investment in CEFs gives you $2,916 per month. That same amount in an index fund like the SPDR S&P 500 ETF (SPY)? Just $750 per month.

Good luck living on that. But CEFs make it not only possible to retire on $500,000, but easy. Remember, while you hold your CEFs, you’re earning not just income but, in many cases, capital gains, as well. That will grow your nest egg while your dividend checks keep rolling in.

That’s why CEFs are a powerful secret in the investment world — and they’re a secret that unwarranted fears are keeping far too many investors away from.

New: The 5 Best CEF Buys for 8% Dividends, 743% Returns

If you’ve read this far, I’m guessing you think the 7-plus percent dividends (and upside) you can get from the regular CEF just might be for you.

So I’m going to make it easy.

I’ve just released a free special report outlining five of my top CEFs for buying right now. These five powerhouses have three things in common:

- They’re cheap. In fact, their discounts to NAV (or the gap between their market price and portfolio value) is so wide I’m calling for 20-plus percent price upside in the next year.

- They give us a valuable hedge in a crash, thanks to their bargain valuations, and …

- They throw off a life-changing cash stream: I’m talking an 8% yield, on average.

Here’s something else you should know: These funds are still cheap, despite putting on massive runs since inception, like Pick No. 1, which has returned 743% and yields an amazing 9.3% now:

This 743% Gainer Is Just Getting Started

And now, thanks to this fund’s unusual 9% discount, we’ve got a short window to jump in before it makes its next move higher.

This is the kind of income and upside CEFs offer, and these five income (and growth) powerhouses are your perfect starting point. Click here to get your free report and discover everything you need to know about: names, dividend yields, tickers and much more.

To learn more about generating monthly dividends as high as 8%, click here.

• This article was originally published by Contrarian Outlook. You can learn more about Brett Owens and Contrarian Income Report right here.