Buying a home is hard — whether you are a first-timer or a seasoned veteran.

A mountain of forms to fill out, thousands of dollars needed for a down payment, hours of house hunting and days (even months) before you can finally move in.

It’s likely why 34% of Americans rent their home (or apartment) rather than own.

But in recent years, there’s become a fundamental problem with renting … the cost.

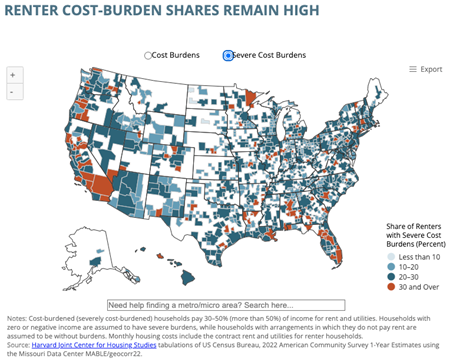

Nearly 52% of renters in America spend more than 30% of their monthly income on rent alone. What’s worse, in 2023, 25% of renters were classified as “severely rent-burdened” because they spent 50% of their monthly income on rent.

As the chart above shows, most of the severely rent-burdened areas are in California, Florida and the Northeast.

The challenge for renters is the recent rise in interest rates, alongside soaring home prices, has priced them out of buying a home.

But things are starting to brighten up for potential homebuyers. Because of that, I’m going to share a stock Adam O’Dell has already tapped for impressive gains.

The Inflation Cool-Down Helps Homebuyers

In his flagship Green Zone Fortunes service, Adam told paid-up subscribers (rightly, I might add) that last week was one of the most important weeks of the year for investors.

Adam broke down his logic into three steps:

Step No. 1: The latest data shows inflation cooled to its slowest pace since 2021. This suggests it’s now far more likely that…

Step No. 2: The Federal Reserve will begin interest rate cuts as soon as September. This suggests…

Step No. 3: Small-cap stocks are about to get the “rocket fuel” (rate cuts) that will propel them considerably higher (and lead them to outperform large-cap stocks).

For today, I want to focus on Step No. 2, which concerns the Fed cutting its target rate as soon as September.

On June 21, 60% of analysts projected a Fed rate cut during its September meeting. Now, that number has jumped to 94%.

A potential rate cut will be a huge benefit for potential homebuyers as one of the hurdles currently is higher-than-normal interest rates for mortgages. The Fed trimming back its target rate will push lenders to do the same — making mortgages more affordable.

For example, if you took out a $300,000 30-year fixed mortgage with a 7.5% interest rate, your monthly payment would be $2,100. If you reduce the interest to 7%, the monthly payment is $2,000.

Now, saving $100 a month may not seem like much, but you save $36,000 throughout the life of the loan. That’s a big difference for homebuyers.

Homebuilders Are Coming in Vogue

Another problem in the American housing market is the lack of available houses for sale.

With the prospect of lower interest rates, homebuyers are taking a different approach. Rather than spend hours searching for just the right house on the market, they’re electing to build their dream home from scratch.

It might be slightly more expensive, but you get exactly what you want, how you want it.

The trend of homebuilding over homebuying is hugely beneficial for companies like Hovnanian Enterprises Inc. (NYSE: HOV).

Hovnanian builds everything from condos and townhomes to mid-priced homes and retirement communities. It does so in some of the country’s fastest-growing areas: Florida, Ohio, Texas, South Carolina and Virginia.

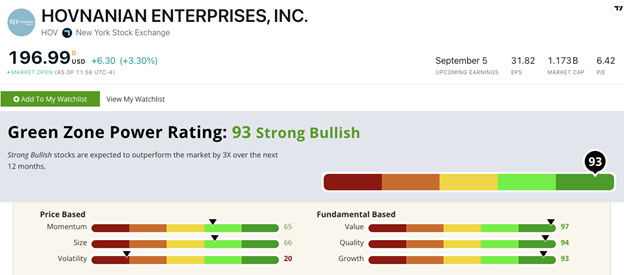

Adam has tapped into HOV’s momentum potential in his Infinite Momentum Alert premium investment service, and his paid-up subscribers have already seen double-digit gains in less than a month.

And he was OK with me “lifting the veil” a bit today because this systematic approach has the potential to find more stocks like this — every month.

Here’s why…

The Three-Legged Stool and How HOV Fits

Without getting into too much detail (I’ll show you how you can learn more in a bit), I can tell you that the idea of Infinite Momentum is to find quality companies… trading at attractive valuations… and with market-beating price momentum.

So, the three-legged stool naturally focuses on Quality, Value and Momentum within Adam’s Green Zone Power Ratings.

On Value, HOV’s price-to ratios (earnings, sales and book value) are all lower than the industry average for home builders and manufacturers. For example, HOV trades with a price-to-earnings ratio of 6, which is half the industry average (13).

Hovnanian’s return on equity (ROE) is 50%, compared to the industry average of 17%. This is why HOV rates so well on our Quality factor.

Then, we have Momentum:

In the last 12 months, HOV has advanced 90% compared to the S&P U.S. BMI Consumer Staples Index, which is only up 5% over the same time.

Not only are homebuilders like Hovnanian capitalizing on the prospect of lower interest rates, but Adam is already one step ahead of the game as HOV has gained nearly 40% in his Infinite Momentum Alert model portfolio.

I’d be remiss if I didn’t mention that Adam is targeting more stocks that fit this three-legged approach … every month.

If you want details on how to join in on this strategy, click here to watch a replay of this week’s Wealth Multiplier Summit now.

And, until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets